As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed countless bull and bear cycles. However, the current Ethereum rally has piqued my interest more than most. The surge in transaction volume, a key indicator of network activity, suggests that smart money is finally stepping in, after months of accumulation.

Over the past few days, Ethereum has seen a significant 35% upward movement from last Tuesday, suggesting a bullish breakthrough and its initial test of key supply barriers since late July. The growing enthusiasm among investors is largely fueled by a spike in Ethereum’s on-chain activity.

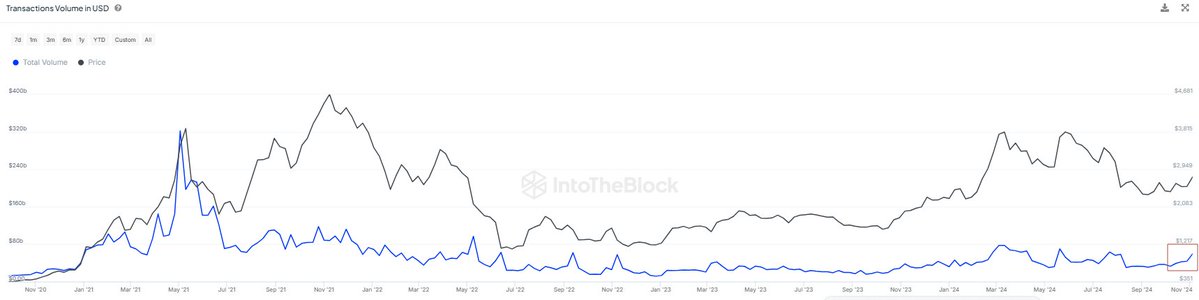

According to IntoTheBlock, transaction activity on Ethereum’s mainnet has hit its peak since July, indicating increased attention and action within the network. This spike in transactions is frequently interpreted as evidence of a breakout, coinciding with investors’ predictions of a robust rally towards Ethereum’s annual high points.

As a crypto investor, I find myself standing at an exciting juncture with Ethereum (ETH). The positive momentum is palpable, and if ETH manages to hold its ground above these fresh highs, it could potentially pave the way for even more growth as the broader crypto market synchronizes its surge with Bitcoin.

Over the coming days, Ethereum’s future is significant as investors observe whether the positive market feeling can endure and drive ETH prices upwards towards uncharted highs.

Ethereum Bullish Trend Begins

After spending eight months under selling pressure and with smart investors stockpiling Ethereum, it appears we’re witnessing a fresh bullish phase for Ethereum. Following a prolonged period of relatively calm price fluctuations, ETH is now climbing higher – a move many analysts and investors have been anticipating as a potential trend reversal.

According to IntoTheBlock’s data, Ethereum’s mainnet transaction volume has dramatically increased, with approximately $60 billion worth of transactions settled within the last week – the highest since July. This rise in activity points to a rekindled market interest, indicating that an increasing number of investors are actively trading and amassing ETH.

An increase in transactions together with rising prices typically indicates robust demand and high market confidence, suggesting that a prolonged bullish trend may persist.

Over the coming months, I anticipate increased volatility due to escalating speculative interest and heightened trading activity. Many traders are gearing up for substantial returns, which could lead to significant price fluctuations. Nevertheless, there’s a general consensus among analysts that Ethereum’s next significant milestone is reaching its yearly high of $4,000. Crossing this barrier would underscore Ethereum’s bullish trend and pave the way for potential new record-breaking peaks, mirroring the broader market’s positive outlook.

