As an analyst with over two decades of experience in the financial markets, I find myself increasingly optimistic about Ethereum (ETH). The recent surge in its price, with over 90% of ETH holders now making profits, is reminiscent of the dot-com boom of the late ’90s. However, unlike many of those early internet companies, Ethereum seems to have a more solid foundation and real-world application.

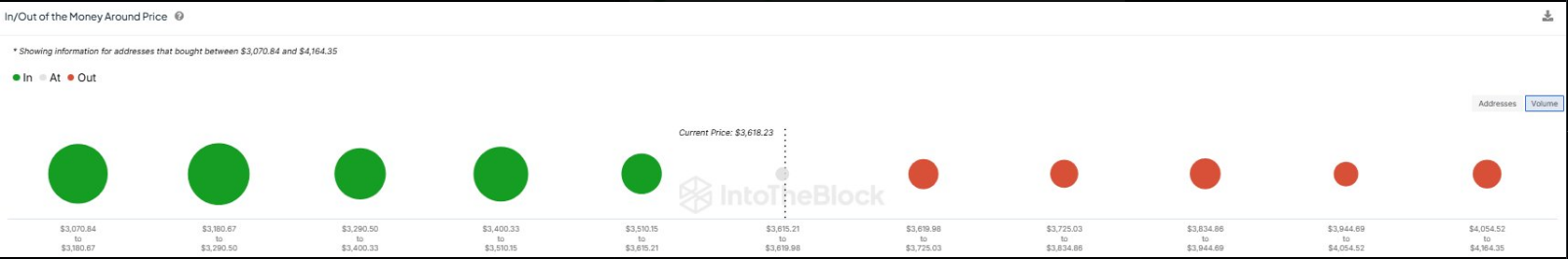

As a crypto investor, I’m thrilled to share some exciting news about Ethereum (ETH). It seems that the tides have turned favorably for us buyers, as recent findings indicate that an overwhelming 90% of Ethereum users are currently in the green due to the significant increase in the cryptocurrency’s price. According to IntoTheBlock, we find ourselves in the most profitable position in the past five months, making now an opportune time for ETH holders to capitalize on these impressive gains.

Excited by Bitcoin reaching over $96,000 again, the token surged to $3,680 – its highest point since June. While Bitcoin paved the way, Ethereum’s growth is evident as it effortlessly broke through barriers. Although trading 25% below its record high of $4,890, Ethereum’s strong underlying factors and market atmosphere suggest a promising future ahead.

90.8% of $ETH holders are now in profit, the highest since June.

It’s worth noting that about 2.8% of the total Ethereum supply is being held by those who are still at a loss, representing roughly 9.2% of all holders. This implies that the selling pressure from this group might not significantly affect the price rise as Ethereum keeps moving upwards.

— IntoTheBlock (@intotheblock) November 28, 2024

Whale Confidence And Long-Term Holding

A deeper look into the investing habits of Ethereum reveals more optimistic trends. In fact, just 9.2% of Ethereum holders are currently experiencing losses, and they account for only 2.8% of the total token supply. This suggests that a significant portion of the market is likely to remain stable or even grow, as these investors with minimal losing positions might not exert much selling pressure on the market.

Moreover, it’s worth noting that Ethereum’s long-term investor base is robust. Over 74% of Ethereum holders currently have been holding for more than a year, indicating a strong belief in the token’s future value. This is significant because only 23% of Ethereum was bought last year, and just 3% were purchased last month, suggesting that most investors are planning to stay invested for the long term.

Decreasing Supply, Bullish Momentum

As a researcher, I’m observing an intriguing trend in Ethereum’s market: the diminishing supply on centralized exchanges. This downward trend has persisted since last year, indicating a decrease in Ether held in centralized reserves. During a bull run, when demand exceeds supply, this discrepancy can significantly drive prices upwards.

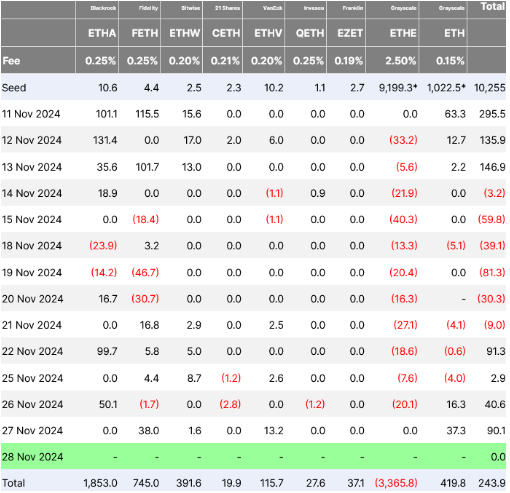

The significant growth of Ethereum lately can also be attributed to substantial investments in spot ETFs amounting to more than $90 million. This influx of institutional funds signifies a growing confidence in Ethereum’s upcoming prospects.

Ethereum: Path To ATH Appears Clear

Currently, Ethereum (ETH) is showing remarkable performance compared to other major cryptocurrencies, with a 12% increase over the past week. Moreover, its value relative to Bitcoin has grown by 18%, suggesting that Ethereum is gaining strength. Analysts believe that if Ethereum manages to break through the $4,000 resistance level, it would bolster the case for reaching its all-time high.

The price of Ethereum has dipped slightly by 5.92% compared to yesterday, currently standing at $3,610. However, given the trends and market feeling, it seems Ethereum could potentially surpass its previous high, aiming to establish new records.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-11-29 18:40