As a researcher with a background in cryptocurrency and blockchain technology, I’ve closely followed Ethereum’s price movements and the ongoing discussions surrounding the potential approval of an ETH spot ETF by the SEC. The recent surge in Ethereum’s price ahead of this decision is an exciting development for the community, and I share the optimistic sentiment that has arisen as a result.

The price of Ethereum (ETH) is rapidly climbing in anticipation of the Securities and Exchange Commission (SEC) verdict on the proposed Spot Ethereum ETF. There’s growing excitement among investors and market observers as Ethereum breaks through the $3,900 threshold.

As a crypto investor, I’ve noticed some analysts expressing optimism about Ethereum’s (ETH) current bullish trend. They believe that this momentum could potentially push the price beyond all previously established price targets.

Ethereum Soars Amid ETF Approval Expectation

I, as an analyst, have observed a noteworthy surge in Ethereum’s value this week. The buzz surrounding potential Ethereum-backed spot exchange-traded funds (ETFs) receiving approval on Wednesday has fueled a wave of optimism within the cryptocurrency community, resulting in a strongly bullish outlook towards Ethereum.

Previously, it was believed among Bloomberg experts that the odds of an ETF approval were low due to the US government’s strict regulations in the industry. But this week, the Biden administration took a surprising turn, leading experts to revise their estimates, raising the likelihood to approximately 65-75%.

Seven days prior, Ethereum was priced just under $3,000. Since then, it has experienced a significant increase, rising by approximately 30.4%. Currently, Ethereum has broken through the previous resistance level of $3,900.

