As a researcher with a background in finance and experience in following the cryptocurrency market closely, I find the recent development surrounding Ethereum (ETH) price and the potential approval of a spot ETH exchange-traded fund (ETF) quite intriguing. The sudden surge in ETH price by 18% within the last 24 hours, coupled with a massive increase in daily trading volume, is noteworthy.

Over the past 24 hours, I’ve observed an impressive surge in Ethereum (ETH) price. It has soared by approximately 18%, breaking through the $3,650 threshold. Furthermore, the daily trading volume has experienced a significant increase of around 250%.

As a crypto investor, I’m thrilled to share some exciting news. Previously, Bloomberg analyst Eric Balchunas estimated the odds of approval for a spot Ethereum ETF at 25%. However, in a recent update, he bumped up that figure to an impressive 75%! Moreover, Balchunas pointed out that the US Securities and Exchange Commission (SEC) has requested filings from exchanges like Nasdaq and NYSE. He speculated that this move could be due to political pressure as there was minimal interaction between the SEC and the issuers just a day prior.

As a crypto investor, I’ve been following the news about potential Bitcoin ETFs closely. Nate Geraci, the President of The ETF Store, shared some insight recently that even if the issuers submit the necessary 19b-4 filings, the SEC’s final decision on whether to require individual fund registrations (S-1s) is yet to be determined.

The Securities and Exchange Commission (SEC) could grant approval for the proposed rule modifications (19b-4s) independently from VanEck’s Ethereum spot ETF registration (S-1). This method allows the regulatory body additional time to examine and authorize the required documents, which might push back the registration deadline past May 23.

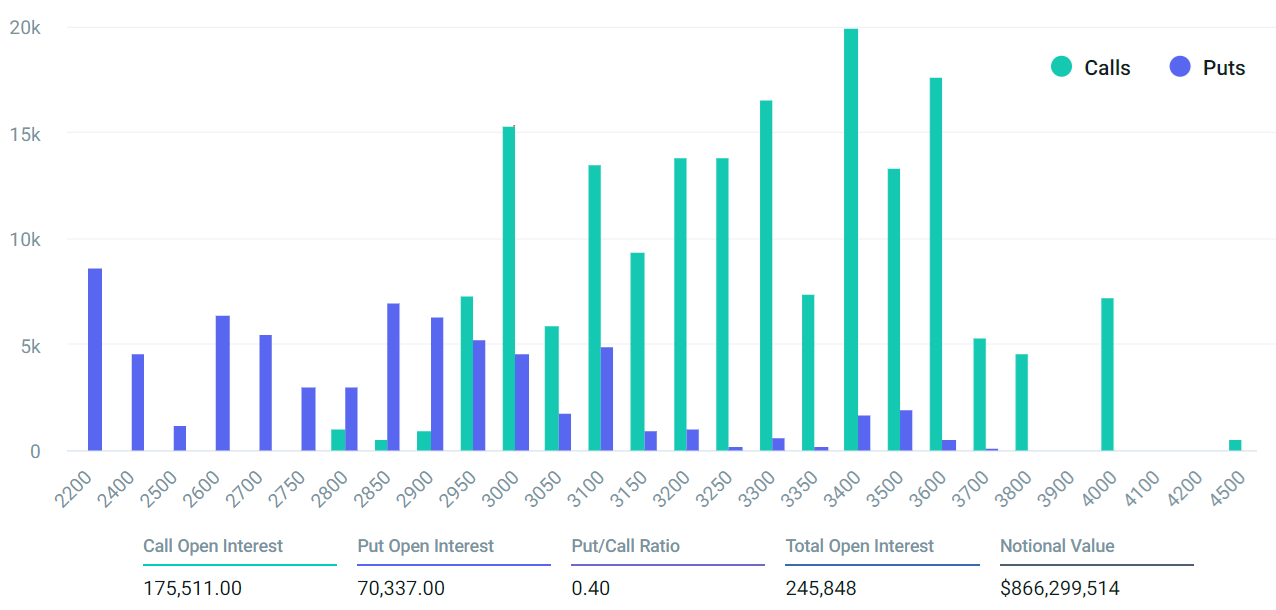

A Look at Ethereum Options Expiry

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing trend: the significant increase in the Ethereum (ETH) price has been driven by surging interest in Ethereum Exchange-Traded Funds (ETFs). This heightened attention to Ethereum has led to a notable uptick in demand for weekly and monthly ETH options, particularly around expiration dates.

As a researcher investigating the options market for Ethereum (ETH), I’ve noticed some intriguing differences between two exchanges: CME and OKX. Regarding open interest, CME’s monthly ETH options boast a total of $259 million, while OKX’s figures stand at $229 million. This implies that more traders are engaged in the options market on these platforms, but the extent of their preferences varies.

If the price of Ether surpasses $3,600 by May 24 at 8:00 am UTC, approximately $440,000 in put options will hold significance for the expiration. In this circumstance, the opportunity to sell Ethereum at a fixed price of $3,400 or $3,500 becomes obsolete as the market value exceeds these thresholds.

As a researcher studying options trading in the cryptocurrency market, I can explain that those who hold call options with a strike price up to $3,600 will choose to exercise them when Ethereum (ETH) trades above this price at expiry. This decision results in an impressive open interest of approximately $397 million for call options if ETH maintains its value above $3,600 during the weekly expiration period.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-05-21 13:34