In recent days, the curious tapestry of finance found itself marvelously embroidered with the symbol of Ethereum (ETH); a creature of the night that, like a phoenix, rose splendidly—no less than 5.35%—offering a glimmer of hope after the rumblings of the FOMC announcements. Oh, how history chortles—it appears that this digital delight has a penchant for springing back after financial thunderclouds loom above heads, with past escapades delivering bountiful returns of up to 34%. Even the esteemed institutions, like the ever-watchful hawk—BlackRock—have begun to circle, injecting a staggering net influx of $67.77 million into ETH ETFs, as though they were gold miners unearthing forgotten treasure.

In this quaint discourse, we shall dissect the frothy waves of Ethereum’s recent price fluctuations, scrutinize the eager hands of institutional investors, and dare to forecast the destiny that lies ahead for this digital marvel.

Ethereum’s Grand Recovery Post-FOMC Drama

Of late, Ethereum, that capricious spirit of the market, has indeed displayed a remarkable resilience. Following the FOMC’s pronouncements, our dear ETH has shown a penchant for swiftly rebounding from the tempest of market turmoil. Ah, data, that relentless investigator of truth, reveals that during these chaotic interludes, ETH often finds itself swept along to new heights of joy.

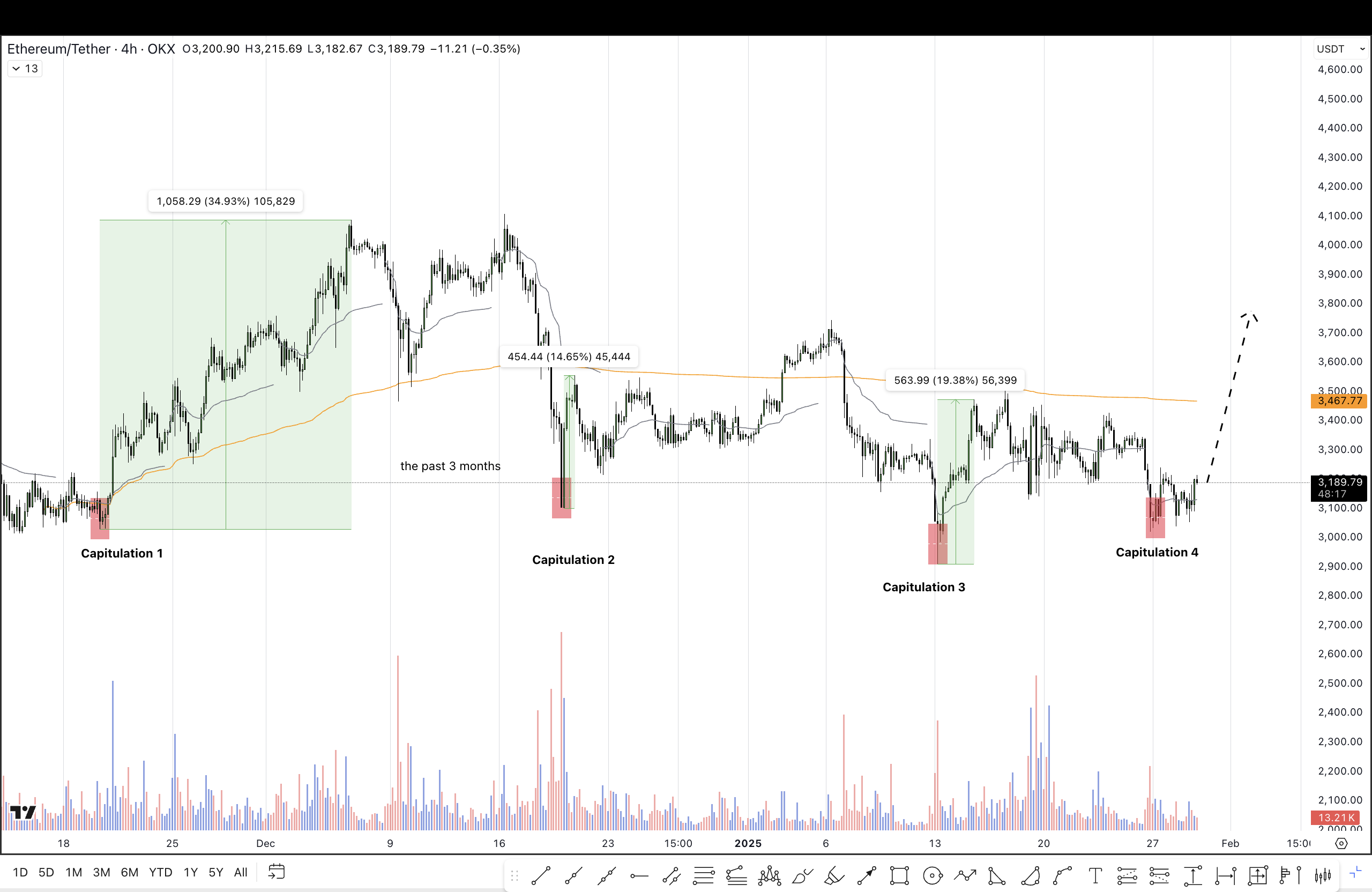

Indeed, upon sudden plummets, this digital engenderer of dreams responds with vigor—swiftly bouncing from the brink of despair, with gains that might tranquilize the nerves of the most anxious investors. There are times when it is rumored that the upward leaps may reach heights of 34%, while on other occasions, the more modest specter of a 14% rise graces the charts.

When the path of Ethereum’s price is plotted alongside those calamitous capitulation dates, the clarity of its emerging patterns reveals an unmistakable saga.

Since the most recent vocalizations of the FOMC, our valiant Ethereum has ascended by 5.35%. This manifestation of optimistic sentiments in the marketplace may just propel ETH onward toward ethereal heights of $3800, regardless of the dark clouds of global economic uncertainty lurking over our heads.

Moreover, the requests from high-minded institutions for Ethereum have not merely resurfaced, but have come roaring back. A notable event transpired on the 30th of January when the daily net inflow for Ethereum ETFs surged to $67.77 million. Lo and behold, BlackRock was the first among the eager to partake, with a substantial acquisition of $79.86 million of ETH.

