As a researcher with experience in analyzing blockchain data and market trends, I find the recent surge in Ethereum whale transactions to be an intriguing development. The data from IntoTheBlock indicating the highest number of large transactions since March is noteworthy, as these transactions are typically associated with Ethereum whales.

Recent on-chain activity indicates that Ethereum‘s large investors, or “whales,” have been more active than usual. Let’s explore what they have been doing.

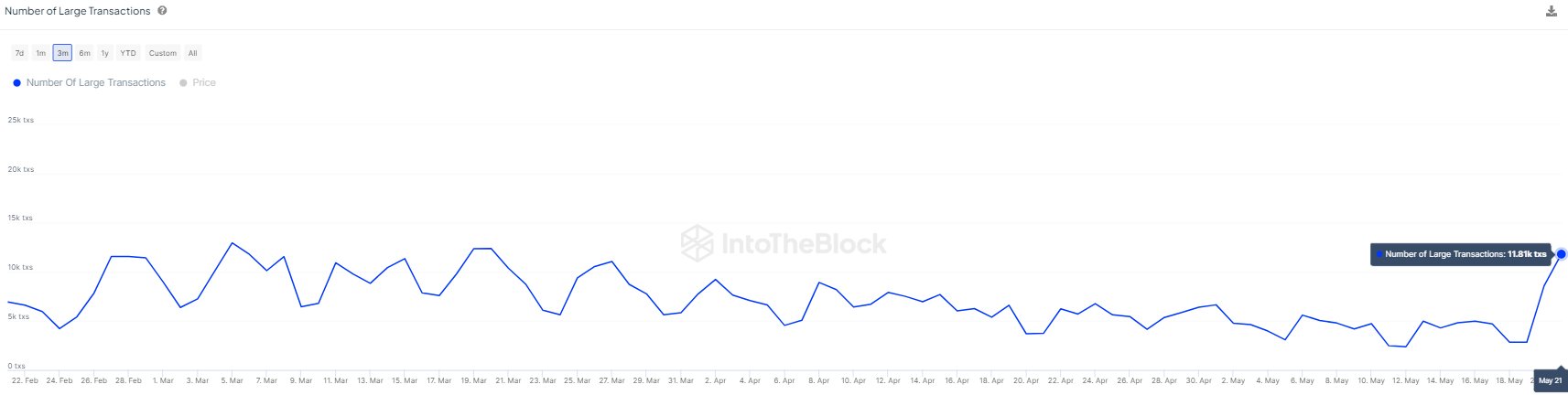

Ethereum Whale Transactions Are At Their Highest Since March

As a crypto investor, I’ve noticed an intriguing update on the market intelligence platform, IntoTheBlock. They’ve shed light on the recent activity of Ethereum (ETH) whales in their latest post.

The metric we’re focusing on within Ethereum’s blockchain is the “count of significant transactions.” This figure, as reported by the analytics firm, represents the aggregate number of Ethereum transactions on the network that exceed a value of $100,000.

Typically, it is mainly whale-sized investors who are capable of executing large individual transactions. Consequently, significant transfer activities are often linked to these massive financial players.

This indicator of the Number of Large Transactions in the given cohort signifies their current level of activity. The following chart illustrates the latest trends regarding this Ethereum metric.

As a researcher studying transaction data on the Ethereum blockchain, I’ve observed an intriguing trend: the number of large transactions has seen a significant surge in recent times. This observation raises the question of who could be driving this increase in large-value transfers? Upon further investigation, it seems plausible that Ethereum whales have upped their game, possibly preparing for upcoming market shifts or capitalizing on current opportunities.

As a researcher studying the behavior of whale investors in the cryptocurrency market, I’ve noticed an intriguing development: there have been renewed signs of life among the whales as rumors circulated that Ethereum-based exchange-traded funds (ETFs) could soon receive approval. This buzz in the market has fueled a surge in demand for Ethereum (ETH), sending its price soaring back up to around $3,800.

Given the market’s current dynamics, it’s only normal for these massive entities to adjust their positions. The size of their transactions is substantial, and a significant number of them occurring simultaneously can have a noticeable impact on Ethereum (ETH). Consequently, ETH may experience volatility if the ongoing whale activity continues at its current pace.

As a crypto investor, I’m constantly monitoring the market trends, and one asset that always keeps me on my toes is Ethereum. The volatility of its price movement is influenced significantly by the collective actions of large investors. Based on IntoTheBlock data, we can see some indications of this trend in the “Large Holders Netflow” chart below. This chart illustrates whether these big players have been buying or selling Ethereum recently, providing valuable insights into the potential direction of its price movement.

this metric tracks the difference between Ethereum entering and leaving the wallets of investors holding at least 0.1% of the total Ethereum circulation.

The Large Holders have been actively purchasing more cryptocurrency than selling it lately, as indicated by the graph’s positive netflow for them. Therefore, their recent market behavior suggests that they have been net buyers.

It’s uncertain whether these massive entities will persist in this pattern in the near future, thereby possibly contributing to further growth.

ETH Price

At the time of writing, Ethereum is floating around $3,750, up more than 26% over the past week.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-05-23 04:16