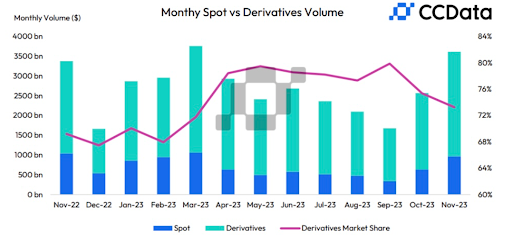

As a seasoned crypto investor with a decade of experience in this volatile market, I’m thrilled about Coinbase’s recent approval for offering cryptocurrency derivative trading to U.S. retail customers. This news brings renewed hope and momentum to the $2.1 trillion cryptocurrency derivative market, which has seen a significant decline in trading volume due to economic uncertainties and regulatory struggles.

Coinbase received the green light from regulatory authorities in the United States to provide cryptocurrency derivative trading to a wider customer base, generating significant excitement and progress within the $2.1 trillion cryptocurrency derivative market.

After a noticeable decrease in derivative trading activity on Coinbase, likely driven by economic instability, regulatory issues, and fewer risks posed by wealthy investors and individual traders, approval for an undisclosed application was granted.

As a market analyst, I’ve observed that derivative trading, including futures, options, and other derivatives, has held significant sway over the cryptocurrency market since 2014. This is due to investors seizing the chance to make larger returns with minimal initial investment. A substantial portion of this market is driven by retail traders, who are inspired by viral meme-stocks and social media buzz on platforms like X, YouTube, and Reddit.

Institutional investors strongly prefer Bitcoin exchange-traded funds (ETFs), keeping a balanced stance in the derivatives market. Nonetheless, these Bitcoin ETFs represent a substantial portion of the total traded assets.

Futures and options trading have had a fair share in the derivative market, but the recent dominance of copy trading is often cited as a key reason for the high volume of the derivative market over the past few months. Copy trading is slowly evolving into a big tool for retail traders looking to explore the derivative market, as many of these traders favour automated trading over spot or manual trading.

Margex’s data indicates a significant trend among retail traders towards copy trading as an innovative approach to boost profits. By following the trades of skilled professionals, traders can capitalize on their expertise while automatically sharing profits through an automated system that benefits both parties.

Copy Trading And Gen Z Influence On The Derivative Market

With copy trading, individuals adopt the investment plans of skilled traders as their own, thereby expanding portfolio diversity, reducing risks, and enhancing potential gains in financial markets. Transactions are carried out promptly and accurately by automated systems.

Copy trading allows users to replicate the trades made by seasoned traders, leveraging their expertise and experience to improve personal trading results or acquire valuable trading and investment insights.

According to recent studies, approximately half of all traders (44%) utilize copy trading methods. This trend has gained significant traction in recent years due in large part to the explosive growth of the social media era and the ongoing evolution of web3 technologies.

As a crypto investor, I’ve noticed an increasing trend among social media users, particularly those in Generation Z, who are eagerly discussing trading strategies on various platforms like X, Reddit, and YouTube. With over half a million active participants, these communities have made copy trading more popular than ever before. In simpler terms, we’re seeing a surge in people learning from each other’s experiences and replicating successful trades within the digital currency market.

Via social media platforms and online forums, there’s been a surging interest among younger generations in copy trading, fueled by their increased exposure to financial news. The social element plays a pivotal role in this trend.

Utilizing the strength of online networks and the social elements of trading, copy trading streamlines the process for retail investors by bypassing the lengthy learning curve of examining individual trades. It also enhances trading procedures and refines strategies to ensure continued profitability.

Copy Trading A Community Building Tool

As a crypto investor, I’ve noticed that following the lead of market experts or forecasters is a common practice among investors and retail traders in the cryptocurrency space. This can range from short-term to long-term portfolio moves. For instance, some may copy the trades of seasoned investors like Warren Buffett or other successful crypto traders. This strategy, known as copy trading, has been around for quite some time, allowing individuals to benefit from the experience and knowledge of others in the market.

In the current retail landscape, there’s a trend reminiscent of the past, with many merchants and users mimicking seasoned traders by copying their open trades.

In the realm of derivatives trading, copy trading has emerged as a favored approach among an increasing number of retail traders. Compared to the spot market, this strategy holds significant sway. More than 91% of futures trading participants are engaged in copy trading, accounting for over 92% of profits generated in this sector.

