As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed countless cycles and trends that have shaped the global economy. The recent surge in Ethereum (ETH) is reminiscent of the dot-com boom of the late ’90s, albeit with a more decentralized twist.

It seems that Ethereum (ETH) is showing signs of awakening, as it has increased by approximately 37% over the past week, coinciding with Bitcoin‘s (BTC) record-breaking high price surge.

Spot Ethereum ETFs Record Daily Inflows

Currently, Ethereum, which ranks as the world’s second-biggest digital currency with an estimated market value of around $404 billion, is making steady progress towards Bitcoin. In fact, the price of Ethereum’s native token, ETH, has surged by over 35% over the last week.

Although the overall digital asset market seems to be thriving following Donald Trump’s win in the 2024 U.S. presidency, it’s important to consider other potential reasons fueling the current industry surge, particularly for Ethereum (ETH).

An important detail to note is the significant increase in investments towards ETH spot exchange-traded funds (ETFs). On the 11th of November alone, these US-based ETH ETFs saw an unprecedented $295 million in a single day’s worth of inflows – the highest amount recorded so far.

Previously, the highest amount of daily inflow into spot ETH ETFs was $106 million, which occurred on the initial launch day in July of 2024.

Based on information from SoSoValue, it was Fidelity’s FETH ETF that attracted the largest amount of funds with a total of $115.48 million being invested.

In a follow-up, BlackRock’s ETHA amassed approximately $101.11 million, Grayscale’s ETH collected around $63.32 million, and Bitwise’s ETHW gathered roughly $15.57 million.

Currently, the combined value of assets in various ETH-focused exchange-traded funds (ETFs) is approximately $9.72 billion. This represents roughly 2.41% of Ethereum’s entire market capitalization. Simultaneously, there has been a total outflow of around $41.30 million from these ETH ETFs.

ETH Price Action And Resurgence In DeFi

The increased attention from institutional investors towards Ethereum Exchange Traded Funds, accompanied by large-scale daily inflows, seems to be having a favorable impact on the movement of Ethereum’s price.

For most part of the year 2024, Ethereum (ETH) trailed behind in price growth compared to notable cryptocurrencies like Bitcoin (BTC) and Solana (SOL). But the last quarter of 2024 presents a strong possibility for ETH’s momentum to make a significant comeback.