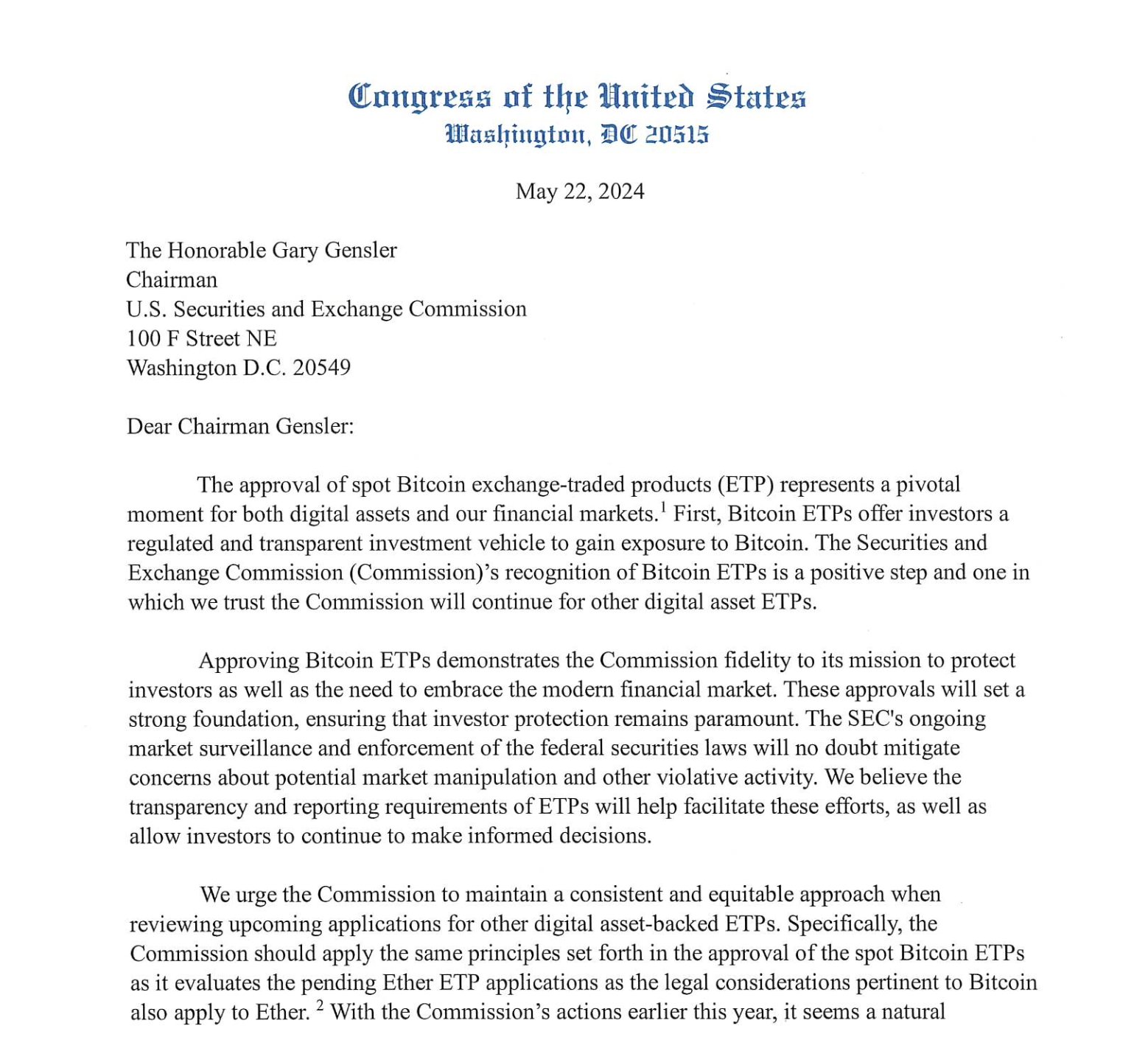

Several US lawmakers are encouraging SEC chairman Gary Gensler to give his approval for Ethereum Exchange-Traded Funds (ETFs), fueling the community’s hopeful outlook.

According to Eric Balchunas’ report, a bipartisan team of House representatives submitted a letter on Tuesday requesting SEC’s authorization for Ethereum (ETH) and other digital asset exchange-traded funds (ETFs).

As a researcher studying the developments in the cryptocurrency market, I’ve come across information from a recent letter sent by Congress members to the Securities and Exchange Commission (SEC). They expressed their belief that digital asset-backed Exchange Traded Funds (ETFs) provide investors with a regulated and transparent means to invest in this growing sector. These lawmakers strongly urged the SEC to ensure a consistent and equitable review process for upcoming applications related to other crypto ETFs.

Are Price Targets Too Low?

Over the last several days, Ethereum has demonstrated exceptional growth. The cryptocurrency ETH has experienced a notable increase of 5.6%, with the community keeping a close eye on the Securities and Exchange Commission (SEC) for their upcoming decision.

I’ve noticed that Ethereum’s weekly candles are currently hovering around levels last seen in the early days of March, according to various market analysts. crypto Yoddha, a fellow investor and market observer, has shed light on Ethereum’s historical tendency during its previous all-time high (ATH) runs.

According to the graph, the second largest cryptocurrency asset underwent a 700-day build-up prior to bursting free and initiating an upward trend. Likewise, Ethereum appears to have concluded a 700-day consolidation phase in this cycle, which may result in a surge towards a new all-time high, should historical patterns hold true. The analyst has predicted a price of $15,300 for this market cycle.

Similarly, Crypto Jelle noted that Ethereum (ETH) surpassed a prolonged falling wedge formation on its chart. Following this breakout, ETH has managed to regain the significant resistance level above $3,600 and is now challenging the $3,900 price range.

The trader believes that with current market conditions being what they are, before the potential approval of Ethereum ETFs, his goal of reaching $10,000 for this cycle may be insufficient. Yet, he advises investors against excessive trading.

Despite the optimistic attitude, Jelle advises the community to pay close attention to the immediate reaction to the decision, as it may be uncertain or unclear. However, he encourages them to keep their focus on the established facts and information, as the future perspective becomes more definite.

In a related development, crypto analyst Mikybull notes that Ethereum is following a pattern similar to what occurred in 2020, which set off the “altcoin season” in early 2021. Based on this observation, Mikybull believes the potential price targets for this market cycle could reach $9,000 to $11,000.

The SEC’s decision regarding ETH ETFs will be announced around 8:30 pm UTC on May 23.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-05-23 22:16