As a seasoned analyst with over two decades of experience in the financial markets, I find myself constantly intrigued by the ever-evolving world of cryptocurrencies. In this particular instance, the recent trend in Ethereum and Tether exchange flows presents an interesting conundrum.

As an analyst, I’ve noticed a significant increase in Ethereum‘s exchange outflows lately, indicating potential bullish activity. However, a recent development concerning Tether (USDT) might pose a bearish challenge to the market.

Ethereum And Tether Both Have Seen Withdrawals From Exchanges Recently

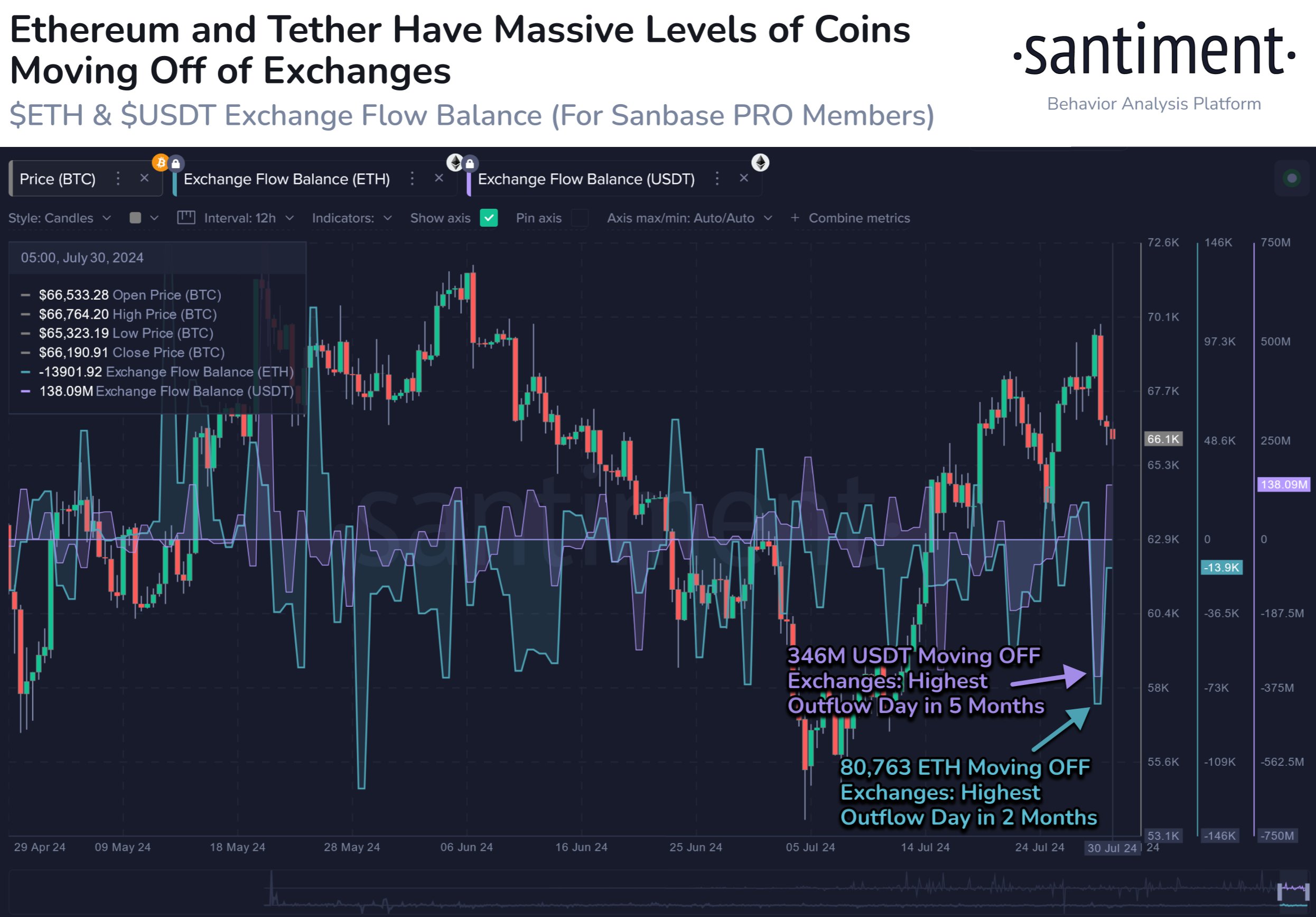

According to Santiment’s recent analysis, the market has shown a mixed picture as we approach the end of July, particularly concerning exchange flows. The key metric being discussed is the “Exchange Flow Balance,” which calculates the net movement (either inflow or outflow) of a specific asset into or out of wallets linked to centralized exchanges.

When the measure indicates a positive value, it signifies that more funds are entering these platforms than leaving them at this time. This situation suggests that investors are actively seeking to trade the asset, demonstrating current demand for it.

Alternatively, when the indicator shows a negative value, it suggests that exchange users are actually taking out more assets than they’re putting in, possibly choosing to keep these digital coins for a longer period.

The impact these trends might have on the broader market can vary significantly depending on whether the specific cryptocurrency in question is a stablecoin or a volatile asset. Given that our discussion involves Ethereum and Tether, it’s important to note that both types of digital currencies are pertinent to this topic.

As a seasoned investor with years of experience under my belt, I find this chart shared by the analytics firm particularly insightful. Over the past few months, it has been fascinating to observe the trend in the Exchange Flow Balance for these two assets. This data gives me valuable insights into market dynamics and helps me make informed decisions about where to invest my hard-earned money. In my experience, understanding the flow of assets is key to successful investing, as it can reveal patterns and trends that might otherwise go unnoticed. So, I’m keeping a close eye on this data and adjusting my portfolio accordingly.

The above graph shows a significant drop (negative spike) in the Exchange Flow Balance for both Ethereum and Tether lately, suggesting that investors are moving substantial quantities of these digital assets to personal storage, away from exchanges.

If a volatile asset is traded away, it may lower its price, making an increase in the exchange reserve potentially bearish (indicating a possible decrease in demand). Conversely, a negative Exchange Flow Balance might be bullish, suggesting that the supply of the coin for sale could be shrinking.

Over the past period, there’s been a substantial withdrawal of about 80,763 Ether (approximately $268 million) from these investment platforms – marking the largest outflow surge in over five months. Consequently, the amount of Ethereum available for sale has significantly decreased.

When it comes to stablecoins, an increase in exchange inflows typically indicates that investors are exchanging other assets for these coins. However, because the value of stablecoins is designed to remain close to $1, these trades do not impact the price of the stablecoin itself.

While it’s not suggesting that these coins have no impact on the market, it’s worth noting that investors often use stablecoins like Tether as a means to purchase volatile assets such as Ethereum. Consequently, significant inflows of Tether into exchanges could potentially be seen as bullish for other cryptocurrencies.

From this perspective, the reserves held in USDT and similar stablecoins can act as a potential “source of demand” for fluctuating cryptocurrencies. Lately, there has been a net withdrawal of $346 million from USDT, which implies that the demand for these volatile cryptos has decreased since this source has diminished.

According to Santiment, this situation indicates reduced purchasing power among traders for potential future transactions on Ethereum, which is typically essential to escalate prices over time. It’s unclear at present how the Ethereum price will trend in the immediate future, as both optimistic (bullish) and pessimistic (bearish) events have unfolded concurrently within the market.

ETH Price

At the time of writing, Ethereum is trading at around $3,300, down more than 3% over the past week.

Read More

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-08-01 07:35