As a seasoned researcher with a decade of experience in the crypto market, I must say that the latest surge in digital asset investment products is truly intriguing. The comeback we’re witnessing now feels like a phoenix rising from the ashes after the market dips earlier this year.

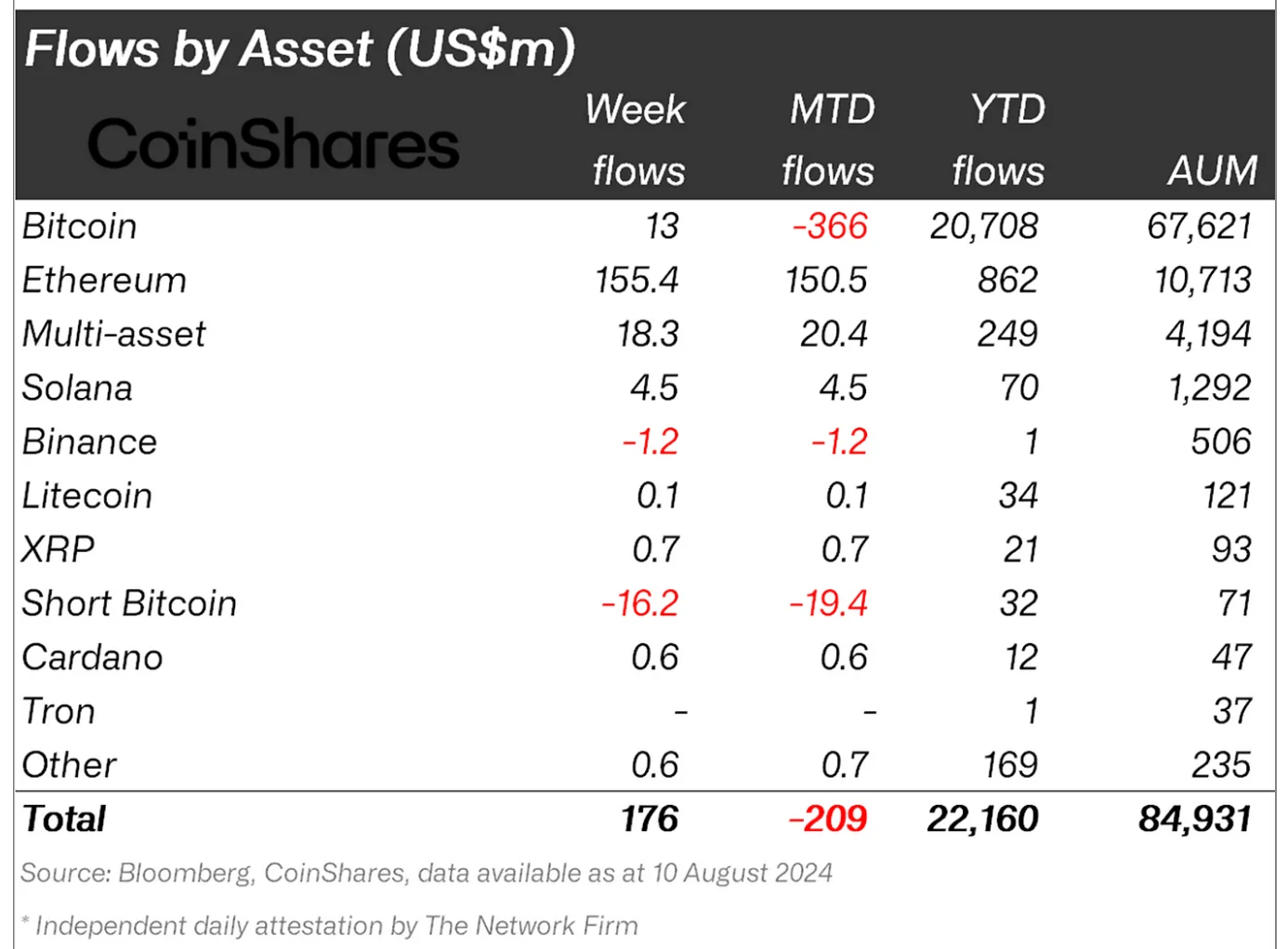

According to the recent findings from CoinShares, the cryptocurrency market has shown a strong resurgence. In their ‘weekly report on digital asset fund flows,’ they highlighted that last week witnessed a substantial boost in investor trust, as crypto investment products recorded a $176 million inflow.

As reported by James Butterfill, head of research at CoinShares, the recent increase in investments indicates a widespread, undeniably optimistic attitude, especially focusing on Ethereum investment funds.

Dissecting The Crypto Fund Flows

Upon examining the report, it was noted by Butterfill that Ethereum-related products have been particularly noteworthy, drawing in a record-breaking $155 million, which represents the largest year-to-date inflow since 2021.

The surge indicates a refreshed enthusiasm towards Ethereum, particularly following the debut of U.S.-based spot Ethereum exchange-traded funds (ETFs), as per Butterfill’s observation.

Significantly, the thriving live trading of these funds has significantly enhanced Ethereum’s status within the international cryptocurrency market. It seems that this activity has not only contributed to a rise in its market capitalization but also expanded the range of investment products associated with it.

