Currently, the overall crypto market capitalization is approximately $3.63 trillion, representing a significant increase of 6.10%. This surge brings the market close to setting a new record high. Specifically, Ethereum (ETH) is experiencing a strong upward trend, with its price increasing by 5.47% intraday. Furthermore, Ethereum’s 24-hour volatility stands at 5.6%, while its current market capitalization amounts to $407.02 billion. Over the past 24 hours, Ethereum has also seen a trading volume of $69.56 billion. This bullish momentum has resulted in the creation of a bullish engulfing candle for Ethereum.

Will this move create a new swing above the $4,000 psychological mark? Let’s find out.

Ethereum Breakout Rally Aims to Surpass $4,000

On the day-to-day graph, the Ethereum price dynamics suggest a period of retreat. Additionally, the Ethereum price dynamics show a trendline of resistance emerging from successive lower highs. Yet, the local trendline of support creates a descending channel pattern.

Right now, Ethereum is holding a bullish edge over the $3,100 area, even amid significant price swings. The day’s recovery has countered the 2.83% drop that occurred overnight, positioning Ethereum to attempt breaking through the resistance trendline overhead.

Following the general direction, the Fibonacci level at approximately $23.60%, situated in the $3,500 significant area, suggests strong potential for resistance due to heavy supply pressure. However, as the wider market rallies, the atmosphere surrounding Ethereum appears increasingly bullish.

As a researcher, I’m observing an intriguing pattern in my analysis today. The Relative Strength Index (RSI) line on a daily basis shows a bullish divergence, indicating potential price increases may be imminent despite a downtrend in the market. Additionally, the Moving Average Convergence Divergence (MACD) and signal lines are currently crossing positively, which typically suggests an upward trend is about to start. Therefore, it appears that the technical indicators I’m using are leaning towards the possibility of a successful breakout.

If Ethereum’s closing price consistently stays above $3,500, the Fibonacci sequence suggests a potential price peak at approximately $4,172. Moving forward, significant price milestones are expected at $4,465 and $4,837.

Rising Bullish Speculations Fuel Ethereum Rally

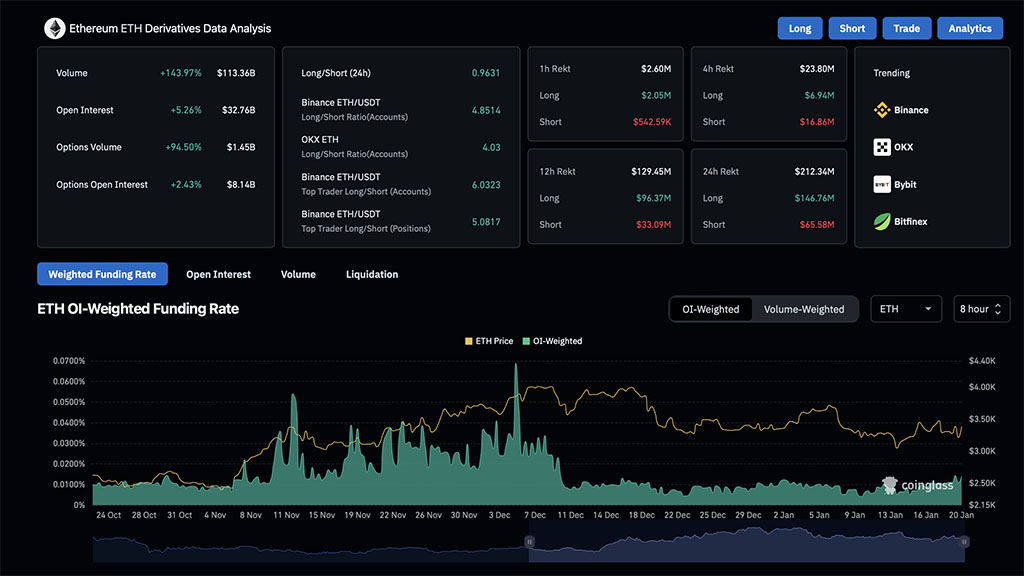

With the wider market showing increased optimism and Bitcoin reaching a fresh record high, Ethereum’s open interest has soared to an impressive $32.65 billion, marking a 5.25% increase. This surge in bullish sentiment towards Ethereum is growing rapidly.

Further fueling the theories, the funding rate has climbed up to 0.014%, indicating traders are prepared to pay a premium for maintaining bullish stances. Nevertheless, the long-short ratio over the past day stands below 1, at 0.9616, hinting at more bearish than bullish positions being held.

Trump’s World Liberty Buys More ETH

In light of the growing likelihood of a powerful market surge, Donald Trump’s company, World Liberty Finance, has purchased a substantial quantity of Ethereum. Over the past few hours, they have used 20 million USDC tokens to buy approximately 6,041 Ethereum tokens.

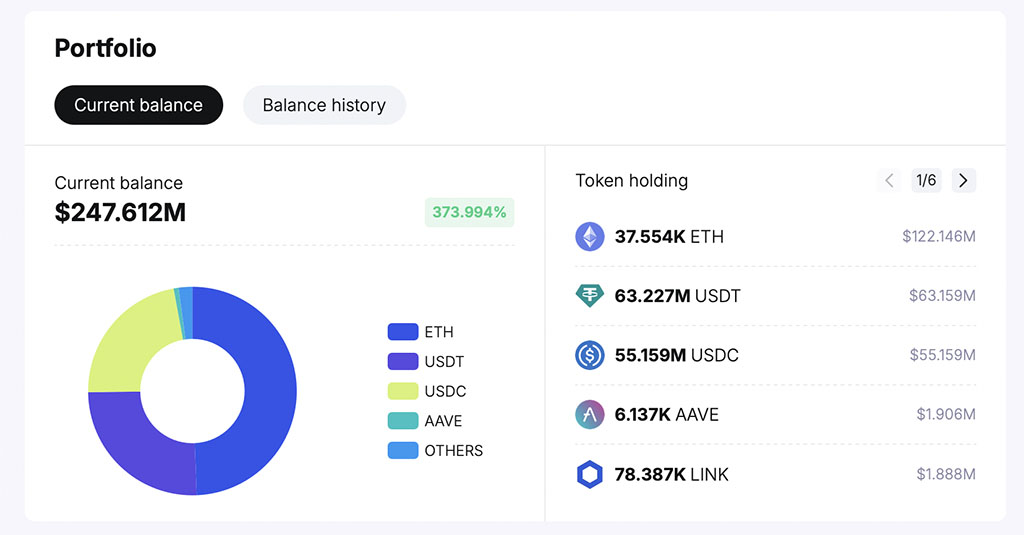

*The cost per average purchase of Ethereum Corporation is approximately $3,311. As per data from Spot On Chain, World Liberty Finance’s portfolio contains around 44.663 ETH tokens, which equates to a total value of roughly $151.73 million.*

Sharing a Lookonchain post regarding the latest Ethereum buy by WLF, Eric Trump, son of former President Donald Trump and Executive Vice President of the Trump Organization, expressed a highly positive sentiment about it.

“Wait until you see what they do tomorrow.”

The corporation manages a stablecoin valued at $160 million, alongside DeFi tokens such as Aave ($345.6), which has a 24-hour volatility of 14.8% and a market cap of $5.2 billion. Other tokens in their portfolio include LINK ($25.60), with a 24-hour volatility of 11.9% and a market cap of $16.22 billion, Wrapped Ethereum ($3,370), Ethena ($0.90), Solana ($263.1), Ondo Finance ($1.45), and more.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2025-01-20 13:45