As a seasoned analyst with years of experience in the crypto market, I’ve seen my fair share of rollercoaster rides. The recent Bitcoin crash below $50,000 was a stark reminder of the market’s volatility, and it’s always intriguing to dissect these events to understand their causes.

On August 5, there was an unexpected drop in the value of Bitcoin, causing it to slide beneath $50,000. This rapid decline led to numerous positions being liquidated in the cryptocurrency market, taking everyone off guard. Consequently, Bitcoin reached its lowest point in six months, and many other digital currencies also experienced a similar downturn. While Bitcoin has since rebounded by 20%, trading around $59,000 currently, short-term investors are still grappling with unrealized losses.

A fresh analysis from Glassnode, a prominent blockchain research company, highlights key reasons behind the sudden drop in the market. The study indicates that the fall was primarily triggered by excessive reactions from short-term investors, who hastily sold off their holdings as soon as the market started declining.

Bitcoin Short-Term Holders Quick To Capitulate

Investors who keep cryptocurrency assets for a short duration, usually around a month or less, are commonly referred to as ‘short-term holders.’ Since they tend to sell off their investments swiftly during market downturns or corrections, they are more likely to give up easily. This behavior has been noticeable in the recent Bitcoin price correction/consolidation that has persisted longer than many had anticipated.

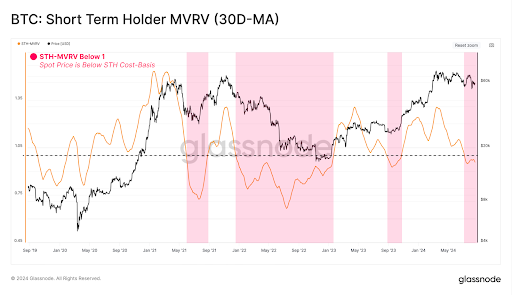

As per Glassnode’s latest on-chain analysis, the STH-MVRV (Market Value to Realized Value) ratio has dropped below 1.0 – a significant threshold. When this ratio falls below 1.0, it typically indicates that new Bitcoin investors are generally holding their Bitcoin at a loss rather than a profit. This is because the market value of their Bitcoin is currently less than what they initially paid for it, but they haven’t yet decided to sell (these losses are often called ‘paper losses’). Realized losses, on the other hand, occur when an asset has actually been sold at a lower price than its original purchase price.

In my analysis, I’ve observed that temporary price dips during bull markets are quite common with Bitcoin. These moments can trigger selling pressure due to a recurring pattern: extended periods of Short-Term Holder – Market Value to Realized Value (STH-MVRV) ratio falling below 1.0. This trend tends to increase the chances of panic and forced selling among short-term investors, as seen in the recent Bitcoin crash we’ve experienced this month.

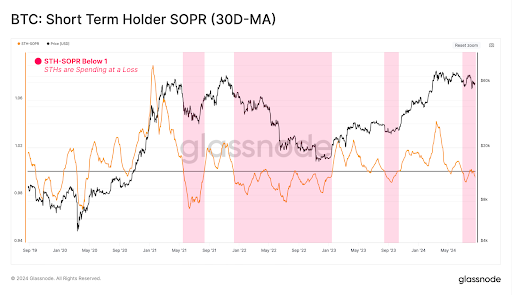

In addition, Glassnode’s report suggests a connection and potential selling pressure could be in effect, as the STH-SOPR (Spent Output Profit Ratio) is currently less than 1.0. This ratio gauges the profitability of spent outputs, implying that more short-term investors are realizing losses rather than profits. This aligns with the assertion that many short-term holders have been excessively responding to price adjustments.

In contrast to those who’ve held onto Bitcoin for a short period, long-term investors have shown resilience during this market dip. At present, the value of Bitcoin stands at $59,540, representing a decrease of 2.15% over the last day.

Read More

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-08-21 23:46