ETH Consolidates Above $3,000

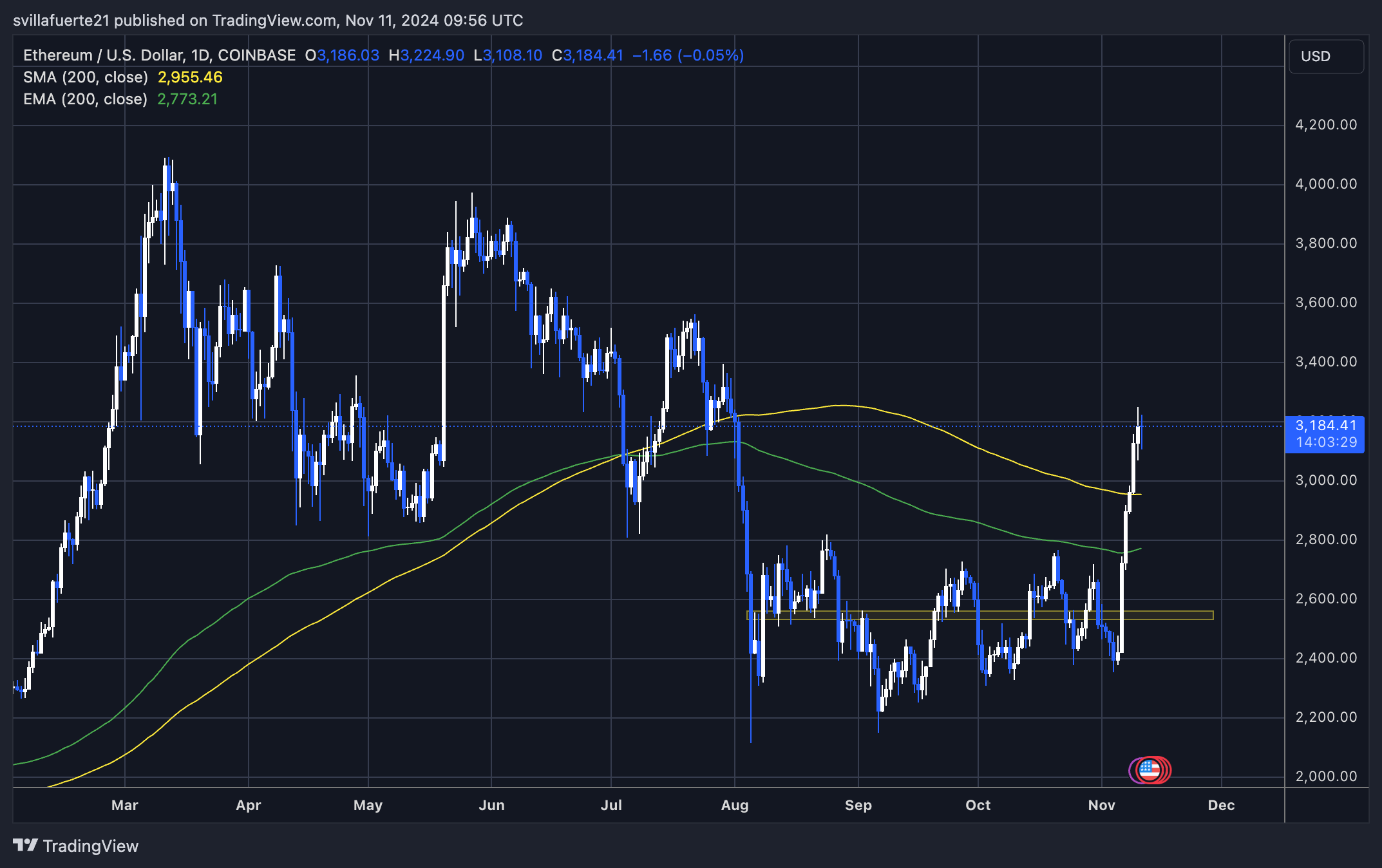

As a crypto investor, I find myself observing the current trading price of Ethereum at around $3,180. Following a robust weekend rally that propelled ETH to hit a local high of $3,250, there seems to be a momentary pause in the price action. This brief halt suggests the need for consolidation before potentially breaking out further, which is crucial for Ethereum to solidify its support and gear up for more upward momentum. During this sideways movement, it appears that both buyers are regrouping and accumulating strength while simultaneously managing any temporary selling pressure.

If Ethereum (ETH) manages to stay above $2,950, which coincides with its 200-day moving average, it suggests that optimistic feelings about the market are likely to grow stronger. Maintaining this essential support level would indicate that buyers are still in charge, potentially leading Ethereum to surge towards $3,500 shortly.

Yet, there’s a chance that ETH might need a few days to gather enough steam for its next significant advance, as investors evaluate the recent surge and ponder forthcoming triggers.

For now, the market is showing positive signs as experts point out that staying above the 200-day Moving Average is essential to validate the long-term bullish pattern. The current consolidation period of ETH might serve as a strong base for its continued uptrend.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- How to Update PUBG Mobile on Android, iOS and PC

2024-11-11 16:34