As a seasoned analyst with years of experience under my belt, I find myself constantly monitoring the ever-evolving landscape of the cryptocurrency market. The second quarter performance of Fantom (FTM) has been a fascinating case study for me.

During the second quarter of the year, the Fantom blockchain showed a blend of results, as crucial financial indicators dipped due to the general decline in the cryptocurrency market and the Fantom Foundation’s decision to rebrand as Sonic Labs, according to a recent report by data intelligence firm Messari.

FTM Market Cap, Revenue, And Token Economics

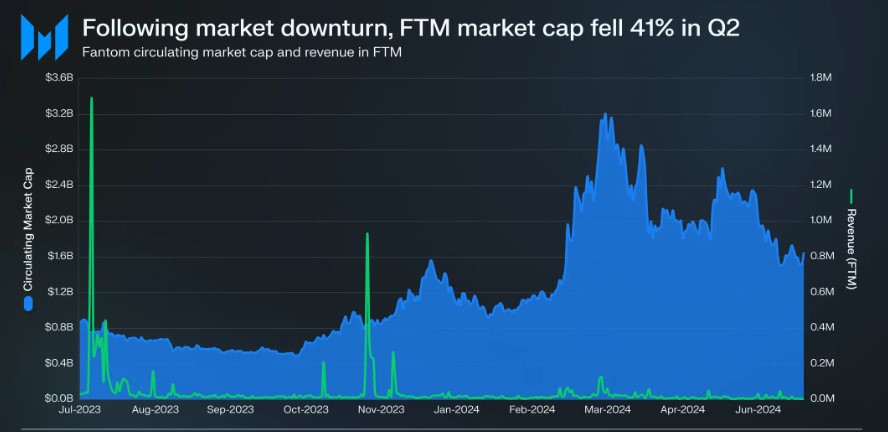

As a researcher, I’ve noticed that despite seeing impressive performance in Q1, Fantom’s circulating market capitalization dipped by approximately 41% when comparing it with the previous quarter (QoQ), falling from $2.8 billion to $1.7 billion. Despite this decline, it’s important to note that the token’s market cap remains a significant 94% increase compared to the same period in the previous year (YoY), or Q2 of 2023.

Network earnings, represented by gas fees, dropped approximately 42% quarter-over-quarter, going from 1.8 million FTM to 1.0 million FTM. This translates to a 38% decrease in US dollars, with the earnings falling from $1.2 million to $0.8 million over the same period.

After experiencing an increase in Q3 of 2023 related to NFT transactions, there has been a subsequent drop. However, based on Messari’s predictions, we can expect income to recover as overall on-chain crypto activities start to grow again.

In addition, the report underscores adjustments made to Fantom’s token economics during the second quarter. The Ecosystem Vault and Gas Monetization initiative were launched in Q4 2022, decreasing the burn rate of transaction fees from 30% to 5%, with the remaining 25% being redirected.

At the close of the second quarter, the total amount of the protocol’s built-in token, FTM, in circulation had risen to approximately 2.8 billion. This number represents a 25% increase compared to the previous quarter, and the annual inflation rate for this token stands at 3%.

Fantom On-Chain Activity Slows

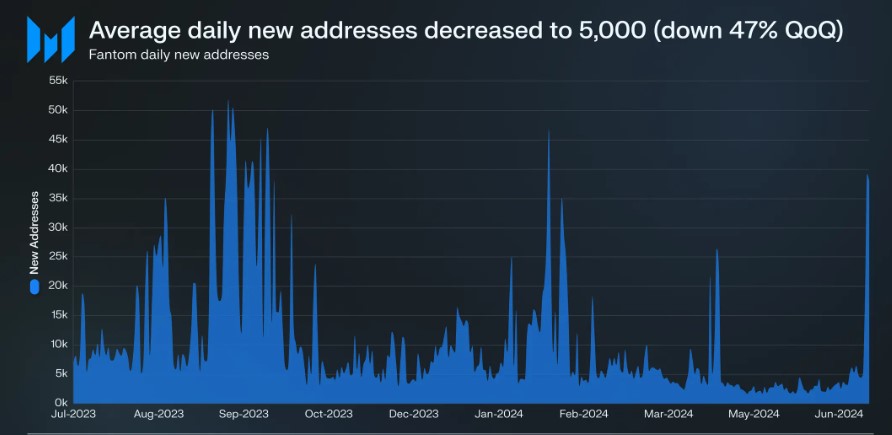

In the second quarter, the number of transactions and active addresses on Fantom’s blockchain decreased. The daily transaction average dropped by around 10% compared to the previous quarter, from approximately 247,000 to over 223,000. Similarly, the number of daily active addresses declined by about 21% QoQ to roughly 31,900. However, the report indicates a possible reversal of this downward trend towards the end of the quarter.

The rate at which new addresses were created decreased by 47% compared to the previous quarter, averaging around 5,000 daily. Yet, the report pointed out some encouraging advancements, such as a rise in the count of active validators within the network.

As a crypto investor, I’ve seen a significant shift in my favorite blockchain network, as a governance proposal lowered the staking requirement from 500,000 FTM to a more accessible 50,000 FTM. This change has led to an impressive 6% quarter-over-quarter increase in active validators, now standing at 58. Notably, among these new validators, 14 have less than the previous staking requirement of 500,000 FTM self-staked. This move has undeniably opened up more opportunities for participation within our community.

For two consecutive quarters, the amount of FTM tokens staked has grown by 5%, reaching 1.3 billion tokens this quarter. However, the overall value in dollars of staked FTM dropped by 39% to $780.4 million, primarily because the price of the token fell.

In the world of decentralized finance (DeFi), Fantom’s overall value locked (TVL) dropped by 28% compared to the previous quarter, amounting to $91.2 million. This places Fantom as the 42nd largest blockchain network in terms of TVL. However, contrary to the decline in FTM token price, the TVL measured in FTM tokens saw a 22% increase quarter-on-quarter, indicating a flow of capital into the platform despite the token’s price decrease.

Currently, a single unit of FTM is being traded for approximately $0.3345, representing an increase of only 1% in the last day. On the other hand, over the course of the past month, this coin has experienced a decrease of 27%, coinciding with the general market downturn when viewed from a monthly perspective.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-08-10 05:11