As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless trends come and go. However, the surge in Grayscale’s XRP trust is one that has piqued my interest. The 11.44% increase in just one week since its launch is a testament to the growing institutional interest in XRP.

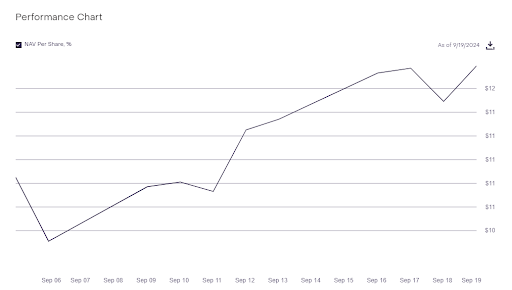

The growth of Grayscale’s XRP trust since its launch suggests a favorable trend for this digital asset, as one of the world’s top cryptocurrency asset managers, Grayscale’s introduction of the first XRP trust in the US last week has opened the door to significant institutional investment in the cryptocurrency. Since its inception, the Grayscale XRP Trust has shown impressive performance, with data revealing a 11.44% increase in value – a sign of robust interest from institutional investors.

Value Of Grayscale XRP Trust Rallies

Grayscale’s XRP Trust mirrors the value of the altcoin, and people purchase shares of this trust to get involved with the cryptocurrency. The momentum for Grayscale’s XRP Trust is based on its Net Asset Value (NAV), which reflects the worth of each share in the trust and is determined daily during business hours. An ascending NAV indicates greater institutional investment in the trust, suggesting a positive outlook among traders and a potential rise in the price of XRP.

Based on information from the manager’s site, the net asset value (NAV) for the XRP trust is $11.79 at this time, representing a rise of approximately 11.4% within a single week following its launch. This significant growth isn’t due to luck but rather the culmination of numerous favorable advancements within the broader XRP community, which collectively point towards the persistence of positive trends.

What Is Driving The Momentum?

A significant factor fueling this positive trend is the upcoming release of Ripple‘s USD-backed digital coin, RUSD. This new stablecoin has stirred much enthusiasm within the cryptocurrency sector due to its potential to improve liquidity and facilitate cross-border transactions more efficiently. The launch of RUSD is scheduled for later this year, however, institutional investors are treading cautiously, waiting for more definitive guidance from the Securities and Exchange Commission (SEC) regarding regulations before making substantial investments in the market.

From my perspective as an analyst, the significant stride taken by XRP is its recent listing on the European edition of Robinhood. Given that Robinhood is one of the leading trading and investment platforms globally, this inclusion represents a substantial milestone for XRP. It signifies the opening of the doors to the vast European market, potentially increasing adoption and bolstering confidence in the cryptocurrency.

To wrap it up, the debut of the Grayscale XRP Trust has sparked optimism that a Spot XRP Exchange-Traded Fund (ETF) could be launched next. Although no formal applications have been submitted by investment firms yet, the establishment of the Grayscale XRP trust is considered an essential preliminary step towards potentially getting approval for a Spot XRP ETF in the future.

As I’m typing this, I find myself analyzing the current price of the altcoin, which stands at approximately $0.59. In the last 24 hours, it has experienced a growth of 1.17%.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The Babadook Theatrical Rerelease Date Set in New Trailer

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

2024-09-21 02:46