As a researcher with experience in the crypto market, I believe that the recent price drop in Bitcoin is due to a combination of factors, including political uncertainties in the US and the ongoing sell-off of seized BTC by governments. The potential withdrawal of President Biden from the reelection bid and the emergence of a stronger Democratic contender who might not support cryptocurrencies have added to the uncertainty in the market.

Bitcoin‘s value plummeted dramatically on Thursday, dipping as low as $56,700. This figure marks a significant decline from its previous level and has not been reached since May 1st. The cryptocurrency is currently grappling with various issues, such as political instability in the US and the German government’s sale of seized Bitcoin. These events have triggered a nearly 20% downward correction for Bitcoin, leaving investors feeling uneasy.

Unraveling The Bitcoin Price Drop

Based on a recent Bloomberg article, there are growing considerations among investors regarding what could transpire if President Joe Biden were to abandon his bid for US reelection. A potential outcome is the rise of a more formidable Democratic candidate who could present significant opposition to Republican Donald Trump, whose policies are supportive of the crypto sector.

Richard Galvin, the co-founder of Digital Asset Capital Management, points out that the possibility of a more robust Democratic presidential nominee who may be less favorable towards cryptocurrencies could contribute to Bitcoin’s temporary price decline.

The ongoing refund process at the defunct Mt. Gox Bitcoin exchange, following its collapse over a decade ago due to an alleged hack, as well as recent government sell-offs of Bitcoins by the US and Germany, have collectively weakened the current Bitcoin market.

Experts keep a keen eye on the potential sell-off risk of Bitcoin held by the US and German governments, who are in possession of confiscated Bitcoins. According to recent reports from Arkham Intelligence, a wallet linked to the German authorities transferred around $75 million in Bitcoin to exchanges last Thursday, following a string of comparable transactions.

Currently, the administrators overseeing the defunct Mt. Gox Bitcoin exchange are gradually releasing a significant quantity of Bitcoin back to their creditors. This development has left some market observers pondering the potential consequences for the Bitcoin market with an estimated $8 billion at stake.

Miners’ Response And Market Impact

As a Bitcoin analyst, I’d rephrase it this way: I’ve observed that Bitcoin miners, who contribute the computational muscle underpinning the Bitcoin blockchain, are still grappling with the financial implications of the Halving event. This significant update has diminished the number of fresh Bitcoins they obtain as remuneration for their efforts.

Some miners are offloading a part of their Bitcoin holdings for sale, intensifying the downward trend in Bitcoin’s price. This persistent selling from the mining community is causing significant price volatility for Bitcoin, as noted by Noelle Acheson in her Crypto Is Macro Now newsletter.

Acheson points out that the crypto market’s mood can shift rapidly, for instance, if disappointing US economic figures spark anticipation of easier monetary strategies from the Federal Reserve.

The prospect of US-approved Ethereum ETFs might boost the general market sentiment. Moreover, US political situations are subject to change and reinterpretation.

Matt Hougan, the Chief Investment Officer at Bitwise, asserts that shifts in the Democratic Party’s leadership may bring about a more favorable stance toward cryptocurrencies. He underlines the significant progress in Washington’s perspective on digital assets over the past year.

Glassnode Predicts Retest Of Previous All-Time Highs

In spite of Bitcoin’s disappointing price trend and lingering doubts about its value, Jan Happel and Yan Allemann, the co-founders of Glassnode, remain confident in their prediction for BTC‘s price. They believe that Bitcoin will surpass the $110,000 mark before the market reaches its peak.

As an analyst, I’ve noticed that Allemann and Happel believe the ongoing consolidation is a chance for Bitcoin to revisit its previous all-time high territory. However, this can only occur if Bitcoin manages to surpass significant resistance levels at $64,000 and subsequently $70,000. Overcoming these hurdles will necessitate further advancements in market conditions and price trends.

