As a seasoned analyst with years of experience navigating the cryptocurrency market, I can confidently say that Ethereum’s current correction is not unexpected. The price action closely mirrors that of Bitcoin, which is often a reliable indicator in this space.

The cost of Ethereum is adjusting its upward momentum at the $2,720 barrier. Currently, Ethereum is trading beneath $2,650 and could potentially encounter buying interest around $2,600.

-

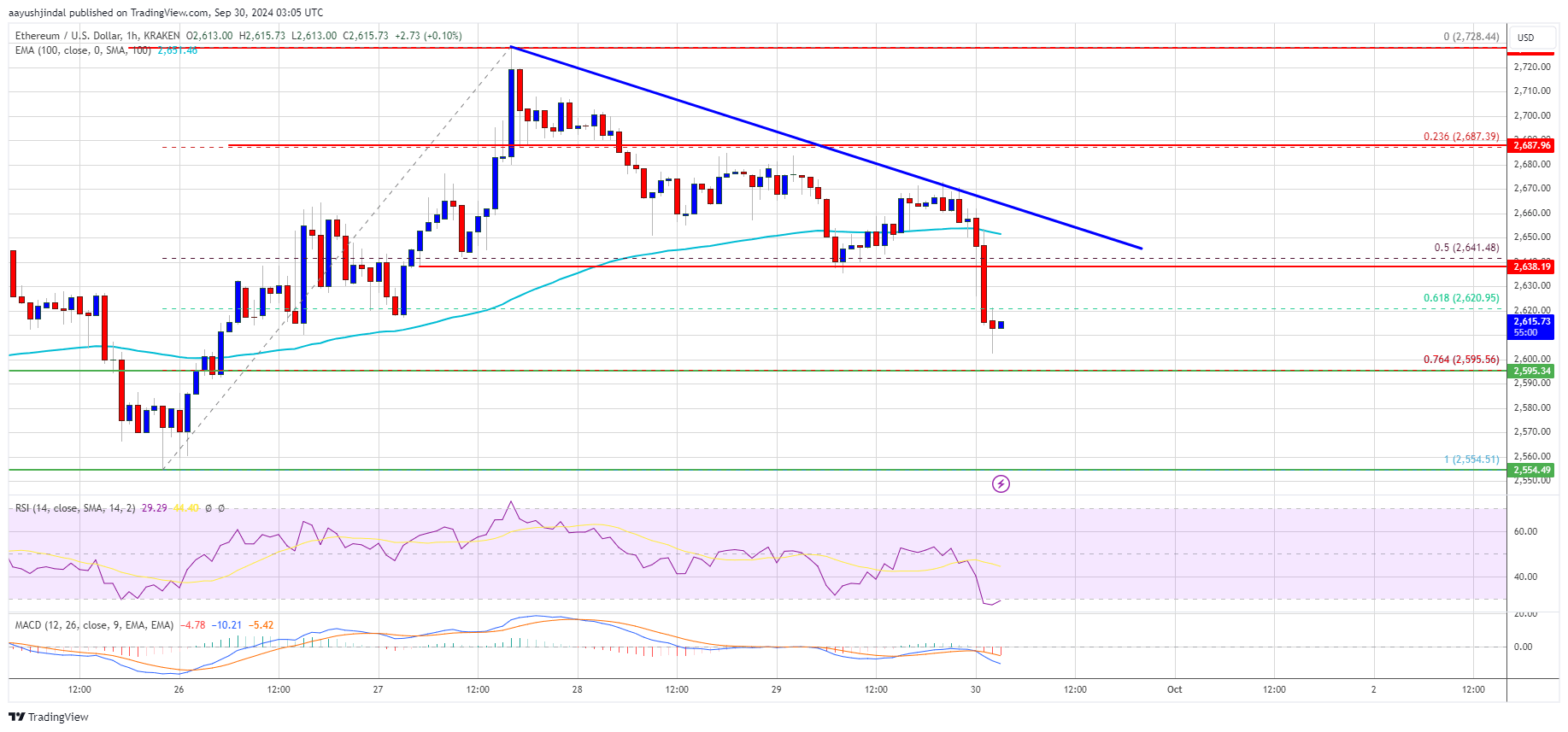

Ethereum started a downside correction from the $2,720 zone.

The price is trading below $2,650 and the 100-hourly Simple Moving Average.

There is a key bearish trend line forming with resistance at $2,650 on the hourly chart of ETH/USD (data feed via Kraken).

The pair must stay above the $2,600 support to start a fresh increase in the near term.

Ethereum Price Dips Again

The cost of Ethereum increased significantly and surpassed the $2,650 mark. It also managed to rise above the $2,700 level, but eventually, a drop followed, much like with Bitcoin. The highest point reached was $2,728, after which a decline commenced.

The Ethereum price dipped beneath the $2,650 mark and also dropped below the halfway point (50%) of its recent upward trend from $2,554 to $2,728. Now, it’s trading below the $2,650 level and the 100-hour moving average.

Alternatively, the price might encounter offers around the $2,600 mark or at the 76.4% Fibonacci retracement level derived from the upward price movement that started at the $2,554 low and peaked at $2,728.

On a positive note, it appears that the price might encounter obstacles around the $2,650 mark. Additionally, a significant bearish trend line is shaping up on the hourly ETH/USD chart with a resistance at $2,650. The first substantial resistance lies at approximately $2,685, and another key resistance can be found close to $2,720.

If Ether manages to surge above its current resistance at around $2,720, it’s likely we’ll see further increases in the upcoming trading periods. In this scenario, Ether might push towards the resistance area of approximately $2,840 in the short term. The next potential obstacle lies around $2,880 or possibly $2,920.

More Losses In ETH?

Should Ethereum not manage to surpass the $2,650 barrier, there’s a possibility it might keep dropping. A potential initial floor could be found around $2,600. The first substantial support level lies roughly within the $2,550 region.

Moving beneath the $2,550 resistance could potentially drive the price down to around $2,520. If the decline continues, it may reach the $2,450 support shortly. A crucial lower support is found at $2,365 in the immediate future.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $2,600

Major Resistance Level – $2,650

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-09-30 06:40