As a seasoned market analyst with over two decades of experience under my belt, I find myself constantly torn between optimism and caution when it comes to predicting Ethereum’s price trajectory. On one hand, I see the historical parallels between ETH and the S&P 500 that Ali Martinez highlights, suggesting a potential breakout towards $10,000. However, Peter Brandt’s technical expertise cannot be ignored, as he warns of a robust bearish pattern that may indicate further downside risk.

Experts monitoring Ethereum are closely watching its progress as it’s been stuck in a prolonged slump. While some anticipate a significant surge upwards, others advise caution, predicting that the downward trend may persist further.

Crypto expert Ali Martinez expresses confidence that the price of Ether will reach an impressive milestone of $10,000 during the upcoming market surge.

Martinez, who frequently connects Ethereum’s trends to broader market fluctuations, has drawn parallels between Ethereum’s growth and that of the S&P 500. This comparison hints that a comparable surge could soon occur.

Nevertheless, not all individuals are satisfied with this optimistic outlook. Peter Brandt, another crypto expert, maintains an alternative perspective. Brandt, who is renowned for his technical expertise and precise predictions, has issued a cautionary note regarding a robust bearish pattern on the daily chart of ETH.

In his latest study, he highlights a “bearish pennant” – a pattern resembling a falling trendline – which suggests to him the possibility of further price drops.

The Stock Market Connection

In his argument, Martinez relies on the historical connection between Ethereum and the S&P 500 (SPX). By looking at Ethereum alongside the SPX, he observed that both investments reached their lowest points towards the end of 2022, but then continued to rise steadily up until 2023.

Ethereum’s price seems to be following the trend of the S&P 500. This might be the final drop before it multiplies by three, potentially reaching a value of $10,000!

— Ali (@ali_charts) November 4, 2024

According to Martinez’s perspective, the current performance of the S&P 500 seems to suggest that ETH could be gearing up for a similar surge. He speculates that ETH might mirror the S&P 500’s path, potentially reaching the significant level of $10,000, given that the S&P 500 dropped slightly after breaking through to around $5,900.

If this trend continues, Ethereum might require an increase of approximately 3.1 times its current value, which is around $10,692 at present. Notably, Ether’s price has risen by 8% over the past day and was trading at $2,618 as of this writing.

Martinez is quite optimistic about it, considering the wider market context and the development on the horizon. However, Brandt cautions that the Ethereum (ETH) path may not be as smooth as anticipated, particularly when bearish indicators appear.

A Blend Of Signals

According to data directly linked to Ethereum’s blockchain provided by IntoTheBlock, it appears that sentiments among Ethereum holders are split. Currently, approximately 23% of active Ethereum address owners find themselves in profitable positions, meaning they are “ahead” or “in the black.

While there is evident backing at a specific point, the fact that 60% of the portfolios need to break even suggests that the market continues to be unpredictable. The actions of these investors – whether to acquire more units or sell them – will hinge on Ethereum’s price fluctuations in the upcoming weeks.

More Losses Ahead?