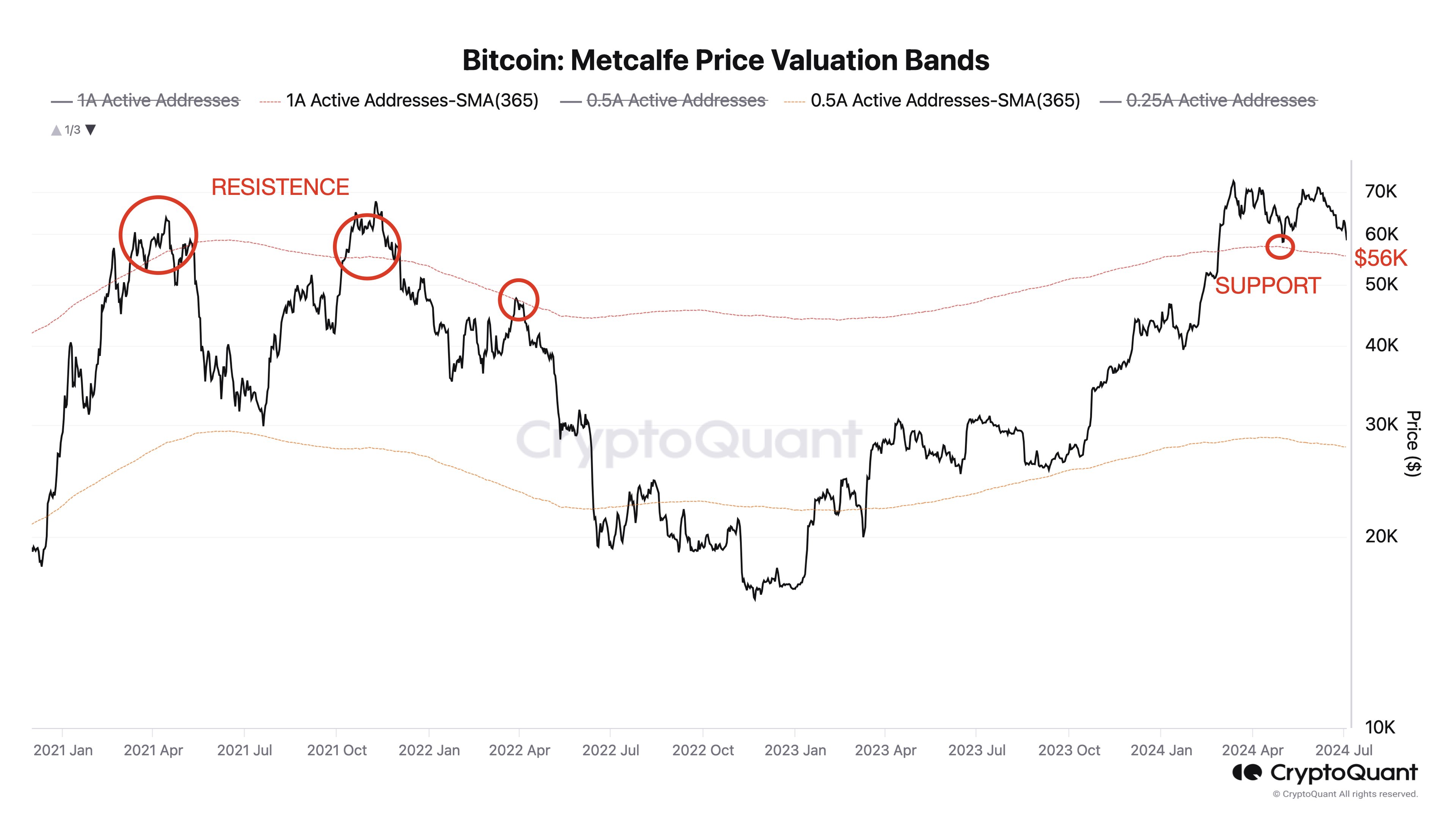

As a meticulous analyst, I’ve come across Julio Moreno’s intriguing perspective on Bitcoin’s pricing using the Metcalfe Price Valuation model. According to his interpretation, the significant support level for Bitcoin’s price lies around $56,000 based on this valuation methodology.

As a researcher studying Bitcoin markets, I found that if the price of Bitcoin doesn’t manage to sustain above the crucial level of $56,000, there is a risk of a deeper correction unfolding. The potential outcomes could be more significant and far-reaching for the market as a whole.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin (BTC) has recovered and is currently trading at around $57,300. However, over the past 24 hours, there has been a 5% decrease in its value, leaving me uncertain about any imminent bullish factors that could push it above the $60,000 mark.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-07-05 03:05