As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market cycles and bull runs. However, the current performance of Ethereum (ETH) is one trend that has left me scratching my head. While Bitcoin (BTC) and Solana (SOL) have been setting new highs, ETH has consistently trailed behind, even after the US spot ETH ETF approval in July.

Over the course of this current bull market, Ethereum (ETH) has generally lagged behind most of its counterparts like Bitcoin (BTC) and Solana (SOL). Despite the approval of the U.S. spot ETH exchange-traded fund (ETF) in July, Ethereum’s underperformance remains evident. In the past 24 hours, Ethereum’s volatility has been -5.0%, while Bitcoin’s and Solana’s have been -2.3% and -4.0%, respectively. The market caps for Ethereum, Bitcoin, and Solana stand at $275.86 billion, $1.16 trillion, and $61.33 billion, respectively, with Ethereum recording a 24-hour trading volume of $15.16 billion, compared to $26.87 billion for Bitcoin and $2.24 billion for Solana.

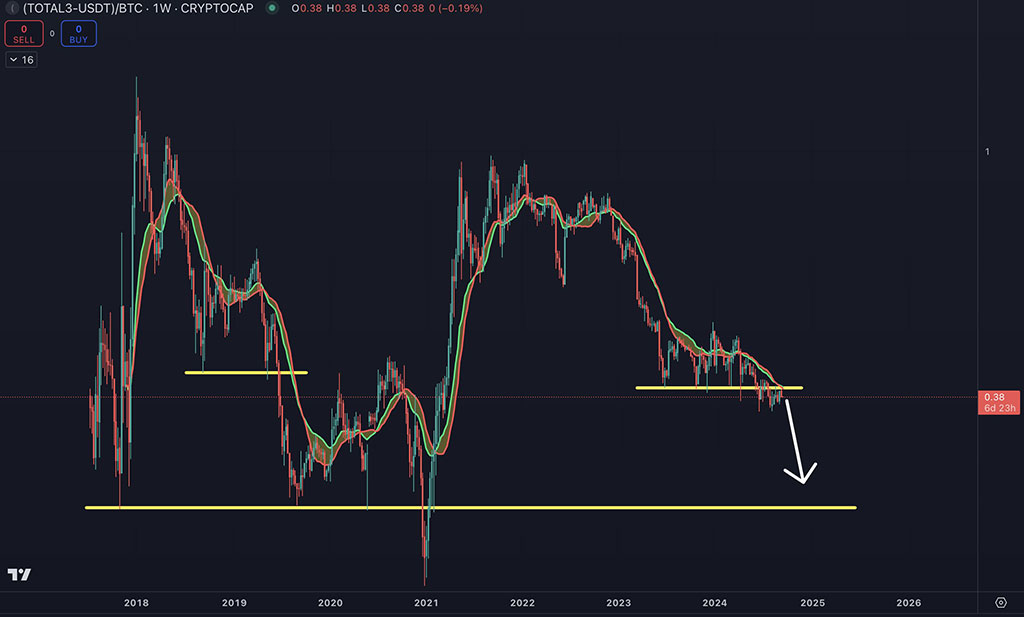

Over the past weekend, I noticed that the ETH/BTC ratio dipped below 0.04 and reached its lowest point this year – a level not seen for approximately 3.5 years. As a crypto investor, this development, according to Alex Thorn, Head of Research at Galaxy Digital, could be concerning, especially given the post-Merge upgrade we’ve recently experienced.

For the first time in about 3 and a half years, ETHBTC was traded at a value of 0.03 (this occurred in April 2021). Since then, it has dropped by 53%. As Thorn contemplated, he wondered what could halt this downward trend.

Currently, as I’m typing this, ETHBTC has dropped beneath its downward trendline and may further decline to approximately 0.035 or even 0.030 if there is a larger shift in investor funds towards Bitcoin.

Photo: TradingView

What’s Next for ETH?

Thorn argued that a substantial change in the underlying story would be necessary for the altcoin to experience a major turnaround.

In simpler terms, he’s stating that there are significant factors influencing this situation. He believes that a simple technical breakout isn’t enough to resolve it. Instead, he thinks a fundamental change in the story or perspective is required.

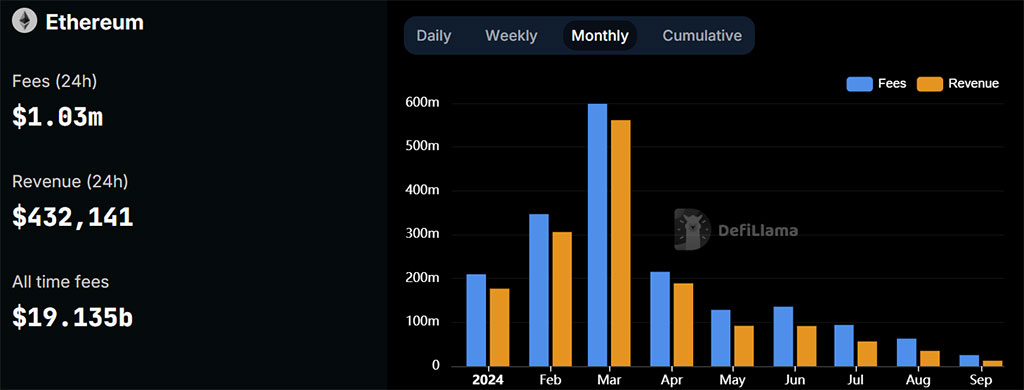

Following the Dencun upgrade in March, Ethereum’s transaction fees significantly dropped, causing a decline in activity on the L1 network. Some analysts attributed this drop to “L2 networks that are parasitic and exploitative.” The monthly earnings plunged from approximately $596 million in March to just $100 million in September.

Photo: DefiLlama

During that span, Ether (ETH) has additionally taken on an inflationary nature (with more tokens produced than destroyed), potentially undermining its ‘ultra-stable currency’ reputation post-The Merge.

Beyond these concerning foundations, David Doung, the Global Head of Research at Coinbase, attributes Ethereum’s underperformance in the market to its current structure. Doung points out the unfavorable seasonal trends during September and intense competition from other alternative cryptocurrencies as key factors.

“Our view is that crypto natives are also driving the market at the moment, and this cohort may be crowded into altcoins and other crypto positions that are getting more difficult to exit,” Duong wrote.

According to Duong’s analysis, the immediate storyline might change if Ethereum successfully integrates a larger number of real-world assets and appealing applications onto its network.

Photo: Cowen

According to crypto analyst Benjamin Cowen, the value of Ethereum compared to Bitcoin might dip as low as 0.30 – 0.40 by December, but it’s expected to rebound in 2025. This means that Ethereum may not do as well as Bitcoin for a while, but there will likely be an improvement later on. Cowen cautions that a downturn in ETH/BTC could potentially halt the growth of other alternative cryptocurrencies.

“But history shows that when ETH/BTC crashes, the ALTs will follow,” Cowen cautioned.

At the moment of reporting, Ethereum (ETH) was estimated to be worth approximately $2,300, representing a decline of almost 10% compared to its peak value of around $2,560 reached during early September.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-09-16 13:04