As a seasoned researcher with years of experience in the cryptocurrency market, I can confidently say that Ethereum’s current price action is exhibiting a mix of bullish and bearish signals.

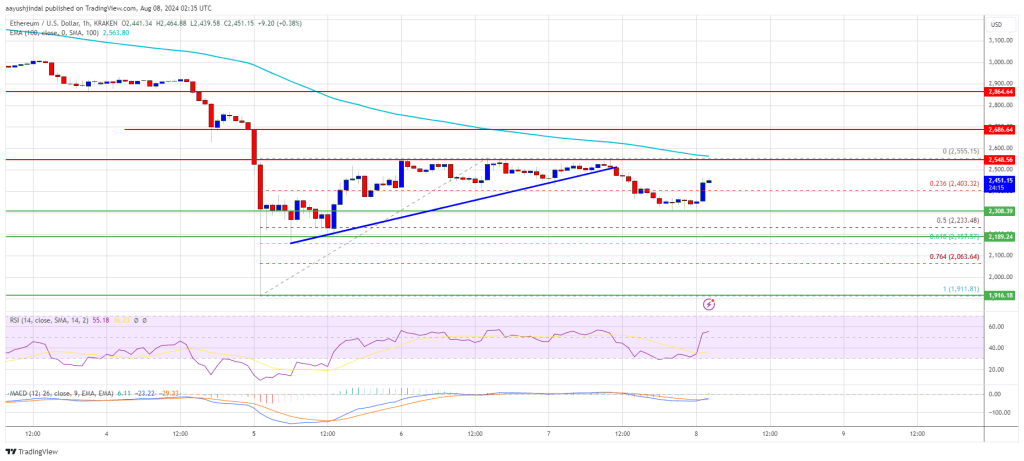

In my analysis, I found that Ethereum‘s price didn’t manage to push beyond the $2,550 barrier, indicating a potential reversal in its upward trend. Now, Ethereum is hovering around $2,450 and displaying some bearish indicators.

-

Ethereum started a recovery wave above the $2,400 and $2,420 levels.

The price is trading below $2,550 and the 100-hourly Simple Moving Average.

There was a break below a connecting bullish trend line with support at $2,500 on the hourly chart of ETH/USD (data feed via Kraken).

The pair could rise steadily if it clears the $2,550 resistance zone.

Ethereum Price Struggles Below $2,550

The cost of Ethereum began a rebound surge, surpassing the $2,250 barrier that previously served as resistance. In much the same way Bitcoin moved past the $65,000 mark, ETH also scaled over the hurdles at $2,320 and $2,450.

Despite being active around the $2,550 resistance area, where a peak of $2,555 was reached before a reversal, the price subsequently dropped below $2,450. It even fell beneath the 23.6% Fibonacci retracement line of the upward trend from the $1,911 low to the $2,555 high.

Additionally, the Ethereum-to-US-Dollar pair experienced a drop beneath a bullish trend line providing support at $2,500 as shown on the hourly chart. This level was tested at $2,320, but the pair has since started to increase.

As an analyst, I’m observing that Ethereum’s current trading price remains below the $2,550 mark and also falls short of the 100-hour Simple Moving Average. On the positive side, potential obstacles lie ahead at the $2,500 level. The primary resistance levels can be found near $2,550 and coincide with the 100-hour Simple Moving Average.

If Ether manages to rise above the $2,550 mark, it could encounter a resistance at around $2,685. Should it surpass this resistance as well, there’s a possibility that it might push further towards the $2,865 resistance in the near future. A break above $2,865 could potentially propel the price upwards, aiming for the $3,000 resistance area in the short term.

Another Decline In ETH?

If Ethereum doesn’t manage to break through the $2,550 barrier, there’s a possibility it might initiate another drop. Its initial support can be found around $2,350, while significant support lies in the vicinity of the $2,300 region.

If the price falls below the $2,300 support, it could potentially drop to around $2,150, which is close to the 61.8% Fibonacci retracement level of the upward trend from the $1,911 low to the $2,555 high. Further declines might lead to the $2,120 support in the immediate future. A crucial support level can be found at $2,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $2,300

Major Resistance Level – $2,550

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

- Overwatch 2 Season 17 start date and time

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2024-08-08 06:22