Other noteworthy investors included Fidelity and Grayscale, whose respective hauls totaled $15.41 million and $12.79 million. In the ever-cynical play of this financial stage, the only figure to part with coin was the Grayscale mini-Ethereum trust, which relinquished $40.29 million to the cosmos. Meanwhile, five other American spot Ethereum ETFs remained resolute, permitting no funds to escape their grasp.

ETH Breaks Free Following Bullish Embrace

Upon examining the sacred scrolls of the 4-hour chart, one finds a striking bullish reversal, manifested in a ‘double bottom’ pattern that, in poetic irony, has lifted the price past the 23.6% Fibonacci threshold of $3248.

This spirited rally has stretched the upper Bollinger band, marking a modest increase of 1.12% over four fleeting hours. With Ethereum now having completed its post-retest reversal at the 23.6% Fibonacci level, the upward trajectory challenges the weary resistance line overhead. Should this fervor continue, the whisperings of the Bollinger bands foretell a formidable breakout.

Ethereum’s Fabled Future

As we consult the oracles, particularly the In/Out of the Money chart from Intotheblock, it appears that ETH stands at the precipice of a crucial resistance zone, resting between $3264 and $3342—an area populous with a staggering 6.26 million ETH, indeed a veritable mountain of supply.

The ‘at the money’ realm presently cradles about 7.85 million ETH within the confines of $3109 and $3264, a salient point of significance within this age of uncertainty.

In our contemplative musings, Fibonacci levels delineate crucial targets at the 50% and 100% retracement points, poised at $3509 and $4079. Should darkness loom, the support provided by the $3000 threshold promises to remain steadfast as we journey onward into the first quarter of 2025.

Despite the present fortune of ETH and its noble position as second-in-command among the market’s altcoins, it behooves the wise investor to also survey the budding crypto realm for hidden gems with lower valuations, which may well yield greater spoils. A marvel to behold in this respect could be the Mind of Pepe (MIND), an endeavor that artfully marries the innovation of AI with the whimsical nature of meme coins, functioning as an autonomous AI agent in the grand symposium of cryptocurrency. It meticulously examines altcoin trends, granting exclusive insights to its beloved MIND holders. The incipient presale has already amassed a staggering $4.6 million, offering, to boot, an enticing staking option with a dazzling APY of 490%—truly, laughter and riches await in these curious times!

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

2025-01-31 15:06