Ah, Ethereum! The ever-elusive muse of the crypto world, has recently flirted with the tantalizing threshold of $2,000—a figure that has become as coveted as a rare vintage wine. Since the fateful day of March 10, our dear bulls have been gallantly attempting to reclaim this lofty summit, only to find themselves tumbling back into the abyss of uncertainty. One might say it’s a tragicomedy of errors, where optimism is but a fleeting shadow.

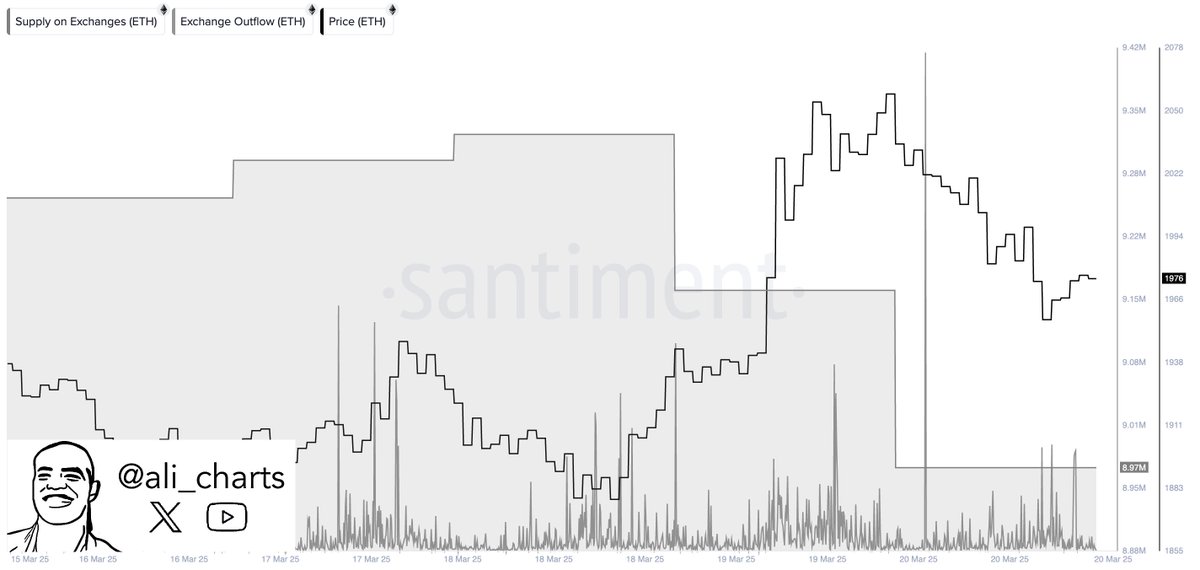

Yet, amidst this theatrical display, a curious twist has emerged! In a mere 48 hours, a staggering 360,000 ETH has been whisked away from the clutches of centralized exchanges, as if investors were playing a game of hide-and-seek with their fortunes. According to the oracle of Santiment, this mass exodus is often interpreted as a bullish signal—an indication that our large holders are stashing their treasures away, perhaps in anticipation of a price renaissance. Or maybe they just fancy a good game of crypto poker. 🎲

However, let us not forget the broader stage upon which this drama unfolds. The macroeconomic landscape resembles a tempestuous sea, with trade wars and erratic policy decisions from the U.S. government casting dark clouds over both crypto and traditional markets. Volatility reigns supreme, and investor confidence is as fickle as a cat in a room full of rocking chairs. Still, the recent outflows from exchanges hint at a potential shift—a whisper of accumulation that could herald a new dawn, provided our bulls can muster the strength to breach the $2,000 fortress.

The Great Ethereum Showdown: Will It Stand Tall? 🎭

Alas, Ethereum has seen its value plummet by over 57% since the halcyon days of mid-December, when it basked in the glory of $4,100. Now, it languishes near the $1,750 mark, a sobering reminder of the capricious nature of fortune. The $2,000 threshold has become a battleground, a psychological and technical gauntlet that our bulls must conquer to reclaim their dignity.

Should Ethereum manage to establish a firm foothold above this level, it could lay the groundwork for a recovery rally worthy of Shakespearean applause. Yet, should it falter, we may witness a further descent into the depths of despair, reinforcing the bearish narrative that has haunted it for far too long.

As the market grapples with uncertainty, we find ourselves at a crossroads. On one hand, the relentless winds of macroeconomic turmoil—rising trade tensions, inflationary fears, and the whims of government policy—have conspired to weaken investor resolve. On the other hand, glimmers of hope flicker in the distance, suggesting that recovery and accumulation may yet be within reach.

Our esteemed analyst, Ali Martinez, has shared the latest revelations from Santiment, revealing that the aforementioned 360,000 ETH withdrawal is indeed a bullish harbinger. Historically, such grand gestures signal that investors are not merely preparing for a sale, but rather, are tucking their assets away for a long winter’s nap. 💤

This could very well indicate a burgeoning confidence among the elite holders, hinting at the dawn of a new accumulation phase—if only Ethereum can maintain its grip above the fabled $2,000 mark.

The Price Tango: A Dance Below $2,000 💃

As we speak, Ethereum finds itself trading at a modest $1,960, having made a valiant yet fleeting attempt to reclaim the $2,000 crown. The psychological and technical resistance at this level remains a formidable barrier, one that our bulls must surmount to shift the tides of market momentum in their favor. Despite a slight bounce from recent lows, Ethereum struggles to gain traction amidst the persistent fog of market uncertainty.

For our bulls to truly shine, they must elevate ETH above $2,000 and reclaim higher altitudes such as $2,150 and $2,300. A sustained ascent above these heights would not only signal a potential trend reversal but could also entice the sidelined investors back into the fray. Until that glorious moment arrives, Ethereum remains perilously perched on the edge of continued downside pressure.

Should our bulls falter in their quest to breach the $2,000 resistance in the coming days, Ethereum may find itself revisiting lower demand zones around $1,850 or even $1,750. With the broader crypto market still ensnared by the clutches of macroeconomic volatility and tepid sentiment, the days ahead promise to be pivotal for ETH’s short-term trajectory. A decisive move, either soaring above or plummeting below this critical range, will undoubtedly set the stage for the next act in this grand performance.

Read More

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Brody Jenner Denies Getting Money From Kardashian Family

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Death Stranding 2: On the Beach controls

- All Elemental Progenitors in Warframe

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Capcom Spotlight livestream announced for next week

2025-03-21 22:18