As a seasoned researcher with a knack for deciphering cryptocurrency market movements, I can’t help but feel a sense of intrigue when I see large-scale transfers like this one from Lido to Binance. While it’s always important to remember that correlation does not imply causation, the timing and magnitude of such transfers often hint at potential shifts in market sentiment.

Based on recent blockchain information, it appears that a digital currency firm has moved a substantial quantity of Ether tokens from the Lido staking platform to Binance, a popular cryptocurrency exchange. Is it possible that this could indicate a potential downward trend in the value of Ethereum?

Is ETH Price Preparing For Further Correction?

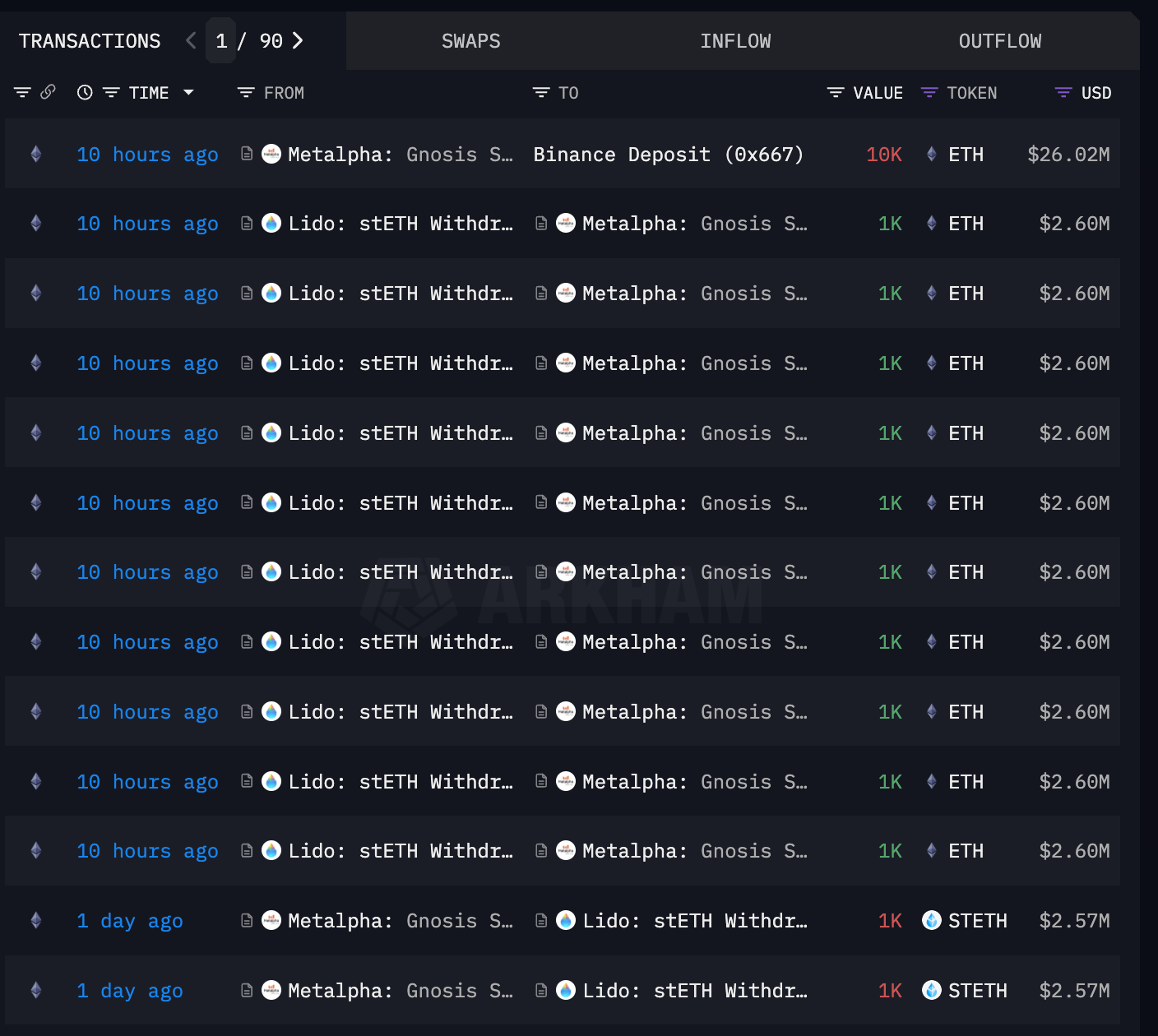

Based on information provided by Arkham Intelligence, digital asset management company Metalpha withdrew approximately 10,000 ETH (around $26 million) from the liquid staking platform Lido last Saturday, August 17. After transferring these Ethereum tokens to a Metalpha-branded Gnosis Safe Proxy wallet, they were subsequently moved to Binance, currently the world’s leading cryptocurrency exchange.

Pay attention to shifts in this kind of asset flow, as it’s crucial to understand the trajectory and scale of such transfers and their possible influence on Ethereum’s value. Additionally, these financial transactions might give us a glimpse into the current opinions of big-time and institutional investors.

From my research findings, I’ve observed that some ETH tokens were moved from a Gnosis Safe Proxy wallet to a wallet on the Binance platform. Notably, Gnosis Safe Proxy wallets stand out due to their multi-signature mechanism, which necessitates approval from several parties before any transaction can be executed.

As a researcher delving into the intricacies of blockchain technology, I find the multi-signature aspect of sender wallets captivating. However, what truly sparks my curiosity is the shift of assets towards custodial wallets on centralized exchanges. This action often signifies that investors are eager to leverage the services provided by these centralized platforms, such as selling their digital assets.

As an analyst, I’ve observed a significant influx of Ether tokens onto the Binance platform recently. If Metalpha is indeed planning to sell these tokens, this could potentially have bearish implications for Ethereum’s price. Given that the rationale behind this move remains unclear, we’ll need to monitor the market closely to determine if Ethereum might experience a downward trend as a result of this transaction.

Ethereum Price At A Glance

At present, the ETH token hasn’t shown much price fluctuation over the recent hours. Conversely, the Ethereum value has stayed steady near the $2,600 mark, registering only a minor 0.5% rise within the last 24 hours.

Despite being in a lower position just over two weeks back, the second most significant cryptocurrency appears to be in a stronger state now. The price of Ethereum has displayed positive signs of recuperation following its drop to a multi-month minimum of $2,200 in early August.

Looking at a larger time span, it appears that Ethereum’s price has slowed down significantly compared to its early 2024 momentum. As per CoinGecko data, Ethereum’s price has dropped approximately 25% over the last month.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- All Elemental Progenitors in Warframe

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- How to get all Archon Shards – Warframe

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

2024-08-18 11:10