In a rather amusing twist of fate, the esteemed crypto analyst known as CryptoGoos has ventured forth with a proclamation: Ethereum (ETH), that capricious creature of the digital realm, may soon liberate itself from the clutches of a bear trap. Yes, dear reader, the analyst dares to suggest that this cryptocurrency could very well leap over its recent ceiling of $4,000, casting its gaze toward a lofty new all-time high of $10,000. One can only imagine the jubilation—or perhaps the incredulity—this news might inspire among the faithful. 🐻💰

Ah, Ethereum, the second-largest of its kind, seems to be on the verge of a grand escape from a bear trap, a term that, for the uninitiated, evokes images of hapless traders ensnared by false signals. Picture, if you will, a scene where traders, lured by the siren song of falling prices, rush to short the asset, only to find themselves caught in a sudden reversal, their positions liquidated like so much spilled milk. 🍶

In a recent missive on X, CryptoGoos has drawn attention to a weekly chart that suggests Ethereum may be on the cusp of a trend reversal, after enduring a relentless sell-off since December 2024. The anticipation is palpable, akin to waiting for a train that may or may not arrive. 🚂

Not to be outdone, fellow analyst Merlijn The Trader has chimed in, likening the current price action of ETH to patterns observed in the fabled year of 2020. He recalls a time when panic morphed into a historic rally, leaving many to wonder if history might repeat itself—or if it will simply serve as a cautionary tale. 📈

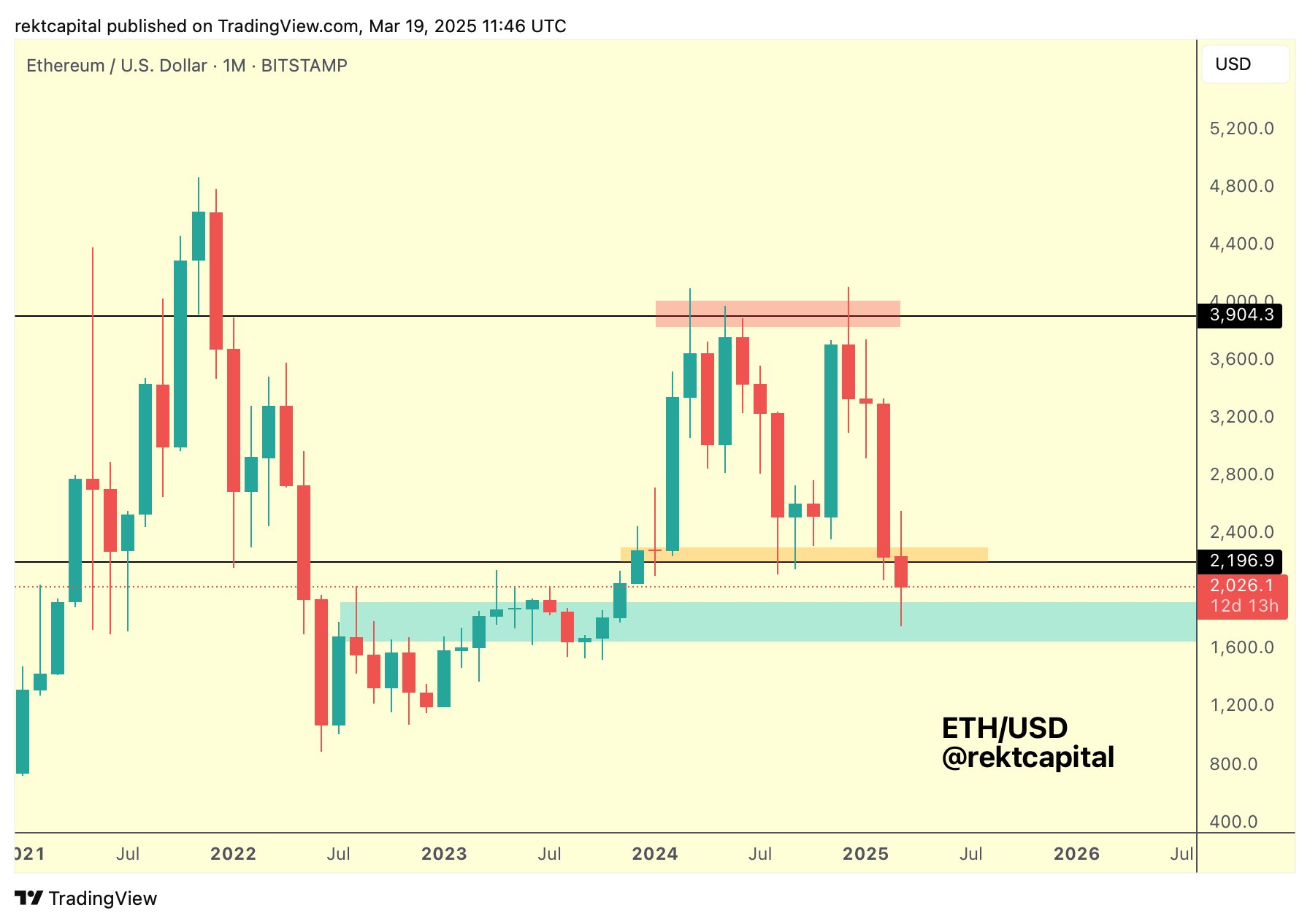

Meanwhile, the ever-astute investor Rekt Capital has weighed in, noting that Ethereum finds itself within a “historical demand area.” He muses, “If price can generate a strong enough reaction here, then #ETH will be able to reclaim the $2196-$3900 Macro Range (black).” A rather optimistic outlook, wouldn’t you agree? If only life were as simple as reclaiming lost territory! 🏰

If price can generate a strong enough reaction here, then #ETH will be able to reclaim the $2196-$3900 Macro Range (black). If ETH does this before the March Monthly Close, then this entire sub-$2200 downside would end up as a downside wick.

As the narrative unfolds, seasoned commentator Ted has shared a chart that suggests Ethereum has broken free from its short-term accumulation phase. He posits that the digital asset has been in a state of quiet gathering since its descent from $3,000 to $1,800. Should it manage to sustain its price above $2,000, we might just witness a rally that would make even the most stoic observer raise an eyebrow. 🎉

In a surprising turn of events, analyst Daan Crypto Trades has revealed that he recently converted some of his long-term Bitcoin (BTC) holdings into ETH for the first time in years. He cites the current ETH/BTC trading pair as an enticing risk/reward setup, a sentiment that surely resonates with many a trader. 🤑

Yet, amidst the optimism, caution lingers like a shadow. Rising ETH reserves on crypto exchanges could dampen bullish momentum, should investors choose to sell. As of now, ETH trades at $2,029, having experienced a modest rise of 7.8% in the past 24 hours. One can only hope that this is not merely a fleeting moment of joy in the tumultuous world of cryptocurrency. 🤷♂️

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- MobLand Season 2: Tom Hardy Show Gets Big Update, Paramount Gives Statement

- How to get all Archon Shards – Warframe

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Rashmika Mandanna’s heart is filled with joy after Nagarjuna praises her performance in Kuberaa: ‘This is everything…’

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Tyler Perry Sued for $260 Million Over Sexual Assault Allegations by The Oval Actor

- ‘Tom Cruise Coconut Cake’ Trends as Fans Resurface His $130 Tradition

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2025-03-20 08:48