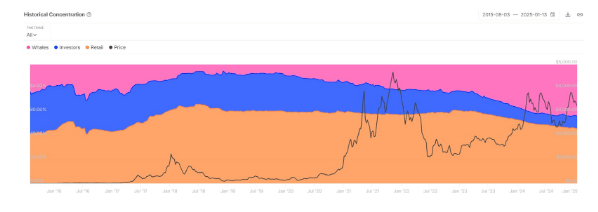

Over the past period, significant Ethereum investors, often referred to as “Ethereum whales,” have been consistently amassing more Ethereum. Notably, data from blockchain analysis firm IntoTheBlock indicates that these large investors now control approximately 43% of the entire circulating Ethereum supply.

The uneven distribution of Ethereum (ETH) tokens poses significant queries concerning how this might influence Ethereum’s pricing and future market trends.

Whale Accumulation Surges By Over 90% Since Early 2023

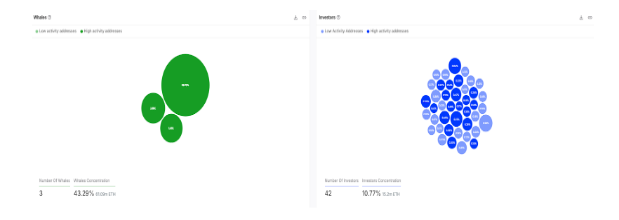

As reported by IntoTheBlock, the proportion of Ethereum (ETH) owned by large wallets or “whales” has significantly increased, now accounting for approximately 43% of the total ETH supply. This is a notable change from early 2023, when these whales controlled only about 22% of Ethereum’s circulating supply. According to IntoTheBlock, a whale address is defined as one that holds more than 1% of the total circulating supply of ETH.

In just one year, there’s been approximately double the amount of Ethereum held by large investors, or “whales.” Typically, such a concentration of cryptocurrency in a small number of wallets could signal trouble for the asset, as it might allow a select few to control price fluctuations at their discretion. However, Ethereum’s situation is different from the norm because of the distinctive characteristics of its ecosystem and significant changes within the network that have occurred since 2022.

It’s been found that the increased number of whales (large crypto investors) can be linked back to two primary reasons: the Ethereum transition and the rising popularity of ETH staking for earning incentives. The Ethereum transition, completed in 2022, moved the blockchain away from a Proof-of-Work (PoW) system towards a Proof-of-Stake (PoS) model.

Indeed, it’s quite logical that a significant portion of Ethereum (61.09 million) is held by just three large investors or whales, according to data from IntoTheBlock.

This essentially implies that most of these ETH are being held in the proof-of-stake mechanism employed by validators within the Ethereum network. By securing their Ethereum, miners and significant holders have not only decreased the readily available supply but also contributed to price growth by limiting the amount of Ethereum up for trade.

Ethereum Holder Dynamics – Investors And Retailers

The rise in Ethereum held by whale accounts has resulted in a decrease in Ethereum available for individual investors and common owners, according to IntoTheBlock’s classification system. In this context, “investors” are defined as addresses that hold between 0.1% and 1% of the total circulating supply, while those with less than 0.1% of the total circulating supply are considered “retail owners.

Currently, as I’m typing this, there are 42 distinct investor locations that together hold approximately 15.2 million Ether (ETH), which equates to about 10.77% of the total available ETH supply. It is important to note that the three largest addresses, often referred to as “whales,” typically don’t influence price fluctuations significantly. Instead, smaller investors with substantial but more liquid portions of ETH have a greater impact on market trends. A considerable sell-off from these investor groups could potentially cause a rapid drop in Ethereum’s price.

Conversely, retail investors, who make up more than 99% of Ethereum addresses, hold approximately 46% of the total circulating supply. Currently, Ethereum is priced at $3,225 and has experienced a 2% decrease in value over the past day.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2025-01-20 03:04