As a seasoned crypto investor with a knack for spotting market trends, I’ve seen my fair share of bull runs and bear markets. However, the recent surge in institutional interest and confidence in the crypto market has me more optimistic than ever before. The $3.13 billion in net inflows into global investment products last week is a testament to this growing acceptance of digital assets as a legitimate investment avenue.

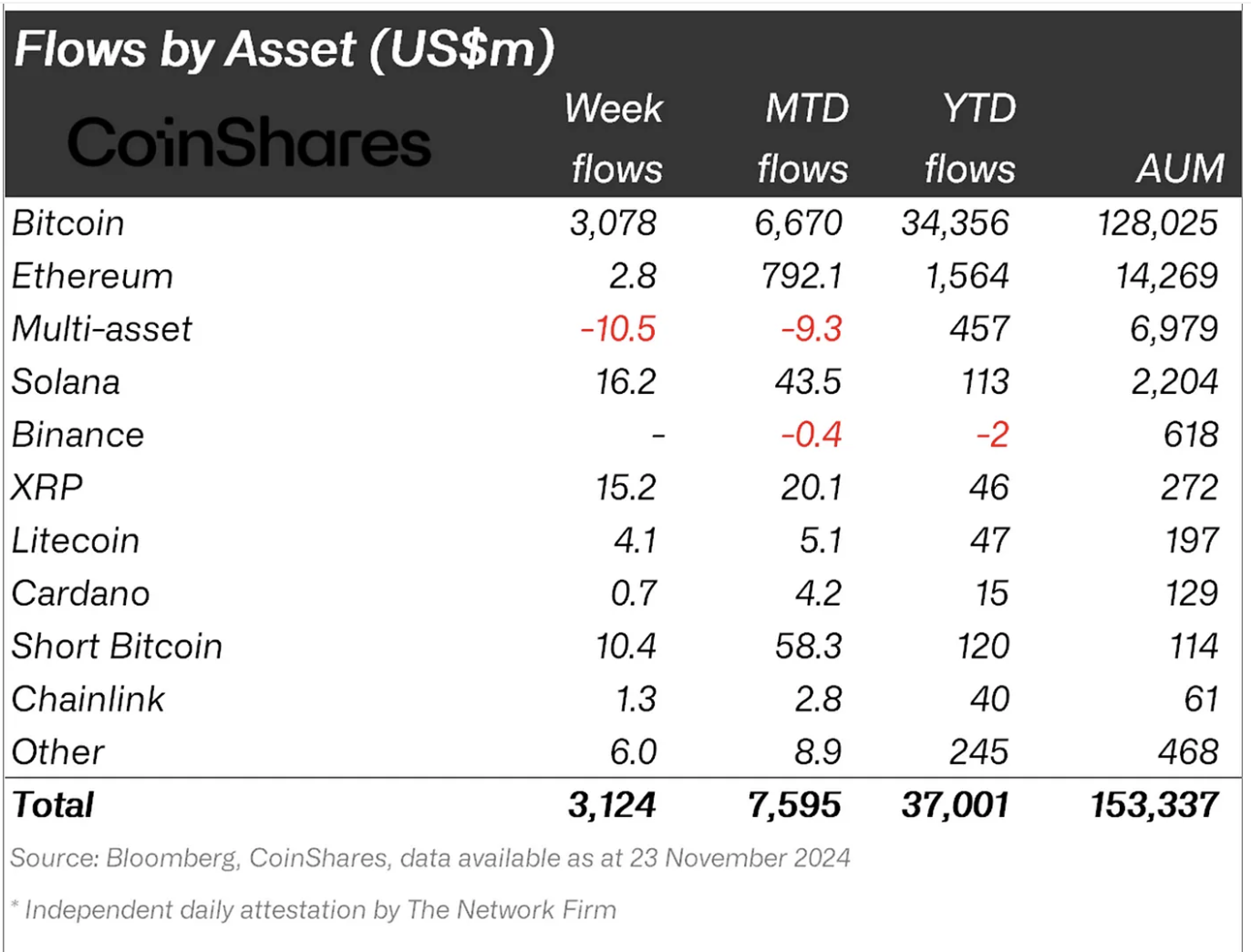

Last week saw a major achievement in the cryptocurrency market with global investment products recording approximately 3.13 billion USD in total inflows, mostly fueled by U.S. spot Bitcoin exchange-traded funds (ETFs). This information is based on data provided by CoinShares.

This significant increase indicates increasing institutional trust and investment in the cryptocurrency market, with Bitcoin taking the front seat. Data from CoinShares shows that this year alone, crypto funds have seen a net inflow of approximately $37 billion, and the total assets under management (AUM) have hit a record high of $153 billion.

Bitcoin Takes The Lead, Altcoins Show Growth

Over the past seven weeks, these key players like BlackRock, Fidelity, Grayscale, and ProShares have consistently seen inflows into their global cryptocurrency investment products.

Last week saw a significant chunk of investments, around $2.05 billion, coming from BlackRock’s IBIT product. This highlights the strong influence of U.S.-based investment funds in the global market. These inflows surpassed the total amount raised by US gold ETFs during their initial year, which was just $309 million.

Last week, Bitcoin investment funds led the way with a $3 billion contribution to the overall inflow. This surge in investments occurred alongside Bitcoin’s ongoing price increase, generating even more attention from both institutional and individual investors.

