Based on current data, the Ethereum Open Interest has been sitting at comparatively lower figures in recent times. Let’s explore the potential implications for its price.

Ethereum Open Interest Has Been Moving Sideways Since Its Plunge

An analyst in a CryptoQuant Quicktake article noted that the number of Ethereum derivative contracts open for trading, often referred to as Open Interest, has mirrored the cryptocurrency’s recent price trend.

When the level of this indicator rises, it indicates that investors are presently purchasing new assets on these systems. Typically, such a pattern results in a higher overall market exposure, which can make asset prices more susceptible to fluctuations.

An opposite trend in the indicator suggests that investors are either choosing to sell off their holdings or being forced to do so by their trading platforms. This decrease may be accompanied by volatile market conditions, but after the drop, the market might experience increased stability due to decreased leverage.

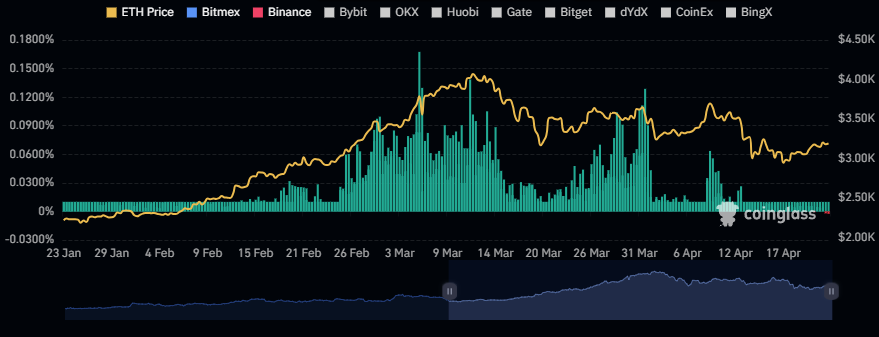

Now, here is a chart that shows the trend in the Ethereum Open Interest over the last few months:

In the graph above, you can see that Ethereum’s Open Interest took a significant dive earlier, coinciding with the decrease in the asset’s price. This decline in Open Interest can be attributed to long contract holders being forced to sell during the price drop.

In simpler terms, the Open Interest’s value has generally remained stable as the price has moved sideways following its decline.

Based on this alignment, it seems that the futures market is showing signs of slowing down. As a result, traders may soon consider taking new long or short positions, which could lead to a significant price shift in the market.

A significant factor influencing Ethereum’s potential price movements in the derivatives market is the funding rate. This measurement represents the ongoing fees paid by holders of derivative contracts to one another at regular intervals.

In simpler terms, when the funding rates are positive, it means that long-term investors are paying a fee to keep their bearish bets (short positions) from shorter-term traders. This indicates that bullish sentiment is more prevalent in the market. Conversely, negative funding rates suggest that the majority of derivative traders hold bearish views and are paying fees to longer-term investors to hold their bullish bets.

The chart below shows that the Ethereum funding rate has recently turned red.

In the past, markets have often gone against the prevailing consensus. So, with the funding rate now in the red, it could be an indication that market reversals or uptrends might be on the horizon.

ETH Price

Ethereum has gradually increased over the last few days, as its price has now reached $3,200.

Read More

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-04-23 03:04