Expert trader Peter Brandt has more recently shared his perspective on the comparison between Ethereum and Bitcoin‘s price charts, providing fascinating observations regarding current market trends.

Brandt’s more recent comment about Ethereum contrasts with his previous criticisms where he called it a “junk coin” and its supporters “Etheridiots.” Yet, following Ethereum’s recent drop in value against Bitcoin, reaching a nearly three-year low, Brandt appears to have changed his perspective.

Ethereum Plunges Against Bitcoin: A Bear Trap?

After examining the graph showing Ethereum’s value in relation to Bitcoin, Brandt pointed out the potential for a “false signal” or “deceptive price move,” which could trick sellers into taking more short positions as they believe Ethereum will continue to drop in value compared to Bitcoin. However, this could actually be an opportunity for buyers to enter the market before a possible price increase.

Yet, this situation might result in a surprising turnaround, making what seemed like a loss of backing appear as a misleading indication instead.

Bear trap? That is always a possibility when price hits a new 35-month low.

— Peter Brandt (@PeterLBrandt) April 8, 2024

Brandt’s identification of a possible bear trap in the cryptocurrency market underscores the intricacies involved in deciphering price trends and the significance of taking various elements into account.

Though Ethereum currently lags behind Bitcoin, Brandt’s optimistic outlook hints at potential chances for a turnaround soon.

Bullish Signals Amid ETH/BTC Downturn

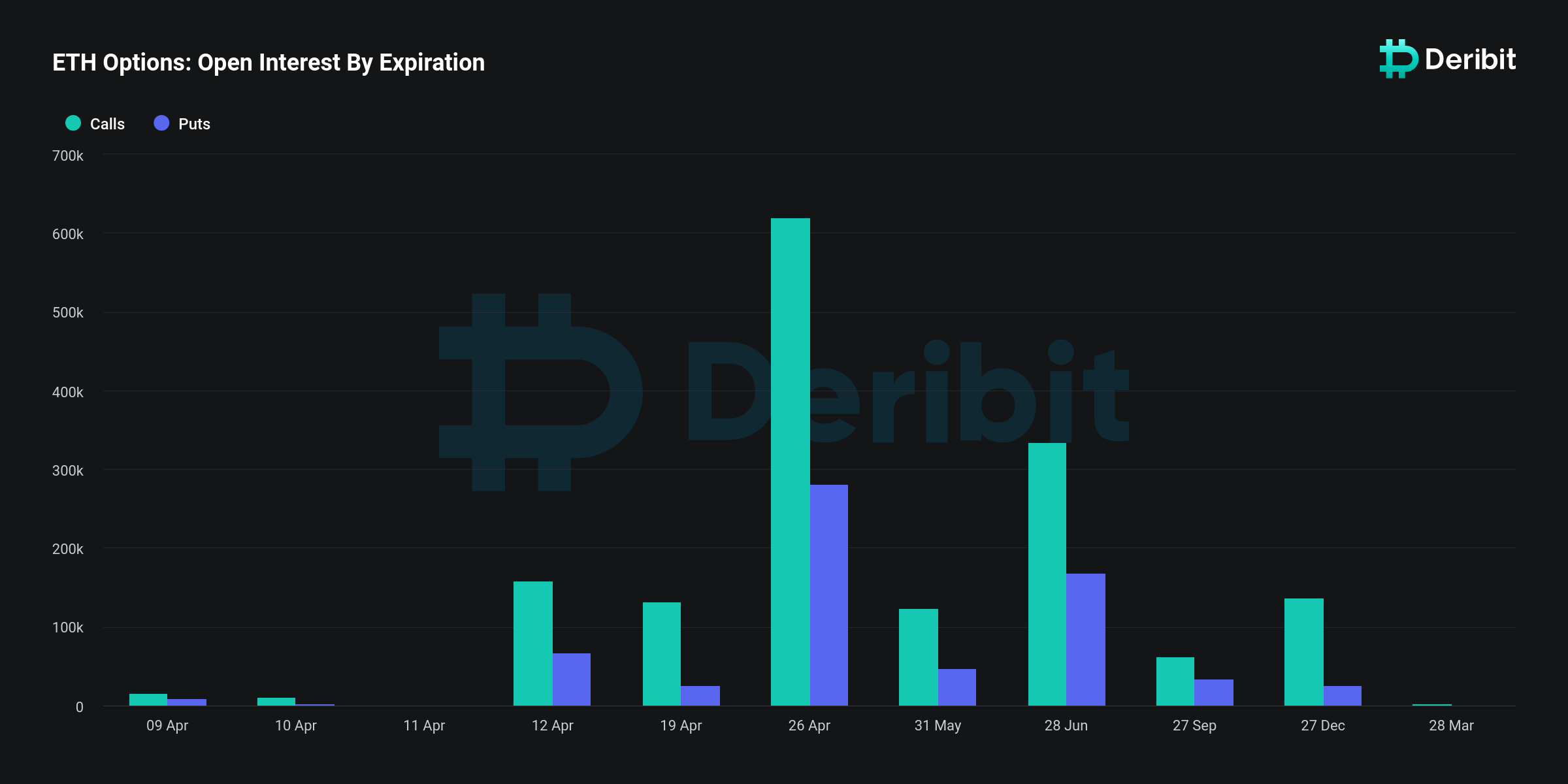

Although Ethereum has faced some difficulties lately, there are encouraging signs pointing towards a possible recovery. Notably, the options market indicates optimism, as a substantial number of Ethereum option contracts set to expire in late April represent bullish wagers on price increase.

Approximately $3.3 billion in ether option contracts are set to expire on Deribit, with around two-thirds of that amount assigned to call options. Additionally, the Ethereum put-call ratio for April expiration is 0.45, suggesting a relatively more optimistic outlook compared to Bitcoin options.

In simpler terms, a put-call options ratio under 1 indicates that investors are more likely to buy call options than put options, showing a positive outlook for Ethereum’s price. Furthermore, the appearance of two new significant Ethereum investors, labeled as 0x666 and 0x435 on the crypto monitoring tool Spot On Chain, contributes to the optimistic feeling surrounding Ethereum.

A significant quantity of ETH was collectively withdrawn from a prominent exchange by these entities, indicating increased faith in Ethereum’s future potential, despite its recent decline.

Ethereum is currently experiencing pressure to decrease in value compared to Bitcoin. However, Bitcoin’s strength in the market is clear as crypto expert Ali points out that Bitcoin could be breaking through with a potential price increase of up to $85,000 if it stays above $70,800.

Bitcoin seems to be making a significant move upward! Should it manage to stay above the $70,800 mark, the upcoming objective would be around $85,000.

— Ali (@ali_charts) April 8, 2024

In simple terms, the Bitcoin market value presently hovers around $71,621 – a significant benchmark. A potential increase toward $85,000 may ensue.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- All Elemental Progenitors in Warframe

- What Happened to Kyle Pitts? NFL Injury Update

2024-04-08 21:04