Ah, Ethereum! The beloved cryptocurrency that keeps giving us all a rollercoaster of emotions. Just when you think you understand it, *bam*, things take an unexpected twist! The supply of Ethereum on exchanges has plummeted to levels not seen since November 2015. This is indeed a curious development, revealing the ever-changing ways that investors stash their digital treasure. 🏴☠️

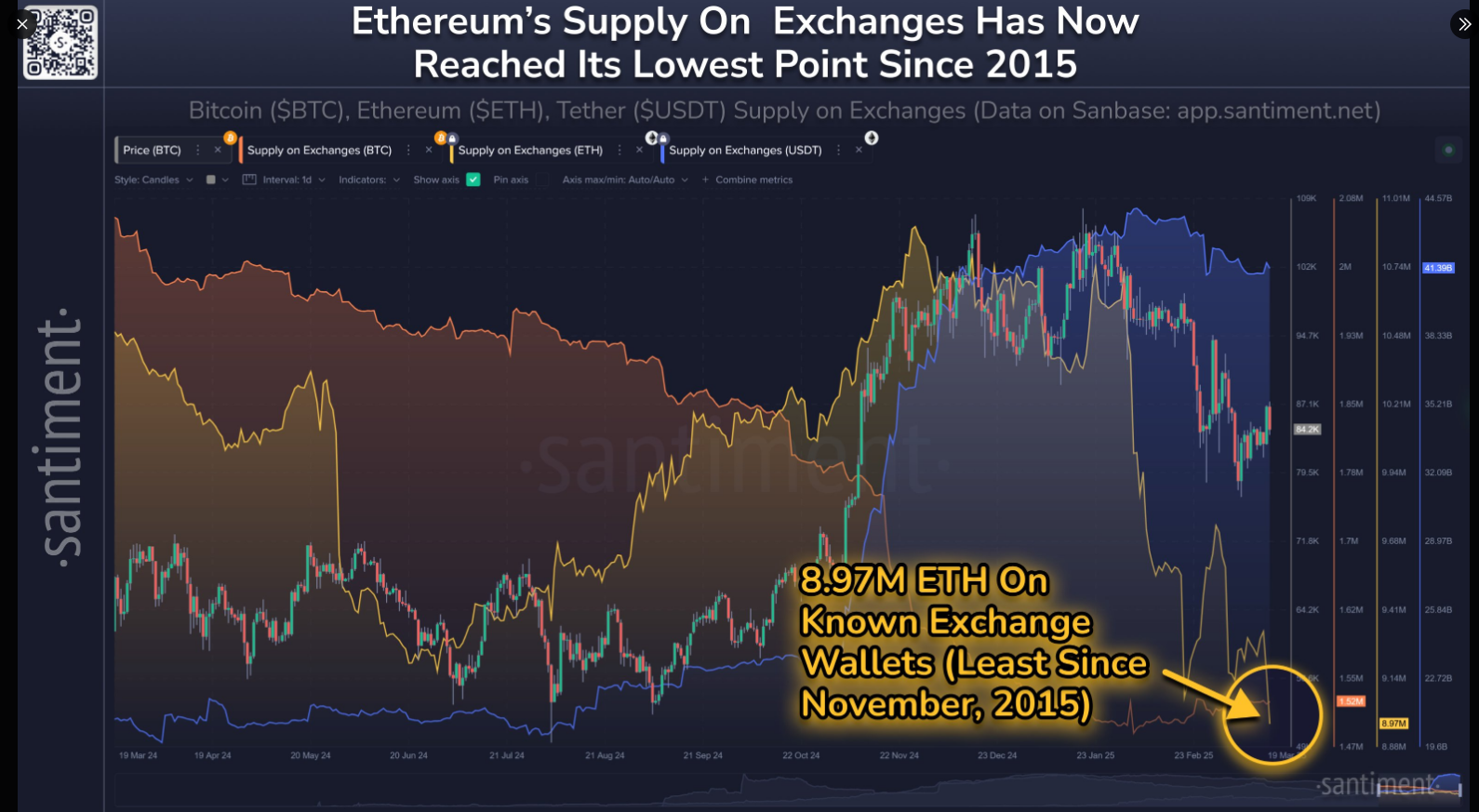

According to the latest data (which, of course, we all trust with the deepest sincerity), a modest 8.97 million ETH are available at the moment. And just to make things more dramatic, this shortage comes just as Ethereum’s price has gone on a *not-so-delightful* dive. Oh, the irony! 🙄

Ethereum’s Exchange Supply Tightens, But Why? 🧐

It seems that Ethereum holders are becoming more selective about where they keep their precious assets. *Gone* are the days of freely trading Ether on exchanges. Many have chosen to move their funds to other destinations. A big factor in this shift? The rise of decentralized finance (DeFi) protocols. It’s like a wild-west of the crypto world out there, folks, and Ethereum holders want in on the action. 🏜️

They’re lending liquidity, earning rewards, and generally making moves that don’t involve their coins just sitting around. On top of that, staking is all the rage! By locking up their coins, Ethereum holders are helping secure the network and getting rewards. *Sounds like a good deal, right?* Sadly, fewer coins are left on the exchanges to sell, creating this delightful squeeze. 🍸

Thanks to the many DeFi and staking options, Ethereum’s holders have now brought the available supply on exchanges down to 8.97M, the lowest amount in nearly 10 years (November, 2015). There is 16.4% less $ETH on exchanges compared to just 7 weeks ago.

— Santiment (@santimentfeed) March 20, 2025

Ethereum’s Price: The Struggle Is Real 😩

Now, you might think, “Hey, lower supply = higher price, right?” Well, not so fast! Ethereum’s price has taken a nosedive, dropping by around 45% since its peak in December. That’s a *very* steep fall from grace. Perhaps a little too steep for some? 🤷♂️

On March 21, the price was hovering around $1,899, and to be honest, it has been one of the worst-performing major cryptocurrencies over the last few years. Ethereum – the underdog, the tragic hero, the fallen star! 🌟

The reasons for this price slump are as varied as the crypto market itself. It’s a mix of market sentiment, global conditions, and, of course, fierce competition from other blockchain systems. How delightful! 🍿

Expert Opinions – The Thrilling Drama Continues! 🎭

Financial analysts, with their ever-confident voices, are sharing their thoughts on the situation. Standard Chartered, one of the *reliable* names in finance, has revised its year-end price target for Ethereum. Originally predicting a price of $10,000, they now suggest a more modest $4,000. Talk about a reality check! 📉

And why this sudden change of heart? Simple. The rise of layer-2 networks that are offering faster and cheaper transactions on the Ethereum blockchain. It seems that users might prefer these new options over the central Ethereum network. Who would have thought? 🤔

But Wait! Could There Be Hope for Ethereum? 🤞

Despite the current price woes, not all is lost. A glimmer of hope shines through! Staking exchange-traded funds (ETFs) could be the lifeline Ethereum needs. If regulations allow these ETFs to stake Ethereum directly, institutional investors might flock to the crypto like bees to honey, increasing demand and perhaps… just perhaps… boosting the price! 💸

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- The games you need to play to prepare for Elden Ring: Nightreign

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

2025-03-22 02:48