As an analyst with over a decade of experience in the crypto market, I’ve seen my fair share of volatility and corrections. The recent 24-hour correction we’re witnessing is no exception, with altcoins taking a significant hit. The total crypto market cap excluding BTC and ETH plunged by an alarming 10.75%, erasing $121.69 billion in valuations.

In the past 24 hours, the altcoin market experienced a significant correction following a temporary dip in Bitcoin‘s price to $94,355 from its previous level of $97,484. During this period, top altcoins such as XRP and Cardano saw corrections ranging from 3% to as high as 12%. Specifically, XRP experienced a decline of 10.06%, while Cardano fell by 12.50%. The 24-hour volatility for Bitcoin was 1.5%, while it stood at 6.1% for XRP. The market capitalization for both Bitcoin and XRP were $1.93 trillion and $127.46 billion respectively, with a 24-hour trading volume of $142.13 billion and $22.99 billion for Bitcoin and XRP respectively.

Over the last 24 hours, I’ve observed a substantial drop in the total market capitalization of cryptocurrencies excluding Bitcoin and Ethereum, which currently stands at approximately $451.14 billion. This dramatic fall represents a decrease of 10.75%, translating to a loss of around $121.69 billion in market value. This significant slide has had a profound impact on altcoin investors, leading to a substantial reduction in the worth of their portfolios.

Crypto Market Loses $1.73B in Liquidations

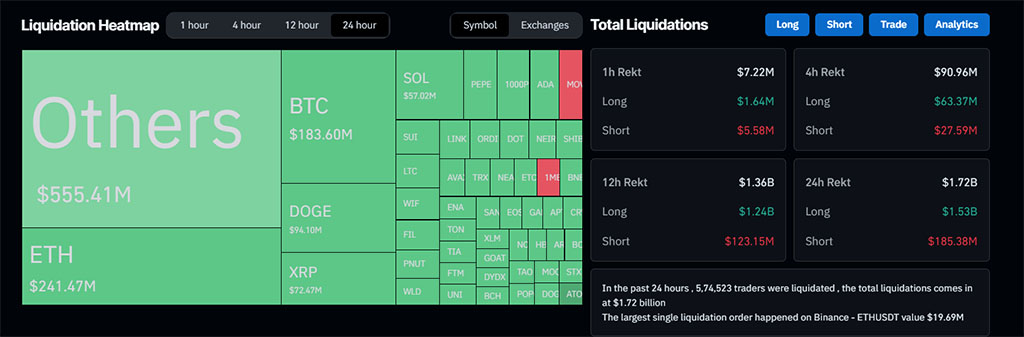

Based on information from CoinGlass, the cryptocurrency market experienced a loss of approximately $1.73 billion in the last 24 hours. This decline is largely attributed to the broader market adjustment, which had a particularly hard impact on optimistic traders who held leveraged long positions.

As an analyst, I’ve observed a significant discrepancy in market liquidations: long liquidations amounting to approximately $1.55 billion, contrasted with much smaller short-sized liquidations valued at around $184.87 million. Notably, the single largest liquidation order occurred on Binance within the Ethereum-USDT pair, contributing about $19.69 million to this total figure.

Additionally, a total of 580,793 entities involved in liquidation were closed during the last 24 hours. In the wider market slump, Bitcoin experienced a drop worth approximately $185.03 million, resulting in a loss of $146.8 million for the bullish investors.

In summary, Bitcoin’s total value of outstanding contracts (open interest) has dipped below $60 billion, currently at $59.72 billion, representing a decrease of 2.76% in the last day. This decline comes amidst the wider market downturn. Additionally, the funding rate, which is influenced by open interest, has dropped to 0.0124%, down from its peak of 0.0262%.

Moreover, the general opinion among society views the correction as a promising chance for investment.

Santiment Reveals Market Willing to Buy the Dip

According to a recent tweet by Santiment, the data indicates a significant increase in crypto investors’ buying interest, as indicated by a sharp rise in social media discussions about buying or purchased cryptos over the last four correction periods.

This reflects the broader market sentiment of buying additional crypto amid market pullbacks.

📊 Here’s a visual representation showing the interest in buying cryptocurrency (shown in blue) versus selling cryptocurrency (shown in red) across social media for the past month. Keep an eye on whether retail investors exhibit fear of missing out (FOMO) as Bitcoin dipped to approximately $94,700. 👇

— Santiment (@santimentfeed) December 10, 2024

Over the last three declines, there’s been a substantial uptick in social media chatter about buying more cryptocurrency. Even during this recent downturn, this spike in interest in purchasing extra cryptocurrency reached a new peak, outdoing the previous three instances.

Therefore, the repeated attempts by the crowd to accumulate more cryptocurrency for a fourth time suggests an increase in underlying trust or optimism. Similarly, on days when there was an increase in social activity, the Bitcoin price also saw a rise.

Source: Tradingview

On November 27, I observed a significant 4.41% increase in Bitcoin’s price. This upward trend repeated itself on December 4, leading to a 2.97% climb. The same pattern was seen again on December 6, resulting in a 2.93% rise. Given these patterns, it seems plausible that we might witness another recovery in Bitcoin’s price with the fourth instance of this trend.

Bitcoin to Lead the Way

As an analyst, I’m observing the current downtrend in Bitcoin’s price. The BTC has dipped below the 50-Exponential Moving Average (EMA) line on the 4-hour chart, signaling potential bearish momentum. At present, Bitcoin is encountering two significant support zones: the 100-EMA on the same 4-hour chart and a well-established trendline that’s been forming over time. With numerous small-bodied candles, the price of BTC is finding it challenging to maintain its value above the $97,000 mark. This situation also represents a pivotal test for the previous bullish reversal point.

Source: Tradingview

The rise in Bitcoin could lead to a potential double-bottom reversal. Yet, the absence of bullish divergence and the downward trend in the MACD and signal lines suggest that there might be a period of consolidation before any significant bullish rebound. As for the BTC price, it’s essential to break through the previous peak at $101,171 as resistance for a bullish recovery to take place. For a sustained recovery, the BTC price needs to exceed the 50-EMA line and close above it. Therefore, traders focusing on price action should be aware of these crucial resistance levels.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

2024-12-10 12:10