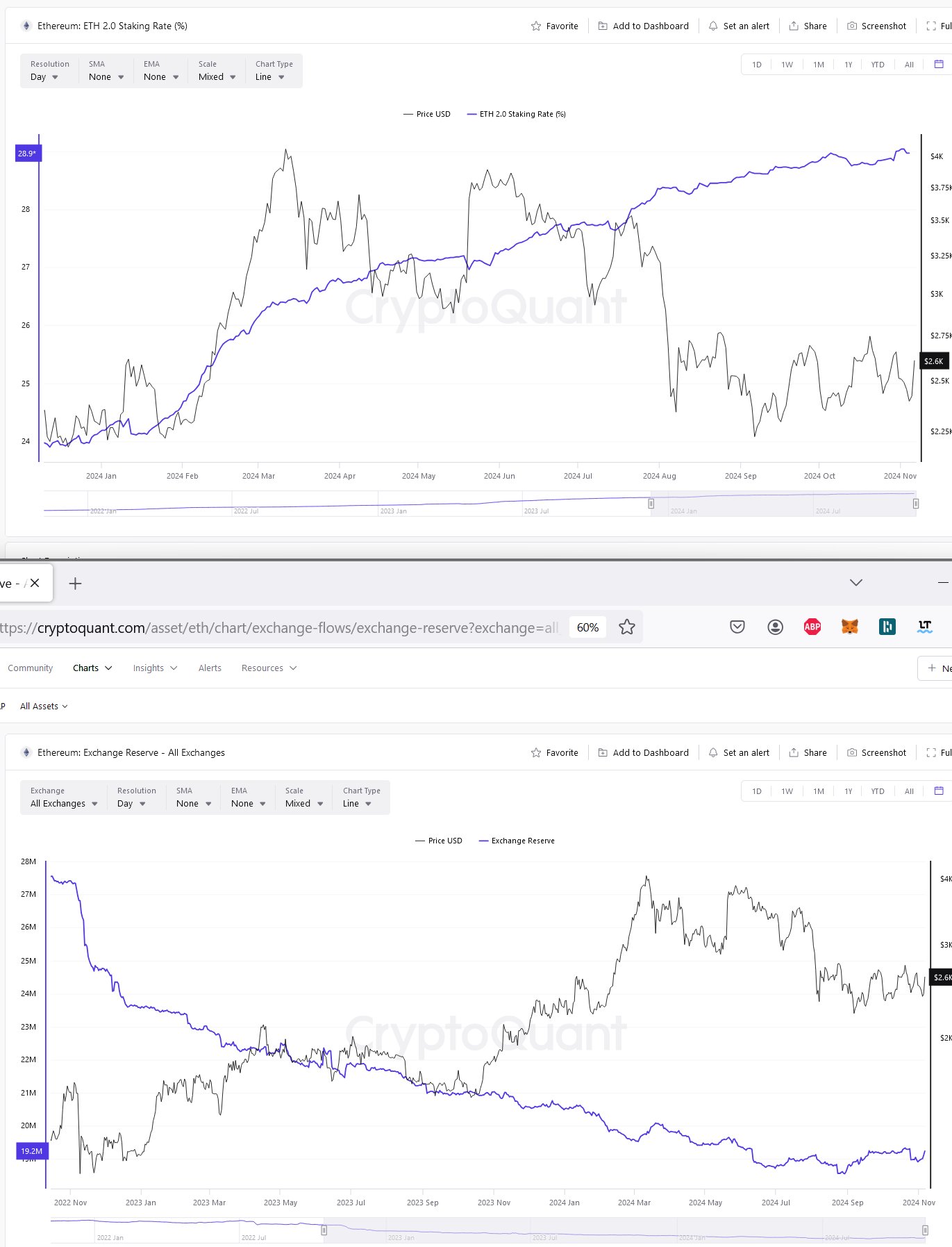

According to Leon Waidmann, who heads research at Onchain Foundation, it appears that the level of Ethereum staking has reached a new all-time high, whereas the amount of ETH held on cryptocurrency exchanges is trending towards historic lows.

With unprecedented levels of staking and a decrease in Ethereum available on exchanges, there might be an impending shortage in supply. This condition could lead to a steep upward trend or ‘parabolic surge’ in the price of ETH.

