As a seasoned researcher with years of experience in the cryptocurrency market, I find myself constantly intrigued by the ebb and flow of digital assets, particularly Ethereum. The recent decline in open interest, a metric that often serves as a barometer for market sentiment, has caught my attention.

Over the past week, I’ve observed a challenging period for several large-cap assets such as Bitcoin and Ethereum, myself included, as the broader market experienced a significant dip in prices. From my perspective, this downturn seems to be influenced by a series of unfavorable macroeconomic events occurring in various nations, which have collectively impacted the market negatively.

As a cryptocurrency investor, I’ve noticed that this substantial market downturn has cast a shadow over the general sentiment, causing many of us to proceed with caution. This trend is evident in the recent decrease in Ethereum open interest, which might signal potential troubles for the price of ETH.

Ethereum Open Interest Declines By $6 Billion — Impact On Price?

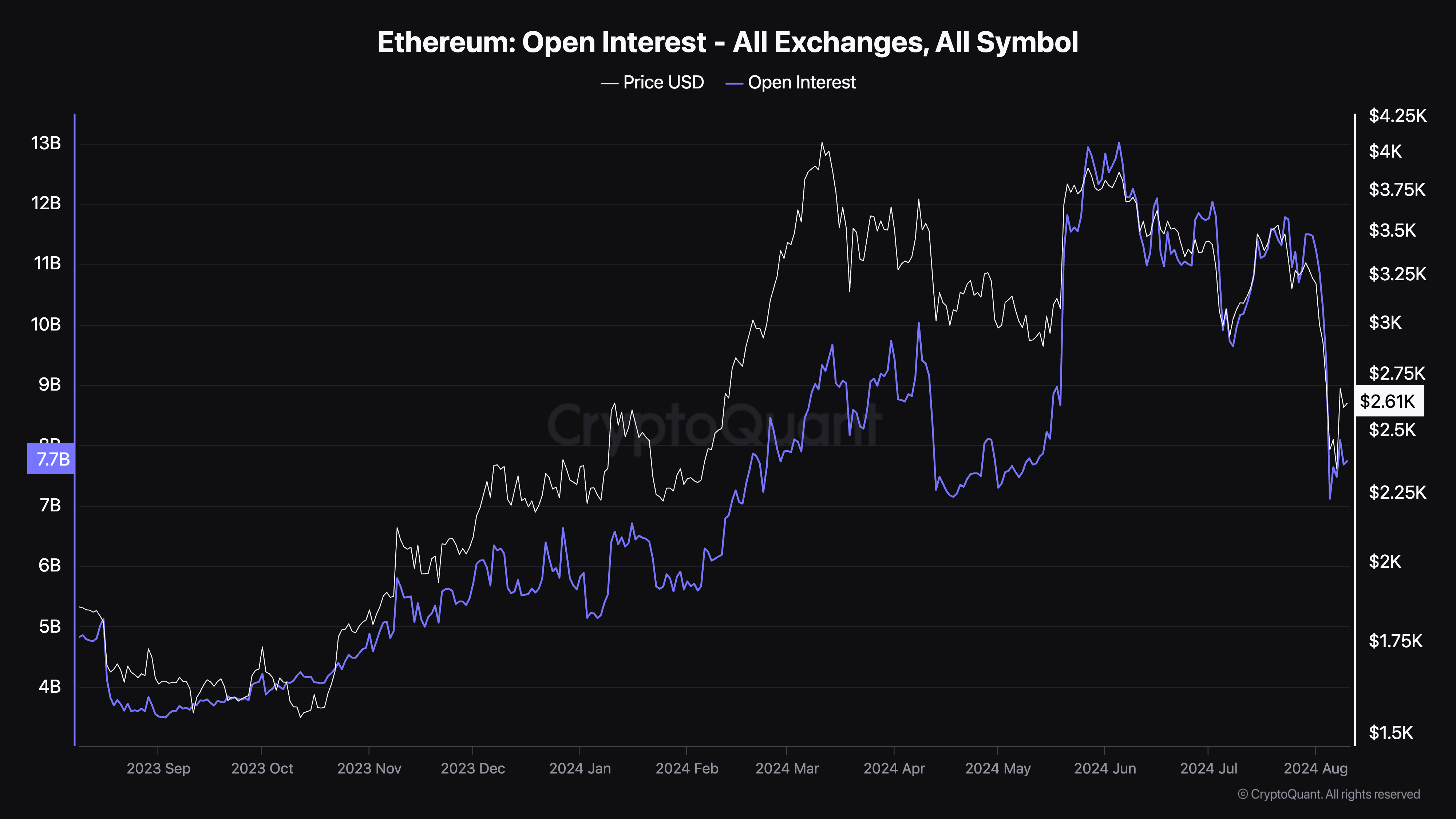

Based on data from CryptoQuant’s recent report, the number of active Ethereum derivative positions on centralized exchanges has dropped by over 40% (around $6 billion) during August. The term “open interest” signifies an indicator that quantifies the current total of open contracts for Ethereum derivatives across all these platforms.

A rise in this indicator suggests that investors are creating new futures and options contracts for ETH at that specific moment, indicating they’re investing in Ethereum derivative products. Conversely, a decrease in the indicator signifies that traders are either exiting their positions or experiencing liquidation in the market due to closing their derivatives trades.

Over the past few weeks, starting from early August, the open interest for Ethereum has been decreasing steadily. This downward trend took a more noticeable dip on Monday, coinciding with the broader market decline. As per CryptoQuant’s latest data, the current open interest of Ethereum stands approximately at $7.67 billion.

While showing signs of improvement yesterday, Ethereum’s low trading volume raises concerns about its price stability, particularly when considering its past trends. A decrease in derivative contracts might reduce the market’s liquidity, potentially leading to significant price swings as a result of market inefficiencies.

Concurrently, a decrease in open interest may reduce the immediate volatility in the Ethereum market. This is particularly relevant now since fewer traders are anticipating significant changes in the ETH price. A low volatility scenario implies that the value of Ethereum might not undergo substantial fluctuations for a while.

ETH Price At A Glance

Currently, Ethereum’s price stays near $2,600, representing a nearly 4% drop over the past day. Data from CoinGecko shows that its value has decreased by over 13% within the last week.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-08-10 17:10