On the other hand, the increased prices triggered approximately $10 million investment in Bitcoin shorts, pushing the monthly total to an impressive $58 million – a level not seen since August of last year.

During a time when Bitcoin was leading the charge, altcoins also received substantial financial backing. Among these alternative coins, Solana stood out as the second-favored asset among institutional investors, with inflows of around $16 million per week, eclipsing Ethereum‘s weekly inflows of roughly $2.8 million.

Additionally, funds focused on other cryptocurrencies besides Bitcoin also reported significant investments. Specifically, XRP, Litecoin, and Chainlink received investments worth $15 million, $4.1 million, and $1.3 million respectively. This influx of money indicates a growing belief in the overall altcoin market, fueled by price increases and expanding adoption.

Global Crypto Inflows And Regional Trends

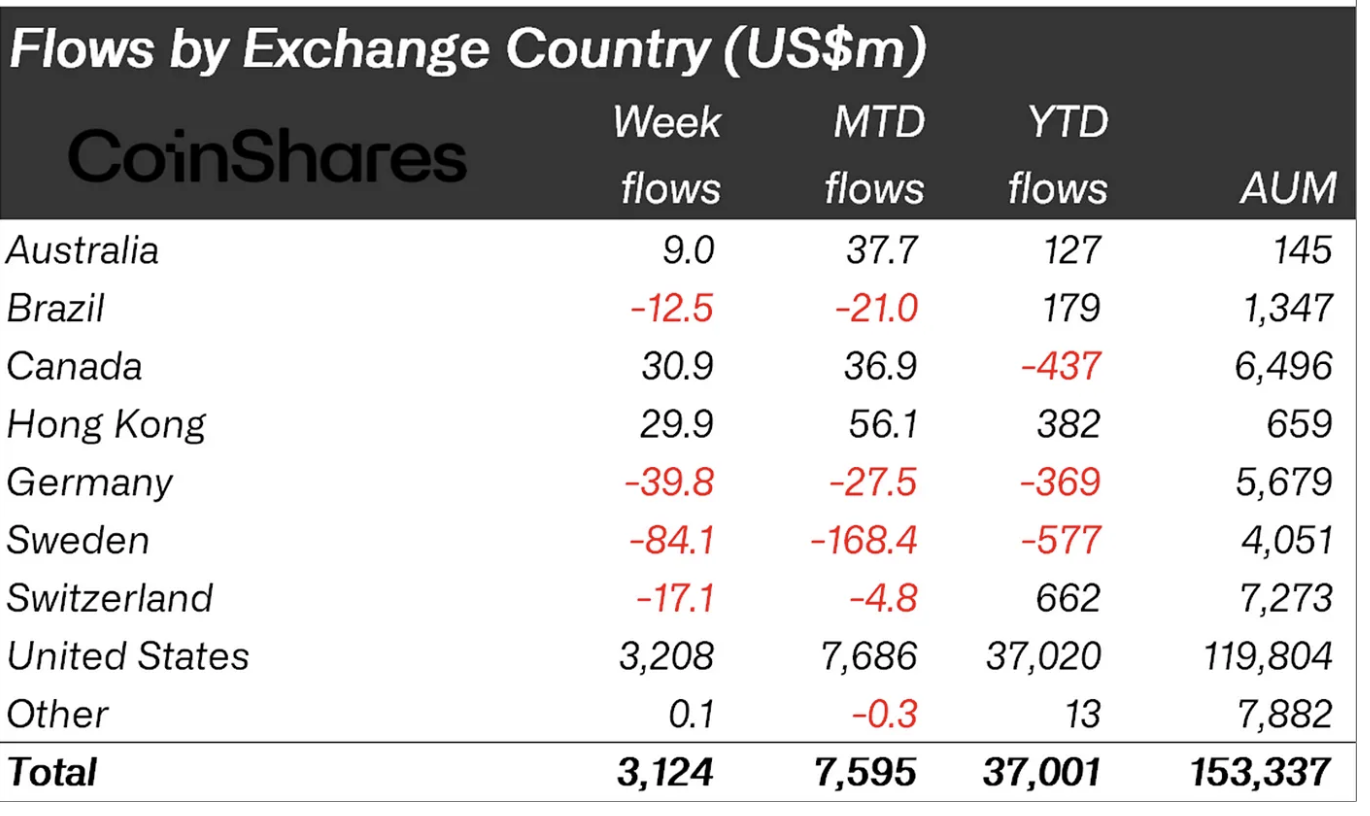

From my perspective as an analyst, it’s clear that US-based funds held a significant position in regional investment trends, attracting approximately $3.2 billion in net weekly inflows.

Nevertheless, these figures were somewhat mitigated due to withdrawals from European markets. For instance, there were $84 million, $40 million, and $17 million withdrawn from cryptocurrency investment products in Sweden, Germany, and Switzerland.

Although there are fluctuations happening regionally, the general sentiment continues to be positive, primarily due to increased institutional investment in the U.S. market.

Significantly, the consistent inflows into CoinShares are driven by a mix of elements, such as the optimistic outlook on the cryptocurrency market’s bull run and the growing recognition of digital currencies as a valid investment asset class.

The launch of spot Bitcoin ETFs has been a pivotal development. It provides institutional investors with a regulated avenue to gain exposure to digital assets.

Consequently, the world of cryptocurrencies is moving towards becoming more widely accepted, boosted by impressive price increases and continuous investments in diverse financial instruments.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-11-26 03:40