As a seasoned researcher with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. The recent trend in Ethereum (ETH) has caught my attention, not because it’s unusual, but because of the stark contrast it presents against Solana (SOL) and Bitcoin (BTC).

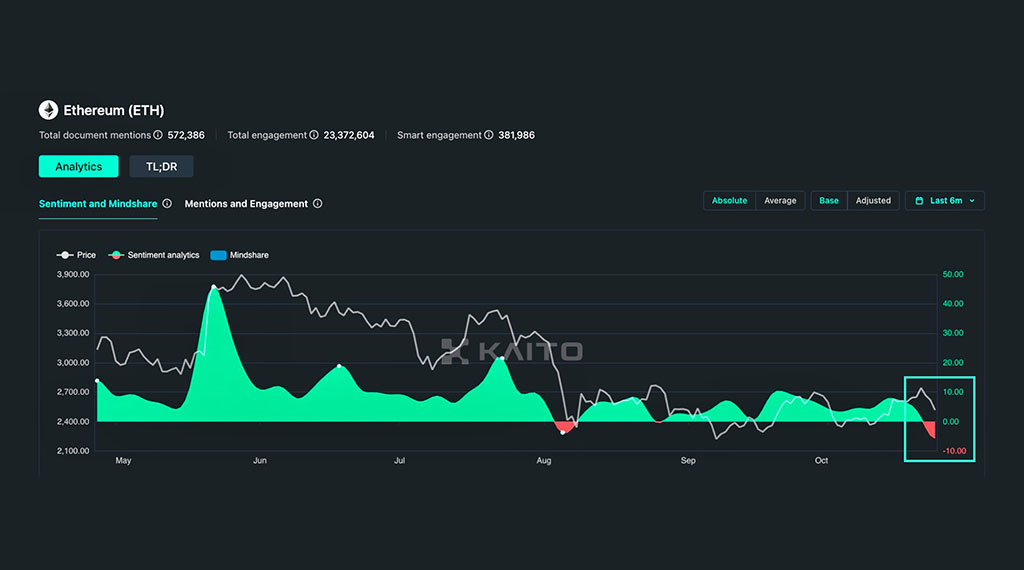

Lately, investors seem to be growing less hopeful about the future value of Ethereum (ETH). Data from Kaito indicates that the market sentiment for ETH has dropped below the levels seen in August, suggesting a pessimistic outlook.

Kaito data

It’s important to mention that the August decline coincided with a broader market downturn. However, the current pessimistic mood appears to be influenced by ongoing concerns about the underperformance of altcoins compared to Solana, specifically in terms of its price and volatility. Here are some key metrics for comparison:

ETH Underperforms SOL and BTC

During the midpoint of its recovery, ETH experienced a drop while Solana (SOL) and Bitcoin (BTC) increased in value, a pattern that has emerged since early 2024. Notably, the ratio between SOL and ETH (SOL/ETH), which measures SOL’s worth compared to ETH, reached a record high this week, peaking at 0.070. This indicates that Solana outshone Ethereum in performance.

Source: CoinMarketCap

In light of Solana’s impressive performance, I find myself echoing the sentiments of Andrew Kang, co-founder of Mechanism Capital, a prominent crypto venture capital firm. His viewpoint suggests that this upward trend in Solana could potentially persist, leading to a potential sell-off in Ethereum.

This year, holding a substantial position in Solana, protected by Bitcoin or Ethereum, has been one of the top risk-reward trades. As more investors jump on board with Solana and long-time Ethereum holders start to sell, I don’t foresee this trend reversing anytime soon,” Kang stated.

ETH Price Action

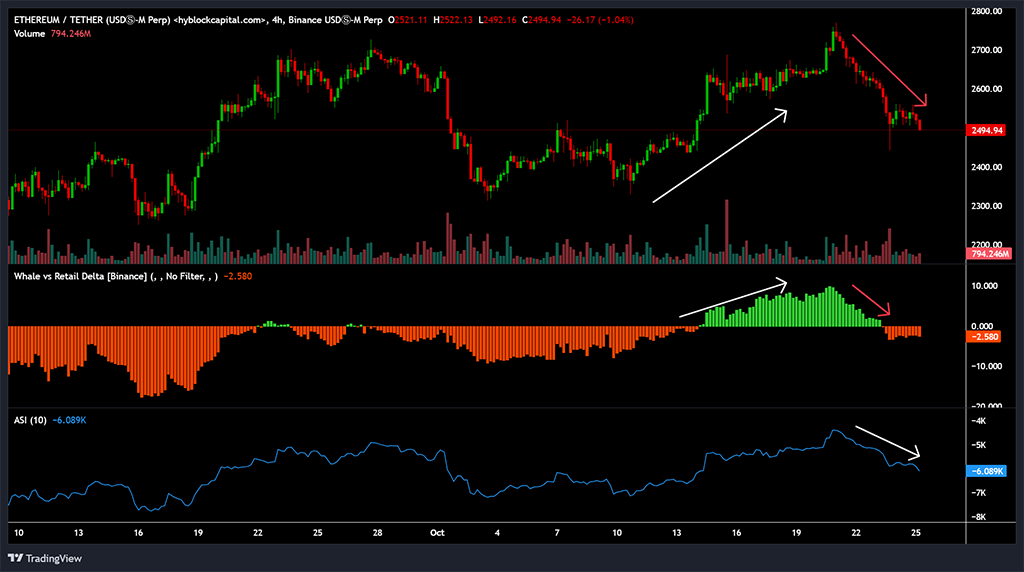

Source: Hyblock

In simpler terms, a significant drop in the price of ETH was also marked by a decrease in whale interest, which was evident from the negative Whale vs. Retail Delta. This implies that whales were not buying more ETH compared to retail investors, suggesting they weren’t planning to invest long-term in the asset. Historically, less whale involvement often precedes price decreases.

As a researcher studying cryptocurrency markets, I find myself closely watching the behavior of large investors, or “whales,” in Ethereum (ETH). It’s worth noting that an uptick in whale positions back in mid-October led to a significant rally for ETH, pushing its price above $2.7K. Therefore, if we don’t see an improvement in whale demand, I anticipate that the current ETH pullback may persist in the near future.

Source: ETH/USDT, TradingView

At this moment, ETH has dropped below $2500 on price graphs. This represents a 10% fall from its recent peak of around $2760. If the downward trend continues, significant points to keep an eye on in the near future could be the trendline support and demand zone above $2300.

The decrease in interest for US ETFs that trade Ethereum immediately (US spot ETH ETFs) might pose a problem for Ethereum’s price. These investment products started the week with withdrawals amounting to $20.8 million on Monday.

From Tuesday to Thursday, the products accumulated more than $15 million, but with a weekly outflow of roughly $5 million not including Friday’s figures, it means that overall, there has been a net decrease in demand so far, which might postpone a significant price increase at this moment.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-10-25 12:15