As a seasoned researcher and analyst with a keen eye for identifying patterns in complex data sets, I find Sina’s analysis both intriguing and plausible. Having spent countless hours poring over charts and models, I can attest to the fact that Bitcoin’s market cycles do bear an uncanny resemblance to clockwork. The alignment of these quantile ranges with historical phase transitions is a testament to this.

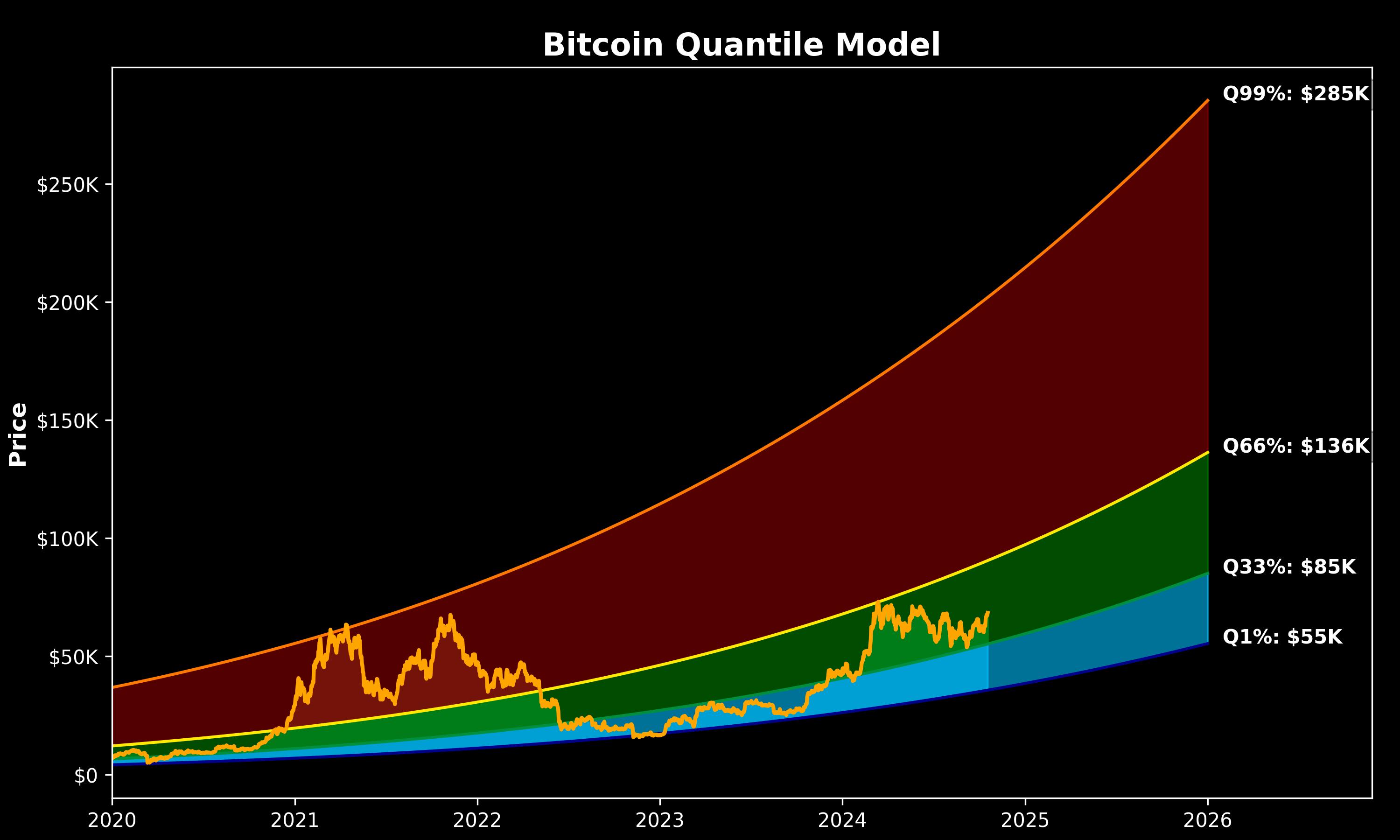

In a recent analysis shared on platform X, Sina – who is a professor, consultant, and co-founder & COO of 21stCapital.com – predicts that the price of Bitcoin could reach as much as $285,000 by the year 2025. Using a quantile regression model, Sina has pinpointed unique stages in Bitcoin’s market cycle.

Can Bitcoin Price Skyrocket Above $200,000?

According to the model, the Cold Zone (which makes up less than 33%) refers to the price range that falls between $55,000 and $85,000. This zone signifies the lowest possible price range by the end of 2025, implying a great timeframe for active buying or “aggressively building up your holdings.

As an analyst, I find myself in the heart of the “Warm Zone,” a dynamic market segment encompassing values between $85,000 and $136,000. This phase is characterized by heightened market activity and growing mainstream interest. Here, the market begins to pick up speed, much like a train gaining momentum as it leaves the station.

In simpler terms, the most crucial period, known as the “Hot Zone,” extends approximately between $136,000 and $285,000. This period is marked by increased volatility and large price fluctuations due to the peak of mass adoption and the widespread use of leveraged positions.

Even though there’s a lot of opportunity for profit, the chances of setbacks increase significantly. Sina recommends investors to either hang on and reap potential profits or think about reducing their investments according to risk evaluations, especially since market highs often happen in the top 1-9% range. Importantly, the top 10% begins at approximately $211,000.

