As a seasoned crypto investor with years of experience observing market trends and patterns, I’ve learned to pay close attention to whale activities, especially before significant events like the launch of ETFs. The recent movement of over $122 million worth of Ethereum (ETH) by three whales to centralized exchanges (CEXes) ahead of the US spot ETH ETF launch on July 23 raises some concerns.

Three Ethereum (ETH) big investors, or “whales,” have prepared strategically to capitalize on the anticipated US spot ETH Exchange-Traded Fund (ETF) launch on July 23. Approximately $122 million in ETH has been transferred to centralized exchanges (CEXes) for potential sell-offs by these whales.

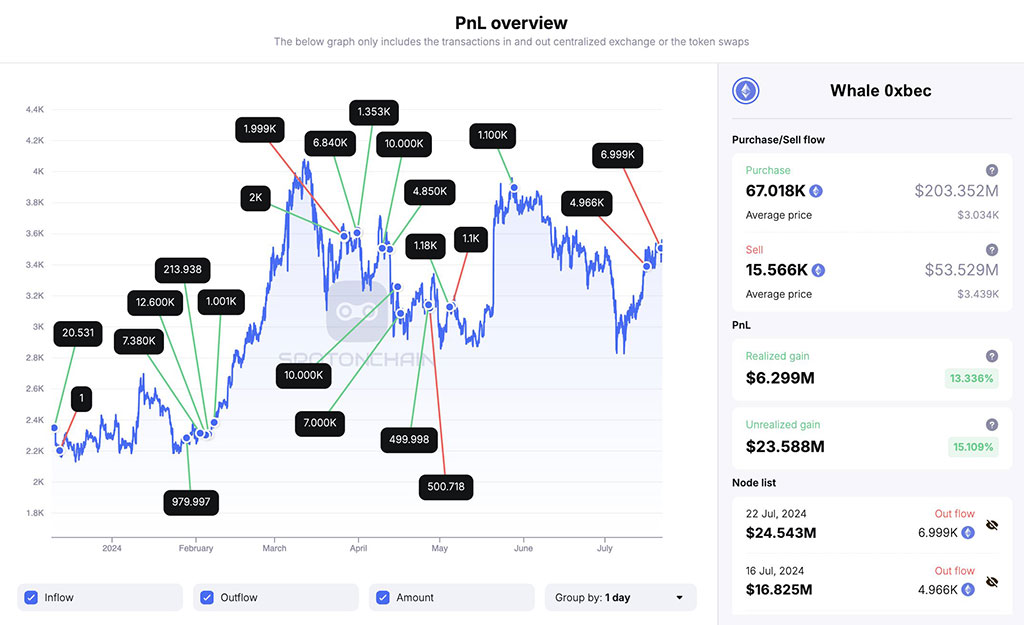

Based on data from the on-chain analysis tool Spot On Chain, approximately $89 million worth of Ethereum has transferred to Binance and OKX exchanges over the past nine days.

Photo: Spot On Chain

In the initial trading hours of London on July 22nd, another significant investor moved approximately $33.6 million in Ethereum (ETH) to Coinbase. This transaction increases the current ETH whale’s impending sell-off to more than $122 million. The potential launch of an Ethereum Exchange-Traded Fund (ETF) on Tuesday could follow this substantial buildup of ETH holdings among large investors.

Will a Surge in ETH Exchange Inflows Drag Prices?

In spite of the imminent Ethereum (ETH) sale from large investors, also known as “whales,” the total quantity of ETH kept in exchanges displayed a decrease based on the Exchange Net Position Change indicator. A figure less than zero signifies that more ETH has been withdrawn from exchanges compared to deposits.

Photo: Glassnode

As a researcher examining the data, I’ve observed that the recent trend indicates an increase in ETH purchases or users transferring their Ethereum to personal wallets or cold storage. Conversely, a positive value would indicate more ETH being moved into centralized exchanges (CEXes) than out, potentially suggesting selling pressure. Based on the data available at press time, the net outflows suggest a somewhat optimistic outlook for the Ethereum market prior to its launch on the spot markets.

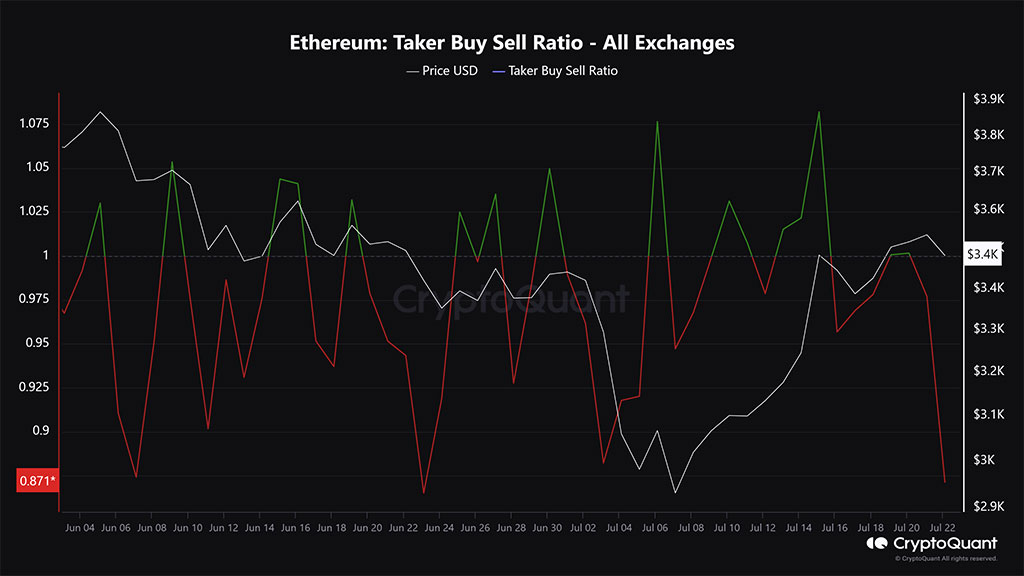

As a crypto investor, I’ve noticed that the mood turned bearish in the Ethereum derivatives market based on the Taker Buyer Sell Ratio dropping below 1. This means that there were more sell orders than buy orders, signaling increased selling pressure among derivatives traders.

Photo: CryptoQuant

If this metric stays under 1 for the largest altcoin, it might postpone a quick bounce-back in its short-term price.

Over the last seven days, ETH experienced a surge of 8.9%, touching the $3,500 mark once more. This uptick came as part of a wider market rebound following a brief slide under $3,000.

The progress towards $3.5K in Ethereum’s recovery came to a halt as investors waited for the debut of US-listed ETH exchange-traded funds (ETFs). With large Ethereum holders, known as whales, reportedly planning to sell substantial amounts prior to the launch, uncertainty lingers regarding the immediate impact on Ethereum’s price.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-07-22 15:30