As a seasoned crypto investor with several years of experience in the market, I find Peter Brandt’s analysis intriguing, but I remain cautiously optimistic rather than making any definitive conclusions based on his exponential decay thesis. While Bitcoin has historically shown a decrease in percentage gains with each bull cycle, it is essential to remember that markets are not always predictable, and external factors can significantly impact price movements.

Crypto specialist Peter Brandt has courageously stated that the peak price of Bitcoin within this market cycle might have already occurred. This assertion is derived from his “exponential decay” theory, which he mentioned could potentially benefit the Bitcoin community.

Why Bitcoin’s Price Has Topped

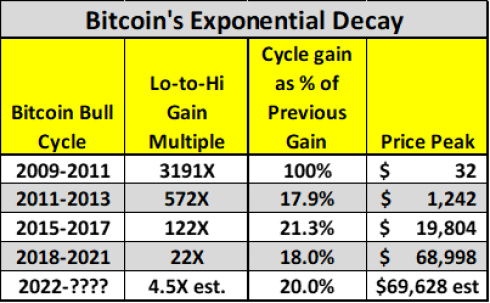

Brandt pointed out that historical trends indicate Bitcoin’s price has peaked. He also hinted at the concept of “exponential decay,” which he applied to Bitcoin’s behavior. According to Brandt’s exponential decay theory, the percentage growth of Bitcoin in each successive bull market has noticeably decreased.

As a researcher studying the cryptocurrency market, I’ve observed an intriguing pattern in Bitcoin’s price history. Specifically, between 2015 and 2017, Bitcoin experienced a remarkable increase of 122 times from its market low to high. Yet, this price surge accounted for just 21.3% of the total percentage gain Bitcoin saw during its previous cycle, which ran from 2011 to 2013.

As a researcher studying the cryptocurrency market trends, I observed an intriguing pattern between the years 2018 and 2021. Despite experiencing a remarkable 22-fold price surge from its market bottom to peak, Bitcoin managed to record merely 18% of the percentage gain it previously achieved during the preceding cycle. With this foundation in mind, I predict that this market cycle will likely follow suit, implying that Bitcoin may only see around 20% of the price growth experienced in the previous market cycle.

Using the market low of $15,473 from this cycle as a reference, it was calculated that 20% of the previous cycle’s growth would lead to a market peak of approximately $72,723. Remarkably, this price point had already been reached during Bitcoin’s progression towards its new all-time high ($73,750).

During the conversation, the acknowledged cryptocurrency authority acknowledged that historically, Bitcoin experiences its greatest price increases following a Bitcoin halving, an event that recently transpired. Nevertheless, he cautioned that the crypto sphere must grapple with the reality of exponential decay, which has led him to estimate a 25% likelihood that Bitcoin has already peaked in this cycle.

Why The Exponential Decay Might Be Bullish For Bitcoin

As an analyst, I’d interpret Brandt’s perspective as follows: If Bitcoin does experience a drop, possibly down to the mid $30,000 or its 2021 lowest points, he considers this decline to be a potentially bullish development from a long-term standpoint.

Related Reading: Brace For Price Impact: Dogecoin Whales Move Massive 456 Million DOGE To Exchanges

Using a traditional perspective on chart analysis, the cryptocurrency specialist indicated that Bitcoin was poised for significant surge in value upward, despite current stagnation.

Brandt provided an illustration of how Bitcoin’s graph might shape up when its price surges beyond $100,000. He made a comparison to Gold’s chart from August 2020 to March 2024 as a potential blueprint for Bitcoin’s upcoming price action. Remarkably, Brandt has forecasted that Bitcoin will soon assume the throne over Gold in terms of market dominance.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-04-27 21:04