As an analyst with over a decade of experience in the financial markets, I have witnessed numerous market cycles and learned to read between the lines when it comes to price movements and technical indicators. While Ethereum’s recent resilience is commendable, the current state of the Taker Buy/Sell Ratio raises red flags for me. The fact that the ratio has declined again, despite ETH‘s recent gains, suggests that sellers are gearing up for another round of selling pressure. This could potentially push Ethereum’s price back down towards the $2300 level.

During the widespread financial market slump in early August, Ethereum (ETH) dropped approximately 30% of its worth, reaching $2,226 per unit. Interestingly, in recent weeks, this well-known digital coin has demonstrated a good amount of strength by returning to the $2,600 price range. However, it’s important to note that this recent price dip comes with a significant level of doubt about how long Ethereum can maintain its upward trajectory. As per CryptoQuant analyst ShayanBTC, there is a strong possibility that Ethereum might revert to its downtrend.

Ethereum Price To Suffer From Sellers’ Dominance

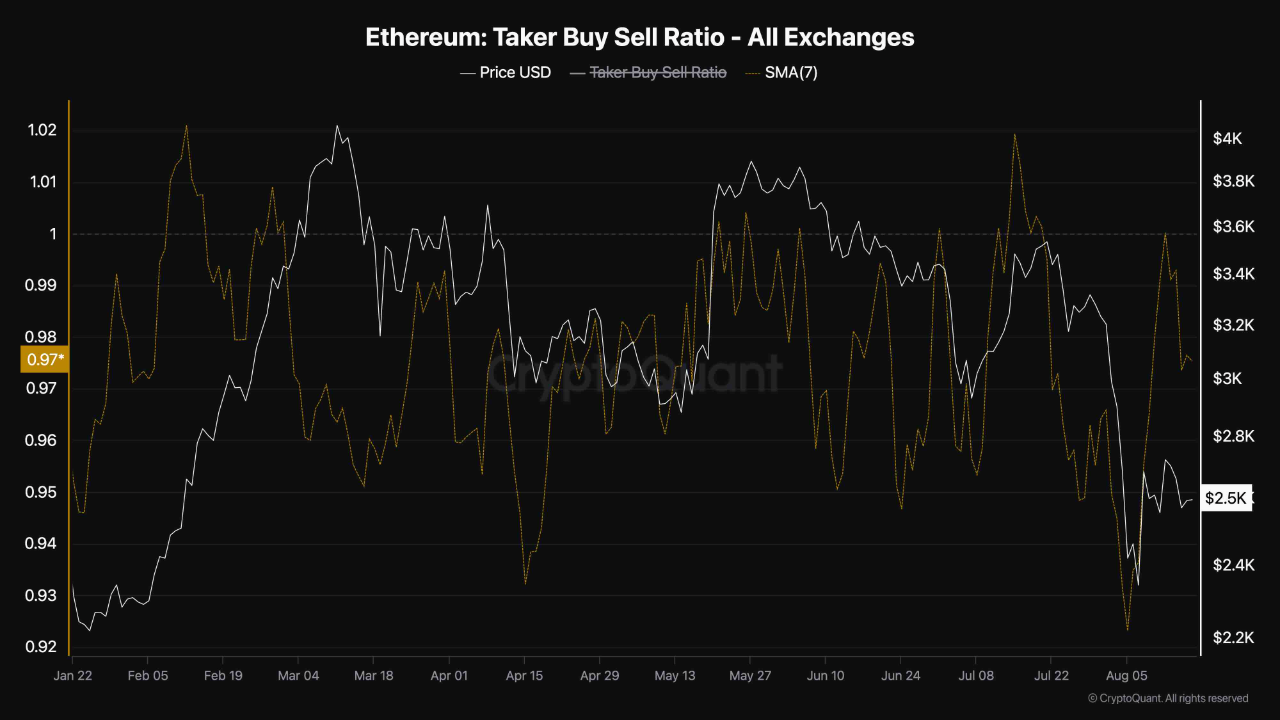

In a QuickTake post on Saturday, ShayanBTC shared that the Taker Buy/Sell Ratio indicated that Ethereum may be set for more price loss in the coming days. To explain, the Taker Buy/Sell Ratio is an analysis tool that gauges the balance between aggressive buying and selling activity. It is calculated based on the volume of taker buy orders and taker sell orders.

In simpler terms, when the Taker Buy/Sell ratio exceeds 1, it usually indicates a strong bullish trend where buyers are more active than sellers. Conversely, if the ratio is less than 1, it typically signals a bearish trend, meaning there’s more selling activity compared to buying.

ShayanBTC reports that Ethereum’s failure to break past the $3000 price barrier led to a significant drop in its Taker Buy/Sell Ratio, as shown by its price fluctuations. Subsequently, as predicted, this metric rebounded following ETH‘s recent price increases. However, despite the uptick, the Taker Buy/Sell Ratio remained below 1, lingering in the zero range, signifying insufficient buying pressure that enables sellers to maintain market dominance.

It’s been reported by ShayanBTC that the Taker Buy/Sell Ratio is decreasing again, suggesting sellers may be planning to unload their Ethereum holdings, which could lead to a drop in its price. The analyst advises caution, as the ETH market might slide further unless there’s a significant increase in demand to counteract this trend.

Related Reading: Brace For Impact: Ethereum Price Could Plunge To $1,200 In December, Says Expert

ETH Price Overview

As per CoinMarketCap’s data, Ethereum is currently being traded at around $2,610, showing a slight increase of 0.61% over the past day. Yet, its performance on longer time scales remains underwhelming, with a drop of approximately 23.93% observed in the last month.

As Ethereum consistently increases in value, it is expected to face initial resistance near the $2,700 price level. If purchasing activity remains strong, ETH may surpass this hurdle and reach up to $3,000. Conversely, intense selling activity suggested by the Taker Buy/Sell ratio might cause its price to drop down to around $2,300.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- All Elemental Progenitors in Warframe

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- How to get all Archon Shards – Warframe

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

2024-08-18 13:16