As a seasoned crypto investor with a decade of experience under my belt, I’ve seen enough market cycles to know that every trend has its ebb and flow. The recent $1 billion outflow of Ethereum from exchanges is reminiscent of similar patterns leading up to significant price surges in the past.

Over the past week, I’ve noticed an impressive spike in on-chain activity associated with Ethereum. Data from the on-chain analytics platform IntoTheBlock indicates that approximately $1 million in Ether was withdrawn from cryptocurrency exchanges last week. This trend hints towards a strategy among investors to hold onto their Ether, despite Ethereum’s current price consolidation below $3,200.

Significantly, the last instance when Ethereum saw such substantial outflows occurred in May 2023. This large-scale departure of ETH from exchanges might suggest that traders are expecting increased prices and transferring their assets to personal wallets, possibly as a strategy to hold onto their investments more securely.

Examining The Ethereum $1 Billion Outflow

The significant departure of Ethereum from cryptocurrency exchanges is emphasized by ‘Aggregated Exchange Netflow’ data from IntoTheBlock. This metric, which tracks the difference between assets entering and leaving exchanges (total assets leaving minus total assets entering), can help gauge traders’ optimism. A high outflow suggests accumulation behavior as people typically buy on exchanges and then withdraw the tokens to their personal wallets.

Based on recent data, there’s been a decrease of approximately 59,240 ETH in total exchange inflows over the past 24 hours. This downward trend isn’t just a one-off event, but rather part of a larger pattern that has been developing throughout the week. On social media platform X, IntoTheBlock pointed out this persistent behavior, emphasizing Ethereum’s weekly net withdrawal from exchanges amounting to about $1 billion.

It’s worth noting that this pattern isn’t unique to Ethereum; Bitcoin, the foremost cryptocurrency, has shown a comparable trend. The weekly exchange outflow for Bitcoin has reached approximately $1 billion, similar to Ethereum’s. This synchronized behavior hints at a widespread market opinion, indicating that significant cryptocurrencies are being withdrawn from exchanges and traders are collectively expecting a surge in the market.

This week, both Bitcoin ($BTC) and Ethereum ($ETH) experienced substantial withdrawals from digital exchanges, exceeding a collective withdrawal of over $1 billion for each.

The last time outflows were this high was in May 2023

— IntoTheBlock (@intotheblock) November 15, 2024

What’s Next For Ethereum?

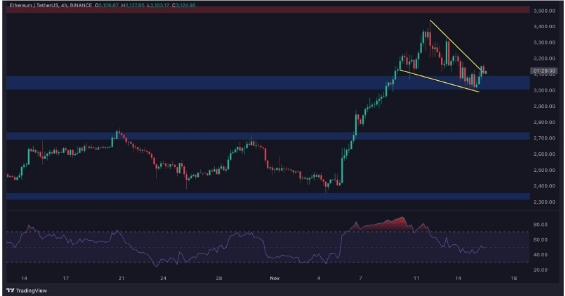

Since hitting $3,420 on November 12, Ethereum has noticeably dropped. More specifically, Ethereum dipped to $3,018 as a large number of Ethereum tokens were listed for sale on cryptocurrency exchanges. However, despite this apparent 11% drop in price, Ethereum has maintained its value above the key support level of $3,000.

It appears that the recent dip has offered buyers another chance to accumulate more ETH. With the price bottom seemingly set at $3,000, it’s likely that the cost of Ethereum will initiate an upward trend in the coming days.

Currently, as I’m typing this, Ethereum is being traded at approximately $3,152. This represents a 1.5% increase over the last 24 hours, suggesting an early indication of recovery. The recent price movements are shaping Ethereum into a falling wedge pattern, which may potentially break in either direction.

If Ethereum’s upward trend continues, it might regain its bullish momentum and challenge the $3,400 resistance in the near future. On the flip side, a downward break could initiate a more significant drop, possibly pushing the price towards the nearby support at around $2,810.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-11-17 22:16