According to the report by Butterfill, even though Bitcoin experienced outflows initially this week, it’s expected to conclude the week with a significant influx of around $13 million overall.

Conversely, it has been reported that Short Bitcoin Exchange-Traded Products experienced their largest withdrawals since May 2023, amounting to $16 million (approximately 23% of Assets Under Management). This reduction in assets under management for short positions brings the level down to its lowest point since the beginning of the year. This significant withdrawal suggests a large number of investors are exiting their short positions.

In addition, Coinshares revealed that, despite some early turbulence, the general attitude towards this market has mainly been extremely optimistic. The findings suggest that the increased investments weren’t merely sporadic events, but rather indicative of a widespread, favorable worldwide trend regarding digital currencies.

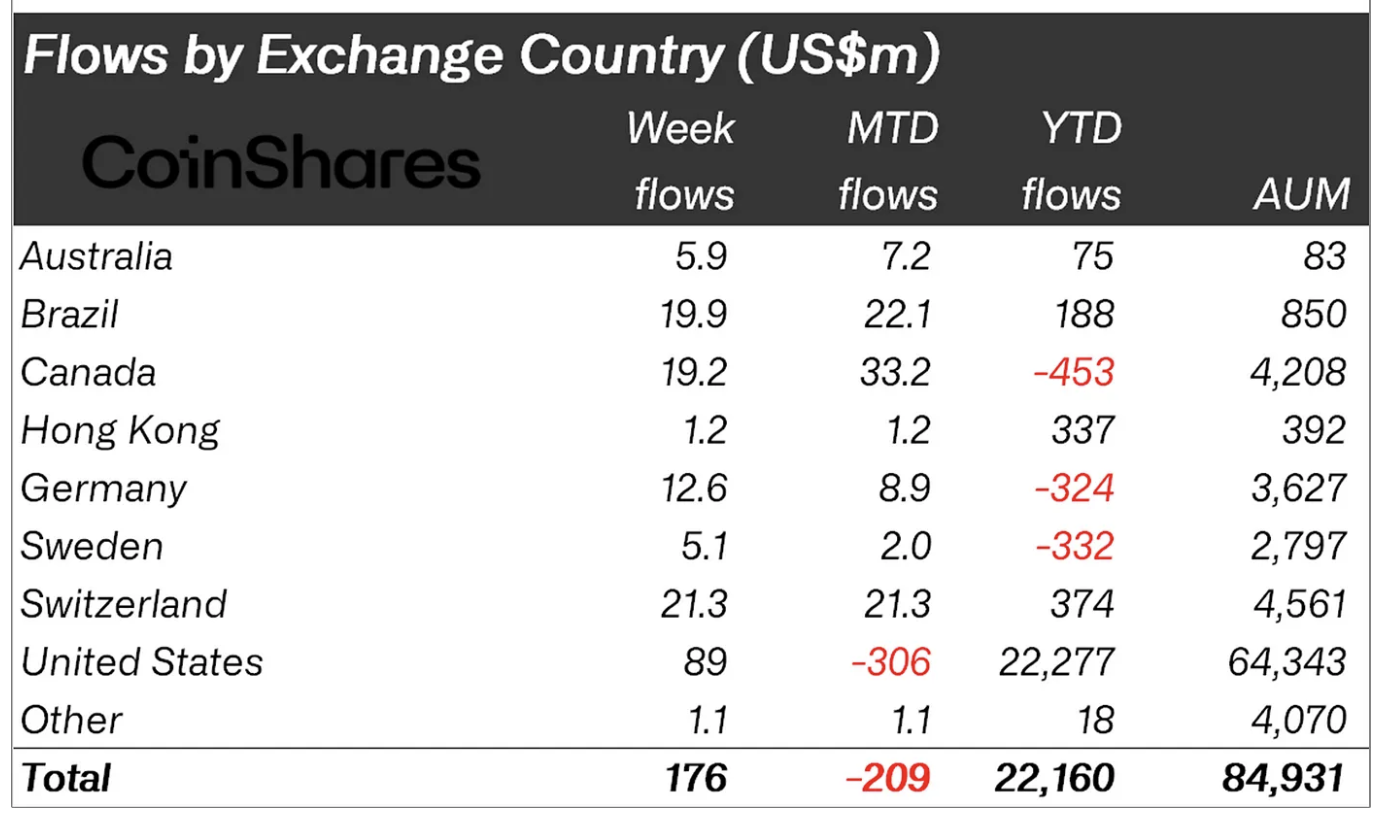

As a researcher, I’ve observed that countries like the U.S., Switzerland, Brazil, and Canada are leading the pack, significantly investing in the market. This global involvement in these influxes suggests a united optimistic stance, even amidst past significant market declines.

Market Performances: ETH And BTC

Bitcoin and Ethereum have been having a tough time overpowering the bearish trend, but they’ve managed to keep their prices above crucial support levels so far.

At this moment, Ethereum is being traded at a price of $2,689, surpassing $2,500. In the last seven days, it has experienced a significant rise of over 11%, and within the past 24 hours, there’s been a bullish jump of approximately 1.6%.

In the last seven days, Bitcoin has experienced a significant rise, amounting to 11.4%. However, over the past day, there’s been a minor drop of 0.4%. Despite this daily dip, the asset’s value still remains below $60,000.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

2024-08-13 02:10