As a crypto investor keeping up with market trends, I’ve noticed an increasing influence of retail traders on the growth of cryptocurrency derivative markets. With the surge in demand for advanced trading tools and strategies, platforms now offer automation features like copy trading and AI algorithms to help enhance our investment approaches. Centralized exchanges have reported a record-breaking $2.3 trillion peak in their derivative markets as a result.

The derivative market has seen significant growth in the use of CCData compared to traditional spot trading. A substantial number of retail traders are turning to copy trading as a profitable investment strategy. Over the past several years, this copy trading community has generated over 74 million USDT in profits, demonstrating increased involvement and the popularity of copy-trading among retail investors in the derivative market.

As a dedicated researcher in the field of cryptocurrency trading, I’ve observed that numerous trading platforms have incorporated copy trading as a solution to cater to the demands of retail traders seeking advanced and reliable trading strategies to enhance their profitability. Among these platforms, Margex stands out as a leading choice for copy trading.

Margex A Next-Gen Copy Trading Platform

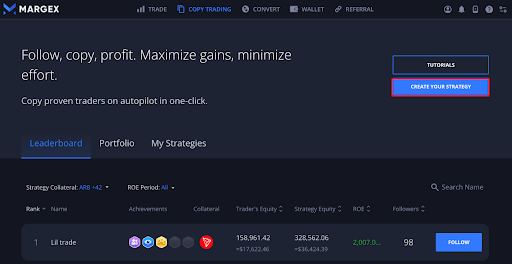

As a researcher studying the crypto trading landscape, I’ve come across Margex – an innovative copy trading platform designed to enable users to emulate the profitable trading strategies of seasoned professionals in the industry. With its user-friendly interface, Margex offers an unparalleled opportunity for newcomers and experienced traders alike to learn from the best and replicate their success in the dynamic crypto market.

As a market analysis expert, I’ve observed that Margex’s implementation of advanced copy trading strategies has significantly benefited numerous retail traders. By catering to the growing preference for automated trading methods, Margex helps users optimize trading outcomes and expand their portfolio diversity to ultimately amplify profitability.

Margex is deeply committed to delivering top-tier services to its users and has invested over $3 million in developing its copy trading platform with a strong focus on user experience. Additionally, the platform comes equipped with a free token converter for seamless swapping between tokens, and a state-of-the-art wallet is on the horizon, allowing users to manage their assets within a secure environment.

Three effortless steps for engaging with the Margex cryptocurrency copy trading platform and mirroring the transactions of seasoned traders.

1 Create An Account With Margex

As a seasoned analyst, I would recommend creating an account with Margex for an optimal copy trading journey. This platform prioritizes the welfare of its copy trading community above all else, ensuring a secure and reliable experience. Furthermore, Margex offers an extensive selection of proficient traders whose trades you may find worth emulating.

2 Select Your Traders

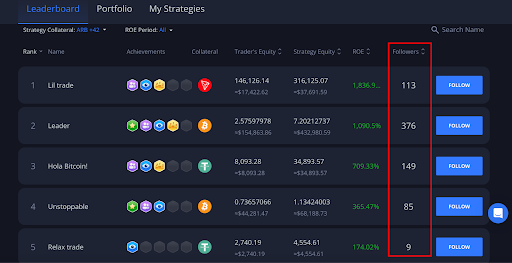

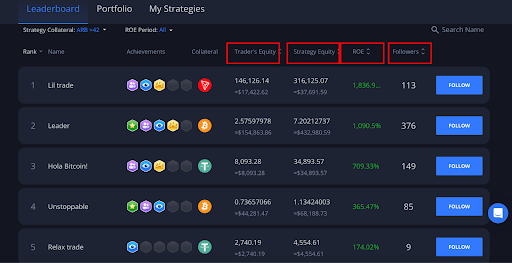

After logging in, I recommend making my way to the copy trading section to examine the leaderboard for top-performing traders. By assessing their key performance indicators, such as follower numbers, traders’ equity, return on equity (ROE), and strategies that resonate with my risk tolerance and investment objectives, I can make an informed decision on which trader to emulate.

3 Allocate Funds

Once you’ve selected a trader to emulate and finalized your investment plan, designate a portion of your funds for mimicking their transactions. The Margex platform will instantly and in real-time replicate these trades on your behalf.

As low as $10 is the minimum amount Margex requires to participate in copy trading strategies.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-02 16:53