As an analyst with over two decades of experience in the cryptocurrency market, I have witnessed numerous ups and downs, and the current state of Ethereum (ETH) is one that requires careful examination. The sharp decline in network fees during Q3 2024 has raised concerns about its future, and it’s clear that multiple factors are at play here.

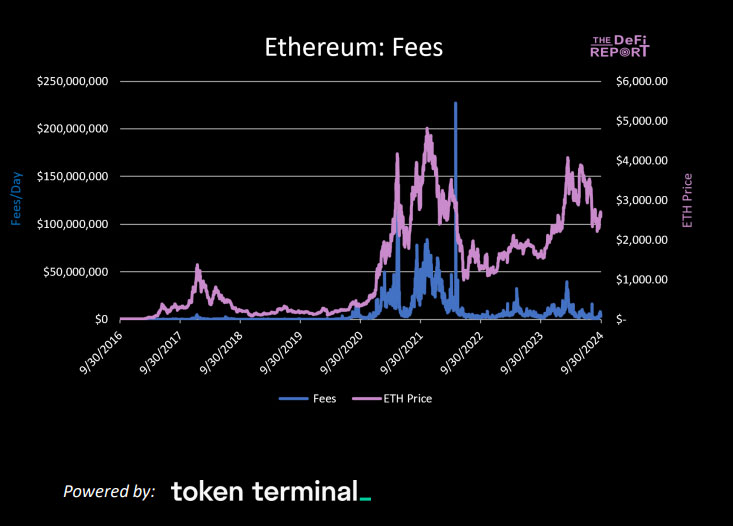

In the third quarter of 2024, Ethereum (ETH) witnessed a significant dip, accumulating approximately $261 million in network fees. This marks a substantial 47% decrease compared to the previous quarter, which is the lowest since late 2020. This downturn has sparked discussions regarding the factors contributing to Ethereum’s challenges.

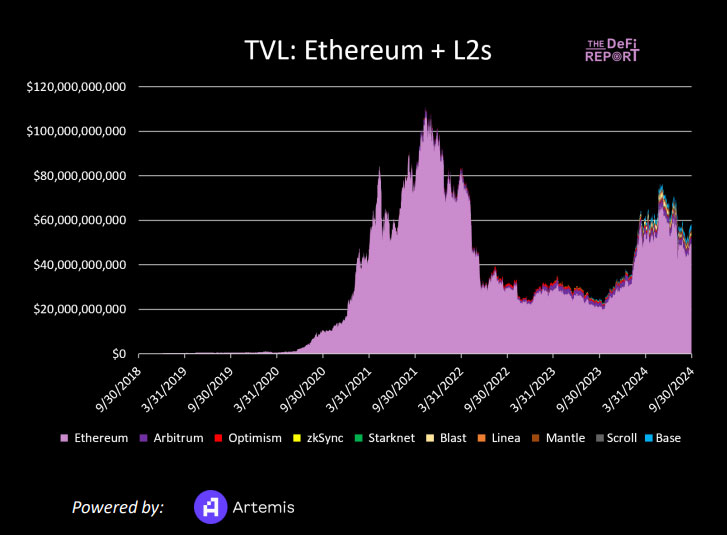

The recently published report titled “The ETH Report: Q3-24,” dated October 16, highlights layer 2 networks’ fast growth as a significant contributor to the decrease in fees on Ethereum’s main network. Additionally, the implementation of Ethereum Improvement Proposal 4844 and a reduced number of new cryptocurrency users during the quarter have also played a role in this challenging situation for Ethereum’s primary network.

This report indicates a 14% decrease in Ethereum’s Total Value Locked (TVL) during the current quarter. However, over the past year, TVL has increased by a substantial 133%. This underscores steady advancement in the long term, even though there have been temporary setbacks. On the other hand, the value of ETH coins dropped by 21% this quarter, partly because more tokens were minted than destroyed, which has added to its downward price trend.

Ethereum Fee Decline Linked to Multiple Factors

According to The DeFi Report, Ethereum’s fee reduction is due to multiple reasons. The EIP4844 enhancement aims at enhancing scalability and reducing costs, yet it redirects some transaction load to layer 2 platforms. Additionally, the emergence of modular data availability networks like Celestia, coupled with more affordable options, has also led to a shift in activity from Ethereum’s main network.

Uniswap Labs’ latest venture, Unichain, as a layer 2 solution, poses a fresh competition for Ethereum’s transaction fee income. Since it manages approximately 20% of the gas fees directed to Ethereum validators, Uniswap’s decision to create its own layer 2 may lead to substantial financial losses for the network. As fees decrease, inflation increases, and Uniswap migrates to layer 2, Ethereum’s ecosystem may undergo potential disruptions.

Michael Nadeau, the founder of DeFi Report, proposes that Ethereum validators have the ability to overcome these obstacles. By increasing the number of transactions and burning more tokens by lowering fees, they can stimulate token demand and enhance network profitability. This, in his view, would be advantageous for app developers, users, and ETH validators alike.

Nevertheless, he cautions that with the growth of layer 2 solutions, validator earnings could experience a short-term dip until fresh use cases materialize to utilize the extra block space.

Ethereum Faces Potential $368M Loss to Uniswap

This week, Nadeau cautioned about the possibility that Ethereum validators and token owners could potentially lose approximately $368 million in settlement fees due to Uniswap launching Unichain. Instead of going to Ethereum, these funds could be directed towards Uniswap Labs and UNI token holders. Consequently, the amount of ETH being burned might decrease, which could have a negative impact on ETH holders and potentially devalue Ethereum.

Uniswap accumulated approximately $1.3 billion in trading and settlement fees over the past year, spread across five major networks. Remarkably, none of this value was captured by the protocol or token holders; instead, it went entirely to Liquidity Providers, Ethereum Validators, MEV bots, and L2 sequencers. However, with Uniswap’s recent launch…

— Michael Nadeau (@JustDeauIt) October 13, 2024

The decrease in fees, along with Uniswap’s tactical moves, indicates changes within the blockchain environment. Layer 2 solutions, which provide enhanced scalability and reduced costs, are posing competition against Ethereum’s mainnet. Responding to these competitive pressures will be essential for Ethereum to maintain its dominance in decentralized finance (DeFi).

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-10-17 15:36