As a seasoned analyst with over two decades of experience in the financial markets, I find the recent analysis by IntoTheBlock on Ethereum‘s on-chain demand zones quite intriguing. The presence of significant investor demand at specific price levels, as indicated by the cost basis of numerous addresses, suggests that Ethereum could potentially bounce back above $4,000 if it retests these regions.

According to the market analysis tool IntoTheBlock, Ethereum has established robust on-chain areas of interest that are likely to support its price and prevent it from dipping below $4,000.

Ethereum Has Two Major Support Centers Just Below Current Price

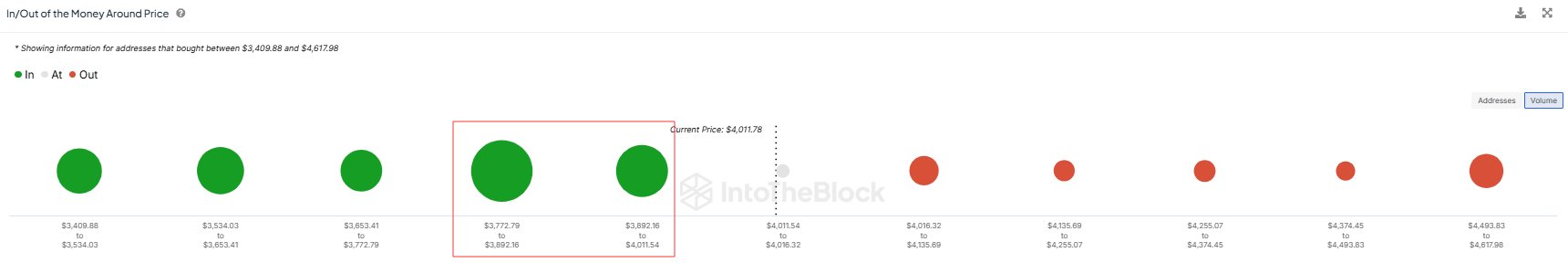

In their latest update on platform X, IntoTheBlock delves into the current state of demand areas for Ethereum based on on-chain analysis. Check out this graph shared by the company which illustrates the volume of investment in Ethereum’s price range close to its current market value.

It appears from the graph that there are few points or dots indicating high prices for Ethereum, suggesting that less of the cryptocurrency was recently bought at these relatively higher levels.

At certain price ranges, there’s a substantial accumulation of cost basis for numerous addresses. Notably, the prices between $3,772 to $3,892 and $3,892 to $4,011 stand out, as investors collectively bought approximately 7.2 million ETH, which is equivalent to nearly $28.4 billion at the current exchange rate, at these specific levels.

In the context of blockchain analysis, demand zones hold significant value because they align with typical investor behavior patterns. Since an investor’s initial purchase price (cost basis) plays a crucial role, they might become more inclined to act when a revisit of this price level takes place.

When a retest happens from an elevated position (meaning the investor was already making a profit before this point), the owner might choose to buy even more, believing that the level will be profitable again soon. Conversely, investors who were in a loss just before the retest may worry about further declines, causing them to sell at their break-even point.

In smaller investor groups, such impacts are typically insignificant to the market. However, when a significant number of participants engage in buying and selling, noticeable changes or volatilities may occur.

If the prices mentioned earlier meet this requirement, then there’s a chance that revisiting these prices could lead to a significant surge in buying activity within the market, ultimately strengthening Ethereum.

Yesterday, I observed a minor drop in the value of Ethereum, bringing it close to a specific price range. Now, it’s intriguing to see if the strong demand will manage to drive the coin back up and surpass the $4,000 mark.

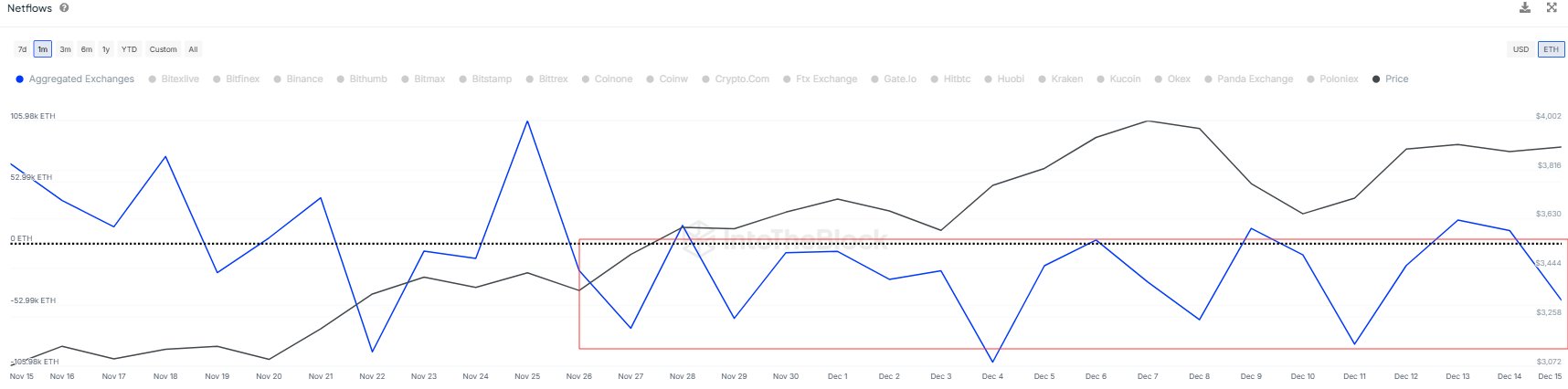

In related updates, the flow of transactions on the Ethereum exchange has been going downwards since the start of this month, according to a recent post by IntoTheBlock.

The Exchange Netflow is a tool that tracks, on the blockchain, the net volume of Ethereum moving in or out of wallets linked to centralized exchanges. As stated by an analytics company, more than 400,000 ETH have left since December 1st, which implies a pattern of accumulation.

ETH Price

At the time of writing, Ethereum is trading around $3,950, up 10% over the last week.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-18 13:34