As a seasoned crypto investor with a knack for analyzing market trends and patterns, I find myself closely watching the Ethereum price movement, especially when it comes to the TD setup. Over the years, I’ve seen this tool prove its mettle in predicting key reversal points, and I can’t help but feel a sense of déjà vu as we approach the critical $2,250 mark.

Over the last week, Ethereum has mostly moved between approximately $2,500 and $2,350. This lack of clear direction in its movement doesn’t yet provide a clue about its future performance, leaving some optimistic investors feeling uncertain.

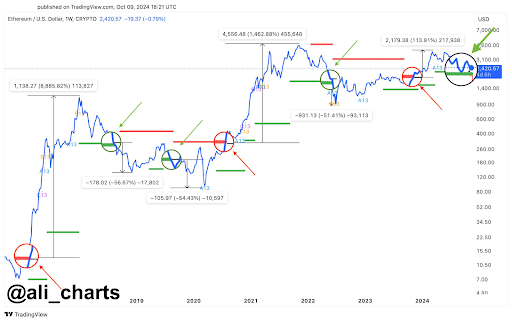

According to a detailed examination by crypto expert Ali Martinez utilizing the TD Setup, there’s a vital value for investors to focus on when tracking the ETH trend. The focal point of this study is the $2,250 price mark, which could serve as a dividing line between a bullish rebound and a sharp decline.

ETH Price Must Hold $2,250

Among cryptocurrency experts and investors, the Technical Analysis (TA) setup known as the TD Sequential model is widely recognized and respected. In the past, Ethereum has demonstrated a consistent response whenever it breaches above or below this TD setup. This tool’s proven ability to identify crucial turning points makes it a preferred choice for analysts such as Ali Martinez due to its high degree of accuracy.

Martinez pointed out on social media platform X that he uses a chart comparing ETH to USD (Ethereum to US Dollar) prices, and he’s observed that the TD Sequential indicator has influenced Ethereum’s price movements in the past. He provided instances where this was particularly evident. Whenever the price of Ethereum surpassed the resistance trendline set by the TD setup, a significant bullish trend consistently occurred. Conversely, when Ethereum fell below the support line defined by the TD setup, it typically corrected, averaging a decline of 53%.

Initially, when ETH broke past its TD setup resistance, it led to a massive 8,885% increase, peaking at an all-time high of $1,138. On the other hand, the initial break below the TD setup resulted in a 56.67% decrease. The most recent surge above the TD setup happened in March this year, resulting in approximately a 113% rise as ETH exceeded $4,000 for the first time in two years.

Currently, the trading situation suggests that the TD setup is approximately at $2,250. As per analyst Ali Martinez’s analysis, falling below this price level might initiate a substantial decrease in Ethereum’s value. If history repeats itself with an average correction of 53%, Ethereum could potentially dip to around $1,100.

Current Market Snapshot

Currently, Ethereum is being traded around $2,410, which represents about a 7% rise from the crucial $2,250 mark suggested by the TD setup. Although Ethereum has so far remained above this point, it’s essential to keep an eye on this significant price level due to its proximity.

The TD Sequential Indicator signals possible ends to an asset’s price trend, be it rising (bullish) or falling (bearish). If Ethereum’s price drops below $2,250, this might indicate the complete shift from a bullish state to a bearish one.

Currently, opinions about Ethereum are divided, leaning slightly toward bearish dominance due to recent selling activity. However, if Ethereum manages to surpass the $2,500 mark, it may trigger a surge in bullish trends.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-11 21:04