Ah, the enigmatic dance of Ethereum‘s price! In the past day, it has shown a significant change, rising by 1.86%. However, according to the trading data from CoinMarketCap, the popular altcoin has recorded negative growth since December 2024, despite some significant gains in the past month. But fear not, dear reader, for there is a glimmer of hope in the form of a potential price breakout.

Ethereum’s Secret Accumulation Society: A Bullish Divergence Unveiled

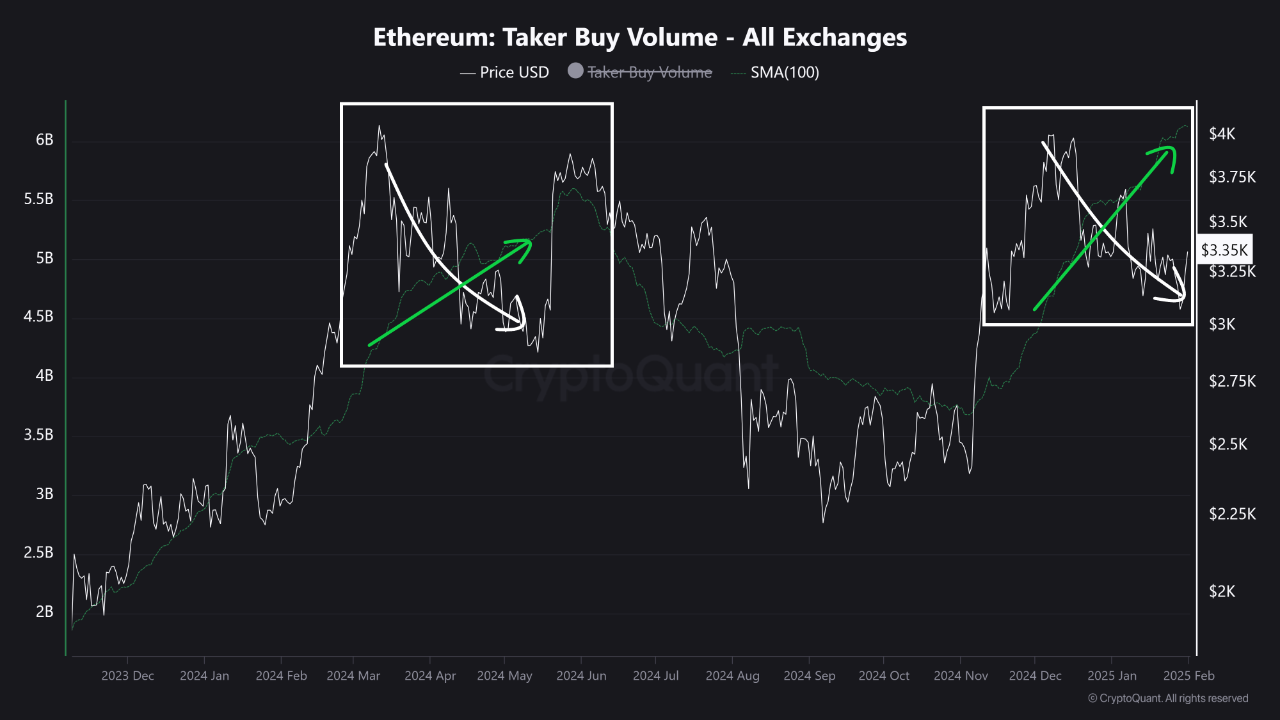

Ever since touching the $4,000 price mark, Ethereum has slipped into a downtrend, falling as low as $3,000. Amidst notable gains by Bitcoin in January, Ethereum continues to struggle, hitting consistent lower lows during this period. But wait, there’s more! A CryptoQuant market expert with the username Crypto Sunmoon has noted an increase in market buying volume amidst the current price dip, indicating a bullish divergence in the ETH market.

As for Ethereum, the increase in buying volume amid falling prices indicates a strong demand from buyers, especially at the current price levels. This development further suggests a strong confidence in the asset’s profitability, as investors expect buying pressure to surpass selling activity in the coming days.

Based on historical data, Crypto Sunmoon predicts Ethereum may experience a price surge such as the one in May 2024 when a similar bullish divergence last occurred. During that month, ETH rose by over 21% suggesting the altcoin will likely return to $4,000 if the projected price breakout occurs, according to current market prices.

ETH Long-Term Holders: A Tale of Unwavering Confidence

In other news, IntoTheBlock reports that long-term holders of Ethereum currently boast an average holding time of 2.4 years, showing massive confidence in Ethereum’s future value potential. But alas, Ethereum faces other issues, including an absence of short-term participants, which prevents ETH from experiencing significant levels of speculative trading that can drive up price appreciation.

Furthermore, the rapid growth of layer 2 solutions such as Optimism, and layer 1 blockchains such as Solana are also tampering with the potential market demand and attention for Ethereum.

At press time, ETH trades at $3,306 after a gain of 1.86% over the past day, as earlier stated. Meanwhile, the asset’s daily trading volume has increased by 55.69%, resulting in a value of $30.3 billion. On larger time frames, Ethereum is also up by 0.22% on its weekly chart but down by 2.27% on its monthly chart, leaving much to desire for many short-term investors.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2025-02-01 15:45