As a seasoned analyst with over two decades of experience in the crypto market under my belt, I must say that the current state of Ethereum presents a unique conundrum. On one hand, the bullish momentum is evident as the price hovers around $3,427, marking a 1.62% increase in the last 24 hours and a 4.40% rise over the past week. The RSI line’s uptick suggests increased buying pressure, which is always a positive sign.

Over the past day, Ethereum (ETH) has seen a 1.62% increase in its price. This daily gain brings its 7-day price rise to 4.40%, currently trading at $3,427. The 24-hour volume for ETH is approximately $24.38 billion, and the market cap stands at a staggering $410.45 billion. The 24-hour volatility of Ethereum is relatively low at 1.7%.

With a current market value of $412 billion, the intricate challenges within institutional backing and significant players (whales) are hinting at substantial price volatility. Will Ethereum’s bullish forces triumph during the upcoming market swings, paving the way for an upward trend by 2025? Let’s explore that possibility.

Ethereum Price at Crossroads

On the 4-hour chart, the Ethereum price could not maintain its position above the 38.20% Fibonacci Retracement level, which is approximately $3,477. This led to a swift decline, bringing the price back to the 23.60% Fibonacci Retracement level, around $3,333.

This represented a decrease of 4.67%, resulting in a bearish engulfing candlestick on the daily graph. In the 4-hour chart, the Ethereum price movement is still confined within two significant Fibonacci levels.

Right now, the Ethereum price pattern is creating a large bullish engulfing candle, which has caused an increase of 3.20%. This surge has led Ethereum to break above its 20-day moving average (EMA). Now, it’s attempting to overcome the resistance provided by the 50-day moving average line.

Additionally, the Relative Strength Index (RSI) line has experienced a substantial rise, surpassing both the 14-day average line and the 50% mark. This suggests that the momentum indicator is showing a surge in buying activity.

ETH Price Targets

The appearance of a bullish engulfing candle in Ethereum’s price chart suggests a potential 38.20% Fibonacci level breach, implying a strong possibility of an uptrend. This upward surge might test the significant resistance at around $3,600.

In other words, if the price falls below the $3,300 mark, it will challenge the bulls’ control around the $3,100 level. The mounting stress during market volatility might lead to a drop down to $3,000.

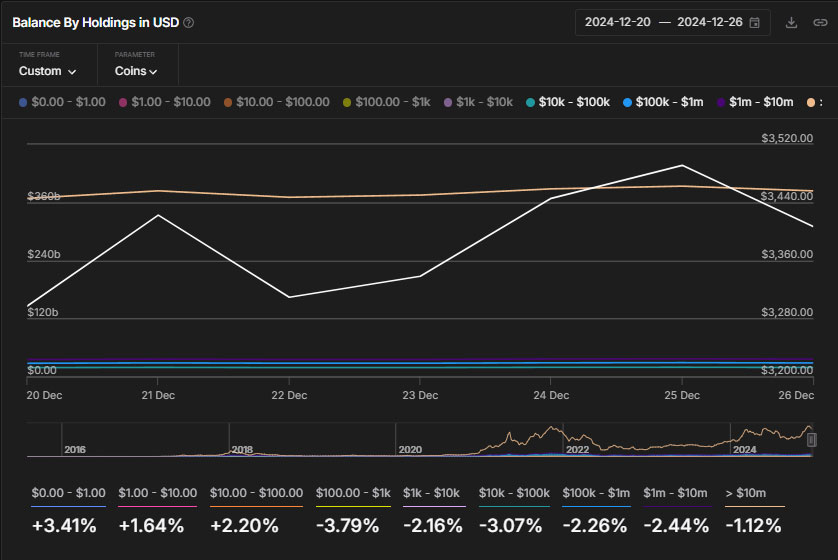

Whale Address Number on a Decline

Over the past week, the number of Ethereum-holding whale addresses (those with over $10,000 worth) has fluctuated between 805,570 and 788,300. This significant change in whale addresses is notable during the correction period.

Diving deep into the categorization, addresses holding more than $10 million worth of Ethereum changed from 2.52k to 2.47k. Furthermore, the addresses holding $1,000,000 to $10,000,000 worth of Ethereum reached 13.14k from 13.37k.

A significant change in the behavior of large Ethereum wallets (whales) suggests a hidden vulnerability within the Ethereum whale group.

Ethereum ICO Whale Returns to Offload

In the midst of bearish signs and off-chain activity for Ethereum, a dormant “Ethereum ICO era whale” has stirred to life. Over the last 5 hours, this long-slumbering whale has transferred 742.11 Ethereum tokens.

I’ve got approximately $2.5 million worth of cryptocurrency spread across two digital wallets. Notably, one of these wallets transferred 431.11 Ethereum to Coinbase.

The trader had invested nearly $600 in the ICO to receive 1,940 ETH at the Genesis block. Currently, the whale continues to hold its 1,198 ETH tokens worth $4.01 million.

With word spreading that several “whales” from the Initial Coin Offering (ICO) era are planning to sell, it’s expected that short-term market movements may be more heavily influenced by a bearish trend.

As a researcher examining the cryptocurrency market, I’ve noticed an intriguing trend with Ethereum. Currently, its price is exhibiting a bullish trend, targeting approximately $3,600. However, I can’t help but notice a few potential red flags that might suggest short-term volatility. Namely, the decrease in whale activity and the stirring of dormant wallets could indicate some turbulence ahead.

Read More

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-12-27 16:08