As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the recent surge in Ethereum (ETH) activity. The whale-sized moves in ETH have caught my attention, particularly given the consistent mirroring of Bitcoin’s price action that Ethereum has shown.

In simpler terms, similar to Bitcoin, Ethereum‘s price trends have been quite similar. However, it hasn’t managed to establish its own independent surge in the recent past. Interestingly, Ethereum has seen a 13% rise over the last week, outperforming Bitcoin’s 5.8% increase during the same period. This growth can be attributed to significant Ethereum investors who appear to be accumulating more of it.

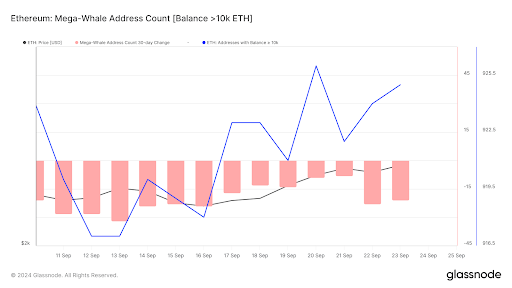

As an analyst, I’ve observed a surge in Ethereum activity from whales over the past few days based on various analytics platforms’ on-chain data. More specifically, Glassnode data indicates that significant Ethereum holders have accumulated at least 70,000 ETH into their wallets since the beginning of last week.

Ethereum Whales Spend Big On ETH

The noteworthy Ethereum activity by large investors (whales) mentioned earlier can be traced using the analytics platform Glassnode. As demonstrated in the graph that follows, there has been an uptick in the number of Ethereum wallets containing 10,000 ETH or more within the past 24 hours, now totaling 925 wallets. This represents approximately seven new whale wallets amassing a substantial amount of ETH tokens, which is an increase from the 918 wallets reported on September 18.

Evidence from IntoTheBlock shows an increase in Ethereum transactions by substantial investors, with the total value surpassing $29 billion in the last week. This metric tracks activities above $100,000. The significant number and worth of these transactions suggest a rise in Ethereum whale activity. Historically, increased activity from large investors has often been associated with positive trends for cryptocurrencies.

As a crypto investor, I’ve noticed a significant surge in activity, particularly with Ethereum (ETH). This is evident in the increased transfers of ETH into larger wallets. On September 23, these transfers skyrocketed to an astounding 515,520 ETH, which marks a staggering 440% increase compared to the 95,820 ETH transferred during the preceding 24 hours.

Currently, at this moment, Ethereum is being exchanged at approximately $2,626. As mentioned previously, this surge follows a 13% rise over the past week, making Ethereum outperform Bitcoin for the first time since the start of the year. The top alternative coin has been so closely aligned with Bitcoin’s price fluctuations that certain analysts have raised doubts about its ability to decouple anytime soon.

Investing in Ethereum (ETH) is always advantageous due to its significant role within the cryptocurrency market. Recent developments have seen ETH surpass $2,600 for the first time in September, signaling an upward trend that might continue. The upcoming goal is to breach the $2,700 mark before October ends, which could potentially lead to a surge towards $3,000.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-09-25 22:16