As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and their impact on various assets, including cryptocurrencies like Ethereum (ETH). The recent surge in ETH’s price, nearly 20% in just two days, has piqued my interest.

Over the last two days, Ethereum (ETH) experienced a nearly 20% surge, coinciding with an uptrend in the wider Decentralized Finance (DeFi) market, which followed the election of Donald Trump as President.

Ethereum Begins To Regain Momentum

For most of the year, the second-biggest digital currency as per declared market value has trailed both Bitcoin (BTC) and competing smart contract platform coins such as Solana (SOL).

After Donald Trump’s victory as the Republican US presidential nominee, ETH has seen an increase of more than 10% compared to the previous day. This surge in value for the token has drawn focus to one of Ethereum’s groundbreaking applications yet – Decentralized Finance (DeFi).

In a long-form post on X, Arthur Arthur Cheong & Eugene Yap from crypto investment firm DeFiance Capital noted that total value locked (TVL) in Ethereum-based DeFi protocols is rebounding.

Analysts attribute part of this growth to increased crypto asset prices, but they also emphasize that trading activity on certain DeFi platforms has almost reached the levels of last year, suggesting that the surge in activity is indeed genuine.

Cheong and Yap highlight various signs suggesting that the Decentralized Finance (DeFi) sector is moving towards a period of “DeFi revival” or “DeFi rebirth.

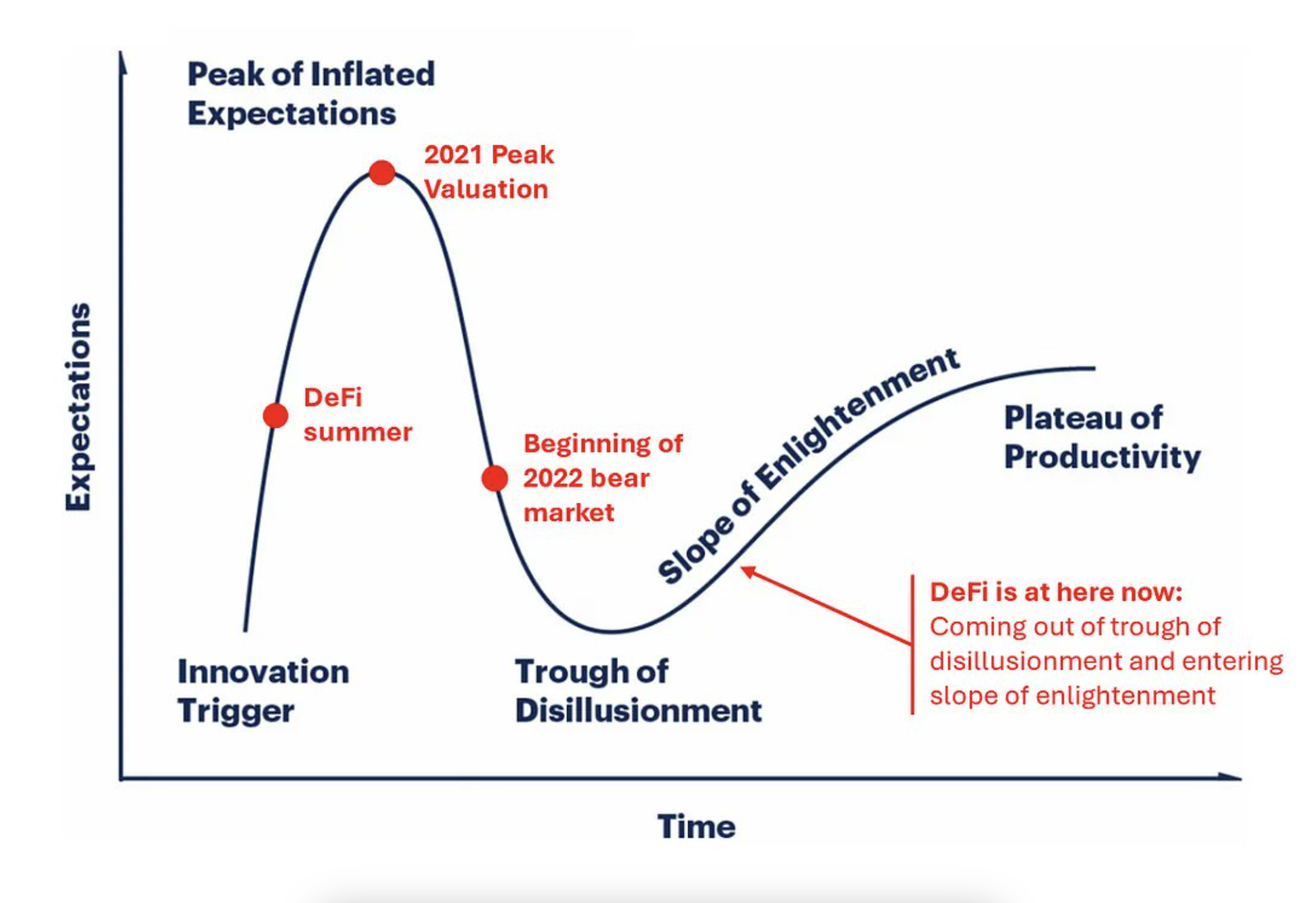

Initially, it’s pointed out that Decentralized Finance (DeFi) seems to be climbing out of a period often referred to as “the valley of disenchantment.” This term is part of the Gartner Hype Cycle and describes a phase where enthusiasm for a technology decreases when early expectations aren’t met.

According to the graph, Decentralized Finance (DeFi) appears to be progressing through the “slope of enlightenment” stage, indicating it may soon reach the “plateau of productivity” as the technology advances and becomes more established.

Moreover, economic factors on a large scale, such as a period of low interest rates, may significantly increase the adoption of DeFi in two key aspects: by decreasing opportunity costs and making borrowing less expensive.

As the returns on treasury bills and conventional savings accounts dwindle, investors are increasingly exploring income-producing DeFi tactics such as yield farming, staking, and liquidity mining for greater earnings.

It’s plausible that reduced interest rates could lead to an expansion in the circulation of stablecoins because it makes borrowing less expensive. This increased liquidity can fuel the growth of Decentralized Finance (DeFi) by offering more resources for development and transactions within the ecosystem.

How Is Trump Presidency Bullish For ETH?

The examination underscores that the 2024 U.S. presidential elections may provide the decentralized finance (DeFi) sector with long-awaited regulatory transparency. A potential Trump presidency might usher in more advantageous cryptocurrency regulations, potentially increasing investor trust.

As a result, Ethereum (ETH) could potentially gain from an upsurge in investor attention towards DeFi. According to cryptocurrency analysts, if ETH manages to surpass certain crucial resistance levels, its value might reach approximately $3,400.

As a researcher, I’ve observed an uptick in the activity of large Ethereum (ETH) holders, often referred to as ‘whales’. This surge suggests that experienced and knowledgeable ETH investors are buying up the token, hinting at their expectation for a possible price rise.

ETH encounters tough challenges from competing smart contract platforms like Solana, and a recent study indicates that the decentralized finance (DeFi) environment built on Solana (SOL) has witnessed a significant surge in Total Value Locked (TVL), reaching an impressive $5.7 billion during Q3 2024.

Currently, Ethereum (ETH) is being traded for approximately $2,806, representing an increase of 7.1% over the last 24 hours. The total market capitalization stands at a staggering $338.6 billion.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Brody Jenner Denies Getting Money From Kardashian Family

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Simone Ashley Walks F1 Red Carpet Despite Role Being Cut

2024-11-08 11:46