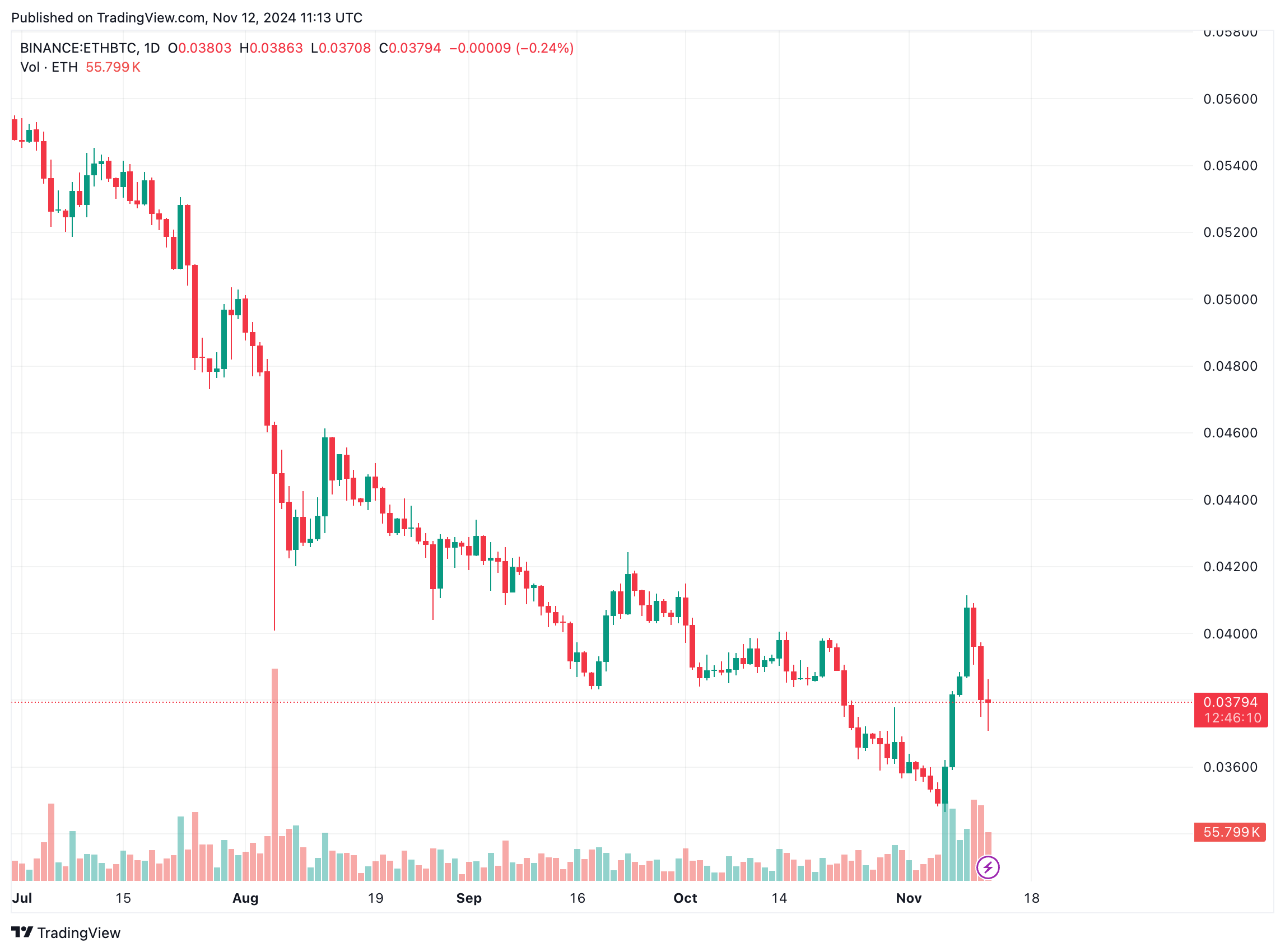

As an analyst, I’ve noticed a recovery in the ETH/BTC ratio, which had been experiencing significant losses for some time. The trading pair has climbed from 0.034 to 0.040, only to dip slightly to 0.037 at this moment.

For the given pair, the next significant barrier is approximately at 0.040. If this level is successfully breached, it could potentially result in further profits for Ethereum over Bitcoin. Currently, Ethereum is around 32% lower than its all-time high (ATH) of $4,878, which was recorded in November 2021.

It appears that the momentum behind Ethereum’s decentralized finance (DeFi) sector is growing steadily. According to DefiLlama, the collective value locked within Ethereum DeFi platforms now stands at approximately $62.36 billion, marking a significant increase from around $24 billion as recently as November 2023.

Approximately 50% of this TVL (Total Value Locked) is linked to the Ethereum staking platform Lido, which manages around $33 billion. After Lido, the DeFi lending protocol Aave and EigenLayer come next, with approximately $15.21 billion and $14.57 billion respectively.

That said, concerns remain regarding ETH’s “ultrasound money” narrative due to the token’s high issuance rate. At press time, ETH trades at $3,291, up 3.1% in the past 24 hours.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- How to get all Archon Shards – Warframe

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- MobLand Season 2: Tom Hardy Show Gets Big Update, Paramount Gives Statement

- Rashmika Mandanna’s heart is filled with joy after Nagarjuna praises her performance in Kuberaa: ‘This is everything…’

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Tyler Perry Sued for $260 Million Over Sexual Assault Allegations by The Oval Actor

- ‘Tom Cruise Coconut Cake’ Trends as Fans Resurface His $130 Tradition

- Fitness Boxing 3: Your Personal Trainer review: No punch back

2024-11-13 12:41