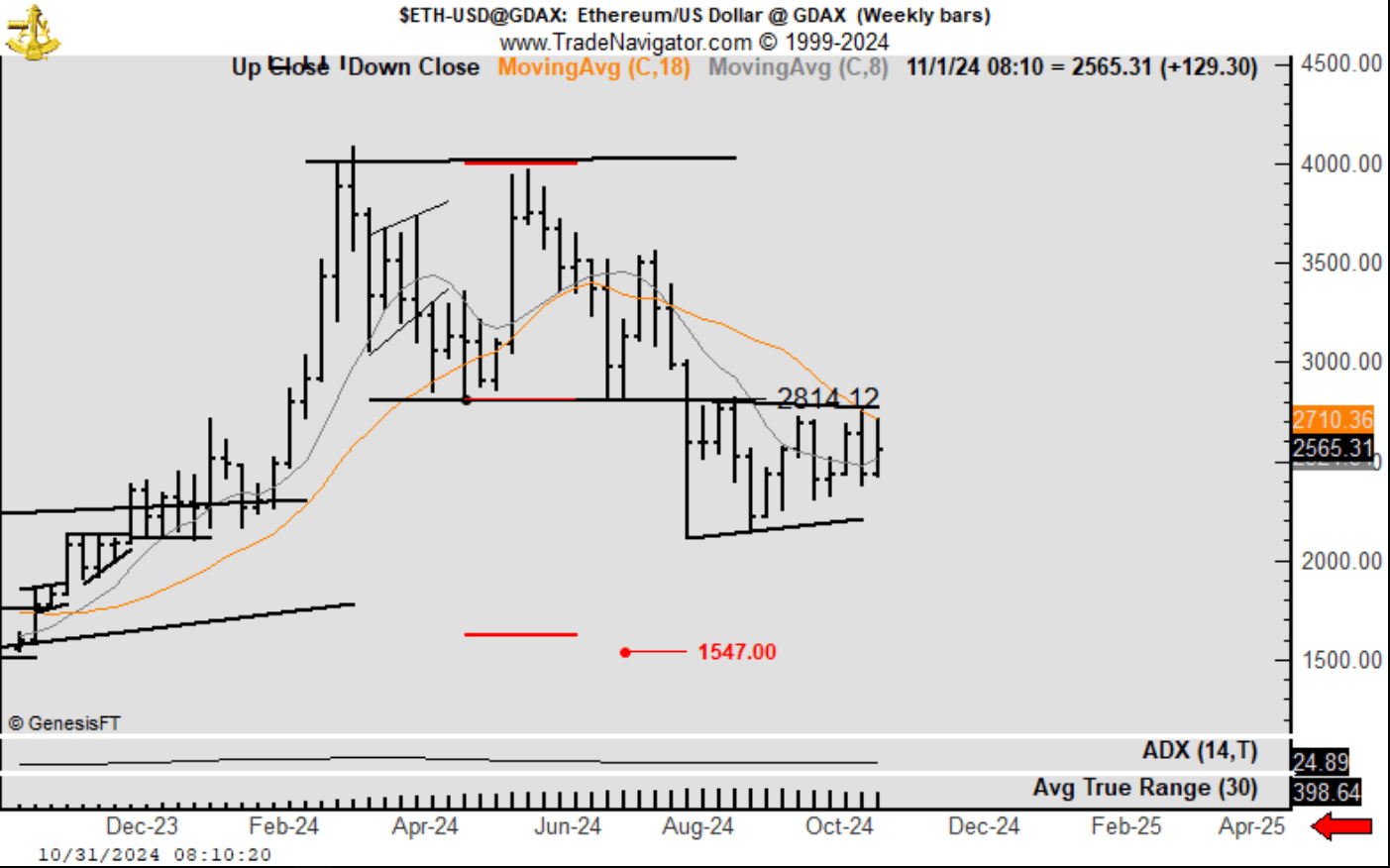

Experienced investor Peter Brandt issues a cautionary note, suggesting that Ethereum’s downtrend is strong and unlikely to reverse soon. As of late, he has noticed the daily chart’s predominantly bearish outlook and predicts further price drops.

It’s worth mentioning that no buy signal emerged for ETH. In other words, the chart continues to indicate a downtrend as the predicted price level of 1551 has not been reached yet.

— Peter Brandt (@PeterLBrandt) October 31, 2024

On October 31, experienced analyst Brandt, renowned for his precise predictions, highlighted Ethereum’s downward trend on platform X (previously Twitter). The one-day chart of ETH, starting from August, shows a descending pattern. This “bearish flag” suggests that the downturn will persist.

Brandt did not detect any indications suggesting it’s a good time to buy Ethereum, nor did he see signs of momentum shifts. This contradicts the bullish predictions made by speculators. Since the chart does not show a reversal, Brandt believes that the price of Ethereum might dip below its current support points.

Despite having vastly differing viewpoints, the forecasts by Martinez and Brandon on potential future developments in Ethereum show a high degree of uncertainty. Their analyses suggest that Ether may experience continued growth, mirroring the trajectory of the S&P 500, potentially reaching $10,000.

From another perspective, Brandt’s warning implies that potential challenges might still be on the horizon, as persistent negative factors could continue to influence the future.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-11-07 01:59