As a researcher with years of experience studying cryptocurrencies and their market dynamics, I’ve witnessed some fascinating trends that have shaped the crypto landscape. The recent Fed rate cuts have undoubtedly ignited a frenzy among Bitcoin whales, as evidenced by their buying spree worth over 1.6 billion BTC. This accumulation trend, combined with the historical trend of significant price increases during halving years and Q4, suggests that we could soon see Bitcoin reaching $70,000 or even beyond.

Confidence among Bitcoin investors has increased significantly due to the Federal Reserve’s interest rate cuts, leading to “whales” purchasing as much as 1.6 billion BTC since the policy decision. Given this optimistic forecast, it is conceivable that the value of Bitcoin could soon reach $70,000.

Fed Rate Cuts Prompt Buying Spree Among Bitcoin Whales

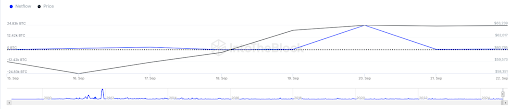

As a researcher examining cryptocurrency trends, I’ve observed an intriguing surge in Bitcoin purchases among large-scale investors, or “Bitcoin whales,” following the Federal Reserve’s rate cuts on September 18. The data from market intelligence platform IntoTheBlock reveals that these whales have acquired approximately 25,510 Bitcoins worth over $1.6 billion since then, starting from September 19.

It’s no wonder this accumulation pattern has emerged, given that the 50 basis point interest rate reduction has fostered a positive sentiment for risky assets like Bitcoin. Experts predict that Bitcoin could witness a substantial price increase due to an influx of liquidity into its market as investors have more funds available thanks to the Federal Reserve’s quantitative easing (QE).

It’s predicted that Bitcoin could experience significant upward momentum, potentially reaching $70,000 in the near future. After the Fed rate cuts, it surpassed the $60,000 price point as a support level and has been maintaining itself comfortably above this mark. As anticipated, an increase in liquidity is noticeable within the Bitcoin market, with whales making a notable $1.6 billion investment.

Consequently, it might not take too much time for cryptocurrency to reach the $70,000 mark. This figure is crucial because surpassing it could potentially lead BTC to establish a fresh all-time high (ATH). The $70,000 price point has been a significant barrier since Bitcoin fell below this level after attaining its current ATH of $73,000 earlier in March.

In contrast, there’s a strong possibility that Bitcoin could surpass its current resistance level on this occasion, given the increased bullish energy following the Federal Reserve’s interest rate reductions.

History Could Repeat Itself

Beyond the Federal Reserve reducing interest rates, the historical pattern of Bitcoin points towards an optimistic forecast for the leading cryptocurrency, indicating a potential surge to $70,000 could occur in the near future. Notably, crypto expert Ali Martinez highlighted that Bitcoin experienced a 61% and 171% price increase during halving years, specifically in 2016 and 2020 respectively.

In simpler terms, the expert suggested that the pattern in Bitcoin’s price movements this year is similar to those seen in 2016 and 2020. This might mean a replay of past events, potentially leading to Bitcoin experiencing growth akin to what it enjoyed in previous years.

Furthermore, it’s common for Bitcoin to see its highest returns during the fourth quarter of each year. Consequently, we might expect substantial price increases for BTC as we approach the final three months of this year. Additionally, the post-halving rally is imminent, which could fuel this price rise towards an estimated $70,000.

Currently, as I’m typing this, Bitcoin is being exchanged for approximately $63,900, marking an increase of more than 1% during the past 24 hours, based on information from CoinMarketCap.

Read More

2024-09-23 12:40