As a seasoned crypto investor with over a decade of experience in navigating the digital asset landscape, I’ve witnessed numerous market cycles and trends. The recent recovery of Bitcoin and Ethereum has caught my attention, especially the surge in institutional demand for Ether that Matrixport has highlighted.

Yesterday, as I watched Bitcoin’s price inch back up towards $98,000, I saw the total crypto market cap surge by 1.41% to an impressive $3.41 trillion. The broader market recovery seemed to be in full swing, with Ethereum pushing past the $3,700 level as well. Despite a modest 0.4% volatility in the last 24 hours, Ethereum’s market cap stood at approximately $448.10 billion, with a daily volume of around $55.78 billion.

After dropping by 10% over the last two days, Ethereum has started to show signs of a bullish comeback with a daily increase of 2.01%. This positive movement could be attributed mainly to the rising interest from institutions.

Matrixport Reports Higher Price Potential in Ethereum

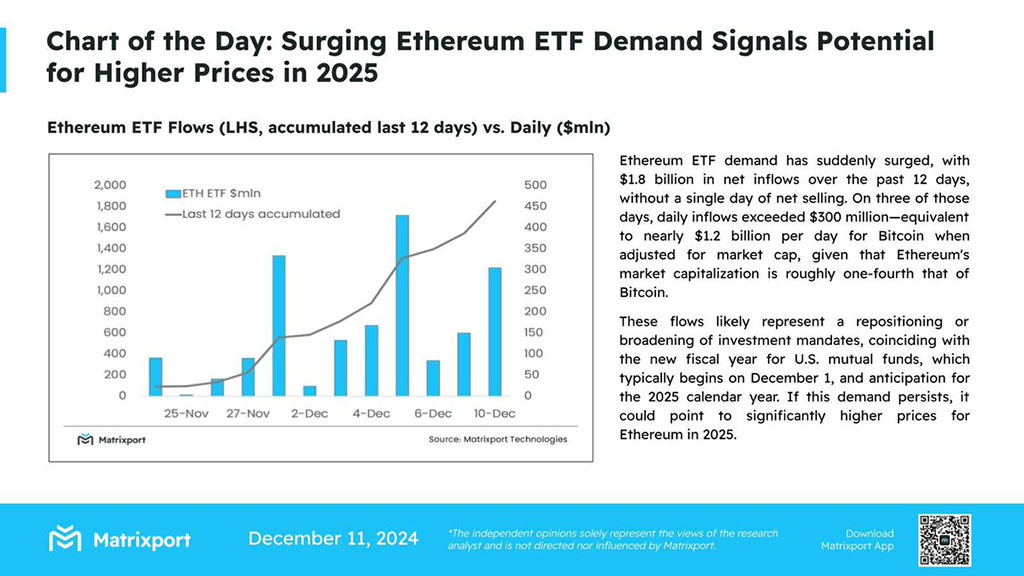

According to a Matrixport study, the significant increase in interest for Ethereum ETFs could indicate a possible rise in prices by 2025. This forecast is based on the fact that these ETFs have attracted approximately $1.8 billion in investments over the last twelve days.

During the course of this event, I observed that no single day saw a net sell-off of Ethereum ETFs. In fact, out of the 12 observed days, three instances witnessed daily net inflows surpassing $300 million.

From my perspective as a researcher, I found that when Bitcoin’s market cap is normalized to daily figures, we’re looking at approximately $1.2 billion. Notably, Ethereum’s market cap is around 25% the size of Bitcoin’s, which puts Ethereum’s daily equivalent at about a quarter of Bitcoin’s value.

A significant influencer behind institutional demand is the expected assumption of U.S. presidency by the Trump administration in 2025. Additionally, the commencement of a new fiscal year for U.S. mutual funds on December 1 has heightened expectations regarding the economic landscape of 2025.

Given the ongoing interest, Matrixport predicts Ethereum’s value may rise substantially by 2025.

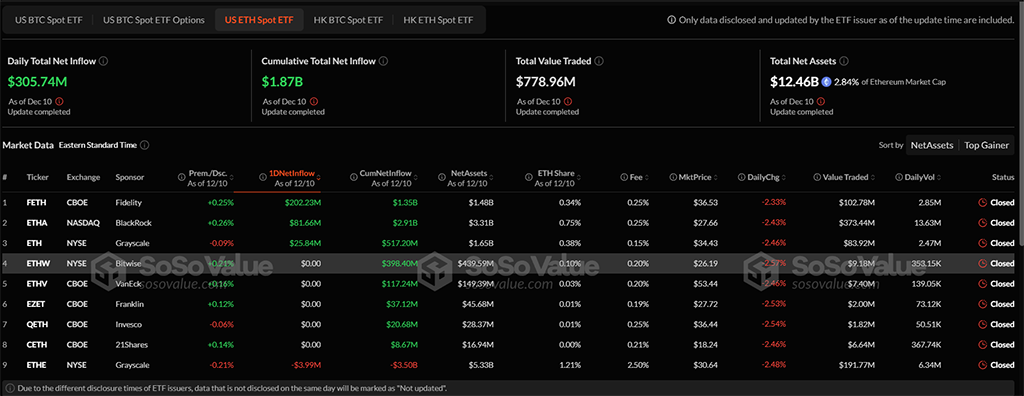

Ethereum ETFs Net $305M on December 10

In the last 24-hour period, the Ethereum ETF market saw a total daily net increase of approximately $305.74 million. Leading the pack was Fidelity’s FETH, which brought in $202.23 million, while BlackRock’s ETHA followed closely behind with an inflow of $81.66 million.

The total net assets of the US Ethereum spot ETF have reached $12.46 billion, dominating 2.84% of the Ethereum market cap.

Altcoin Season to Drive Ether

According to a recent tweet by a well-known cryptocurrency expert (Titan of Crypto), who works independently and provides analysis, there’s a potential for a new altcoin’s value to increase, which could potentially strengthen the positive momentum in Ethereum.

The expert points out an upward-sloping triangle (rising wedge) formation appearing in the Bitcoin dominance price graph, analyzed over a weekly duration. This downward break of the trendline supporting Bitcoin’s dominance suggests a higher probability for a surge in altcoins, implying a potential new era for alternative cryptocurrencies.

In the coming weeks, we might see a significant increase in the total value of alternative cryptocurrencies, given the ongoing decline in Bitcoin’s dominance.

Ethereum Price Rally Targets $4,617

Looking at technical analysis, the Ethereum price pattern on the weekly chart suggests a breakout from a triangle formation, leading to an upward rally. Additionally, this latest recovery has formed a Rounding Bottom reversal, exceeding the neckline at approximately $3,817 which corresponds to the 78.60% Fibonacci level price.

Source: Tradingview

This week’s retreat by 7.65% has us testing that previously broken trendline again, as well as revisiting the Rounding Bottom pattern. With the ongoing market recovery, there is an imminent possibility of a bullish intersection between the 100-week and 200-week Moving Averages.

Additionally, the MACD and Signal lines continue to move upward, indicating a persistent uptrend. With the Ethereum price poised for a rebound following the breach of its trendline, the Fibonacci ratio points toward a potential new high of $4,617 in the near future.

Due to the surge in institutional interest, the potential for an altcoin boom, and positive market trends under the Trump administration, it’s become more likely that Ethereum will reach a fresh record high.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

2024-12-11 15:28