Ethereum, that silent and brooding figure of the marketplace, finds itself standing upon a precipice—one foot sorrowfully in the world, the other hesitating on the edge of dream. In the shadow of distant cannons and undercurrents of Middle Eastern discord, while market winds chill the air, ETH remains stubborn atop $2,500, staring down both destiny and disaster with the detached patience of a Russian landowner gazing at a half-tilled field.

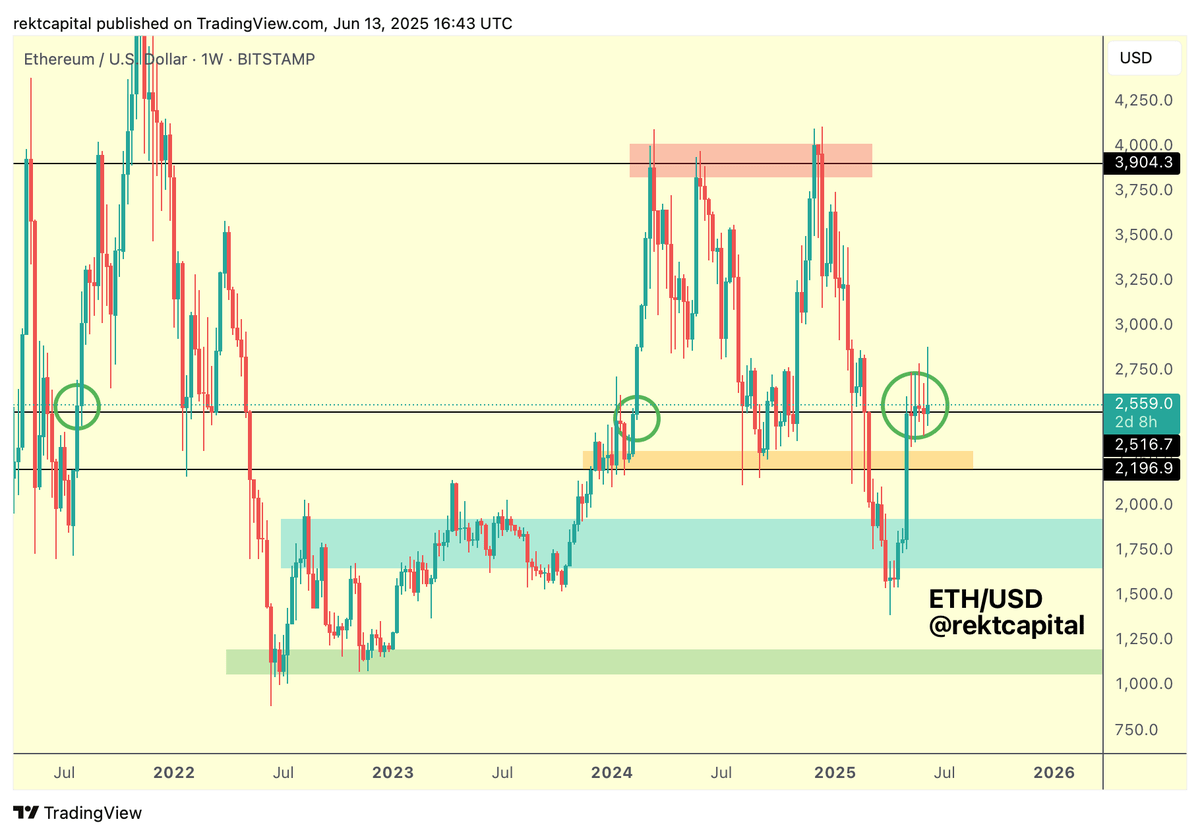

“History repeats, but only to amuse itself,” mutters the analyst Rekt Capital (a name as subtle as a Dostoevskian villain). He charts that $2,500 has, on more than one glum evening, served in lieu of a samovar—warming hands for rallies to $4,000 in ages past. August 2021, the early months of 2024: all echoes of the dance between hope and disappointment, as familiar as the creak of ancestral boards in a Turgenev manor. Will ETH, like some sentimental hero, surmount inertia and astonish us? Or simply trip over its own ennui and tumble back down the stairs?

Geopolitics keeps shaking its fist outside the window, and risk assets—vaporous, flighty as city ladies—quiver at each headline. Ethereum’s test of endurance is less a duel, more an existential standoff. Should $2,500 hold, perhaps the bull will rouse itself, brush melancholy from its horns, and charge anew. Or perhaps it will resign itself to tea and reminiscence.

Pressure in the Drawing Room—ETH on the Edge

A hasty 14% drop since Wednesday has set the servants whispering in the corridors, unnerving both speculators and weary holders (those eternal men of inaction). Only last week, optimism wafted through the air, thick as lilacs, and the clever money whispered of a $3,000 triumph and glorious altcoin cotillions.

Then, the thunderclap: the news of Israel’s salvos, Iran’s replies—global markets shuddered, and crypto traders clutched their ledgers as if they were last wills. An old market saw—”volatility attends bad news, as poets attend winter”—has never rung truer. ETH staggered, sold itself cheap, but still clung to its $2,500 dowry, earning a raised eyebrow from Rekt Capital and a round of nervous applause.

Once again, this tired figure returns to $2,500—a level, it seems, with the stature of an aged aunt refusing to leave the dinner table. Rallies of old began here; but will tradition prevail? Or is history, like a mischievous cousin, plotting a fresh embarrassment for the family name?

For five interminable weeks, ETH has circled these grounds, pacing and ruminating, every test from below reminiscent of a fitful night plagued by dreams of inherited debts. Will another holding mark a defiant stand or merely the prelude to comedic collapse for the wider crypto gentry?

A Comedy of Ranges: ETH Wanders Lost

ETH currently clings to $2,556, licking wounds inflicted by a sharp rejection at $2,830—a plot twist worthy of Chekhov. Per the daily chart, it wanders in a soul-crushing corridor between $2,500 and $2,830, fending off existential crises (and bears) through sheer inertia. At least the 50- and 100-day moving averages slope gently upwards, a hopeful hint in this narrative of sighs.

Meanwhile, the red 200-day moving average, that uncompromising patriarch, blocks passage at $2,642. ETH attempted an escape, failed, and retreated quietly, volume swelling in the markets like villagers at a countryside scandal—everyone has an opinion, nobody brings a solution. War, like a persistent tax collector, has rattled even the most stoic nerves.

All eyes drift to the sullied carpet between $2,500 and $2,520, a modest patch of market turf that could, with luck, launch bulls toward glory—or open a trapdoor to $2,300 and the cold embrace of forgotten ambitions. ETH dreams, the market waits, the world shrugs—such is the cycle of our modern fates. 🚬🐂📉

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Gold Rate Forecast

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

2025-06-14 14:47