As a seasoned cryptocurrency analyst with years of experience navigating the volatile digital asset market, I’ve seen my fair share of market swings and unpredictable trends. The recent volatility in Ethereum has certainly piqued my interest, as it presents both challenges and opportunities for investors like myself.

Over the recent days, Ethereum has experienced substantial fluctuations, triggered by a strong wave of selling following its failure to surpass the annual highs reached in early December. This market behavior has led many traders and investors to ponder about Ethereum’s future trajectory as it lingers below crucial resistance levels, consolidating its position.

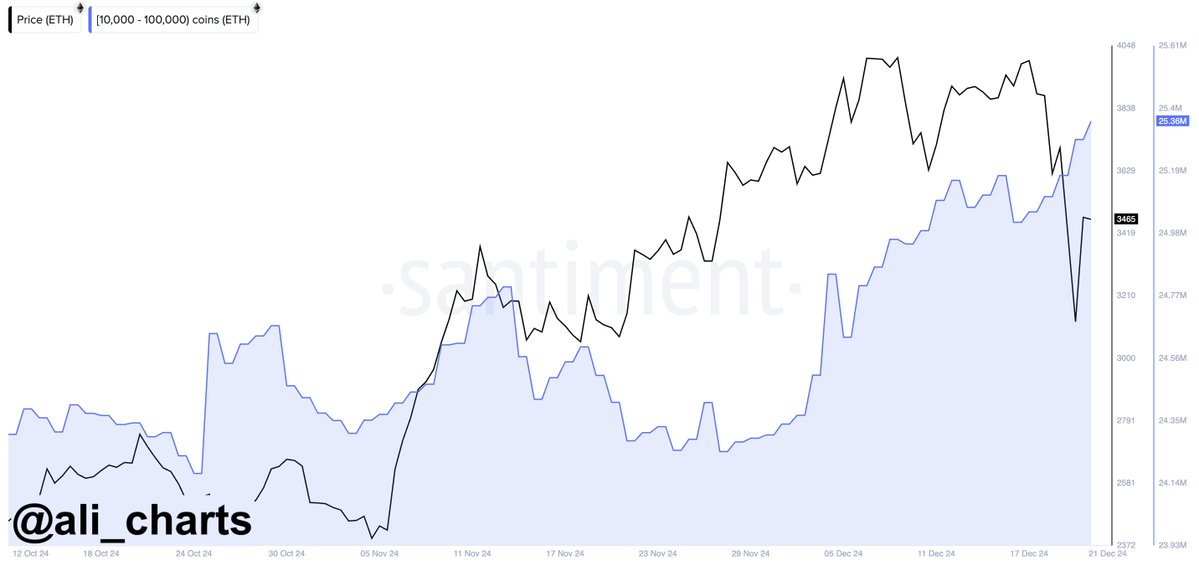

In my analysis, despite the choppy market conditions, on-chain data points towards a potentially bullish scenario for Ethereum. As I delved deeper into the data, it became evident that prominent Ethereum holders, commonly known as whales, have been actively buying during this period of uncertainty. These whales have accumulated approximately 340,000 ETH, equivalent to over $1 billion, in the last 96 hours. This substantial purchase suggests that these major players perceive long-term value in Ethereum, even as short-term market sentiment remains divided.

The persistent whale behavior may indicate a potential surge in the value of ETH, as major investors seem to be readying themselves for profitable future movements. Typically, such accumulation stages have been followed by significant price increases, as heightened demand and decreased supply create positive market dynamics.

Ethereum Whale Demand Keeps Rising

This year, the demand for Ethereum has exhibited considerable volatility, with a constant pressure to sell driving prices down from peak levels. Each attempt at a rally has met resistance, indicating the hurdles Ethereum has faced in maintaining an uptrend. However, Ethereum shows remarkable strength, especially during periods of correction, as significant investors continue to stockpile ETH.

More recently, Martinez presented convincing figures about X, suggesting an impressive increase in whale ownership of Ethereum. In just the last 96 hours, these significant investors have acquired approximately 340,000 Ethereum, equivalent to over $1 billion. This heavy investment highlights the faith that major players place in Ethereum’s future success. Typically, such accumulation could be an indication of a forthcoming market change, as whales are known for carefully positioning themselves before a possible surge.

1) According to Martinez and other experts, the increased interest in whales could signal a substantial price increase within the coming weeks. Additionally, it’s widely predicted that Ethereum will take on a crucial part during the anticipated altcoin season next year, reinforcing its status as a key player among alternative coins in the market.

During this crucial stage, investors will keep a close eye on Ethereum’s capacity to benefit from the ongoing accumulation. If large-scale buyers (whales) persist in their activity, it might open the path for Ethereum to revisit previous highs and even establish new records, further strengthening its position as a dominant force in the crypto market.

ETH Holding Key Support

Right now, Ethereum’s price stands at approximately $3,320. It has demonstrated robustness by maintaining itself above the crucial 200-day moving average (MA) of $3,000. This MA is often seen as a significant benchmark reflecting the market’s long-term strength. Remaining above it implies that Ethereum continues to exhibit a bullish trend, even with the recent fluctuations and market pressure.

As a researcher, I foresee that for Ethereum to gather pace again, it’s crucial that the bullish momentum propels the price beyond the $3,550 resistance barrier and sustains this level. Crossing this threshold would indicate a revived uptrend and boost the prospects of Ethereum exploring higher price points. Nevertheless, it might not occur swiftly, as the market could experience a phase of sideways movement before making any significant progress.

As an analyst, I find it common for markets to undergo a period of consolidation following spikes in volatility. This process helps create a more robust foundation for the next major shift. A robust consolidation phase above $3,000 would serve as additional evidence that the 200-day Moving Average functions as a reliable support level, thereby increasing investor confidence.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-12-22 13:34