What amazes Sina is how these 33% percentile ranges line up perfectly with Bitcoin’s historical phase shifts. He observes that Bitcoin spends nearly a third of its time in each zone before moving on to the next, as if following a schedule. This pattern implies that most of the bear market takes place below the 33% quantile, while the bull market fervor starts above the 66% quantile.

crypto expert PlanC (@TheRealPlanC) commended Sina’s theory, stating that it provided an “outstanding and crystal-clear” explanation. In response, Sina attributed his ideas to PlanC, acknowledging the significant influence of his pioneering work on his own model.

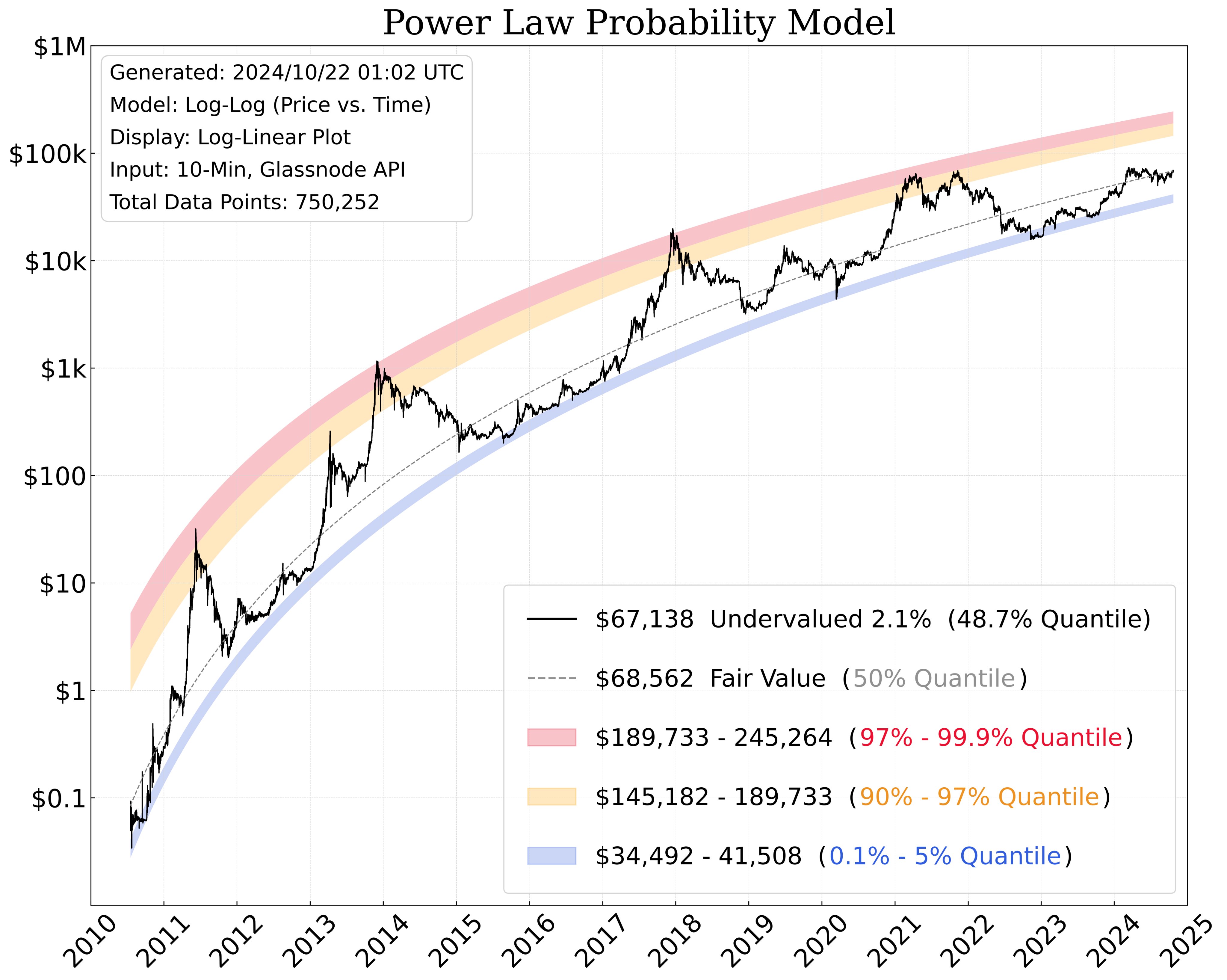

PlanC has also recently updated his “Power Law Probability Model,” which forecasts Bitcoin prices ranging from $189,733 to $245,264 for the 97% to 99.9% quantile and $145,182 to $189,733 for the 90% to 97% quantile. He emphasizes that despite appearances, the underlying data follows a power-law relationship, independent of how it’s plotted—be it linear, log-linear, or log-log scales.

He clarifies that the data exhibits a pattern where it increases proportionally on a logarithmic scale when plotted against quantiles and time, not manually drawn lines. This pattern is demonstrated using a rainbow chart, which employs logarithmic regression with a log-linear relationship. The quantile regressions he refers to are based on the natural logarithm of price plotted against time, utilizing all available data.

To help understand the model’s forecasting abilities, PlanC explains the importance of different quantiles. The 99.9% quantile is a level where the price has been above it just 0.1% of the time, which equates to approximately one day out of every 1,000 days—a seldom event. Similarly, the 99% quantile shows that the price has gone over this line 1% of the time, or about one day in every 100 days, also considered infrequent. On the other hand, the 0.1% quantile signifies that the price has dropped below this level only 0.1% of the time.

At press time, BTC traded at $67,121.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-10-22 21:04