As a seasoned crypto investor with a deep understanding of the market dynamics, I’m excited to see Ethereum (ETH) experience such positive developments following a much-needed price surge. The recent approval of Ethereum ETF applications by major asset managers, including Grayscale and ProShares, has brought renewed enthusiasm and significant inflows into the market.

As an analyst, I’ve noticed a significant surge in Ethereum (ETH) prices lately, bringing it close to the $4,000 threshold. This price increase has sparked renewed interest and inflows into Ethereum. The cause? The US Securities and Exchange Commission (SEC) has given its approval to Ethereum ETF proposals from major asset managers.

Best Week For Ethereum Since March

As a researcher studying the trends in digital asset investments, I’ve come across some noteworthy data from a recent report by CoinShares. The report reveals that investors have poured a total of $2 billion into digital asset investment products over the past week. This inflow marks the fifth consecutive week of positive inflows, with a grand total of $4.3 billion added during this period.

As a researcher studying the trends in exchange-traded products (ETPs), I’ve observed a significant surge in trading volumes during the past week, reaching a total of $12.8 billion. This represents a noteworthy jump of 55% compared to the previous week.

As an analyst, I’ve noticed an uptick in investments flowing into different providers recently, signaling a shift in investor sentiment. Even traditional incumbent providers have seen a decrease in outflows, adding credence to the optimistic market trend.

In the picture provided, Bitcoin (BTC) remains the market leader, accumulating a significant inflow of $1.97 billion over the past week. Conversely, there were withdrawals amounting to $5.3 million from short Bitcoin investment products for the third week in a row.

Ethereum has experienced a significant increase in investments, marking its strongest weekly inflow since March with a total of $69 million. This surge may be attributed to CoinShares and other investors reacting to the unexpected SEC announcement permitting spot-based ETFs for Ethereum.

Differing Perspectives On ETH’s Price

Although Ethereum has experienced some favorable advancements, its value has had difficulty sustaining a bullish trend and hasn’t managed to revisit its peak of $4,100 set in March. On Friday alone, the price dipped down to $3,577.

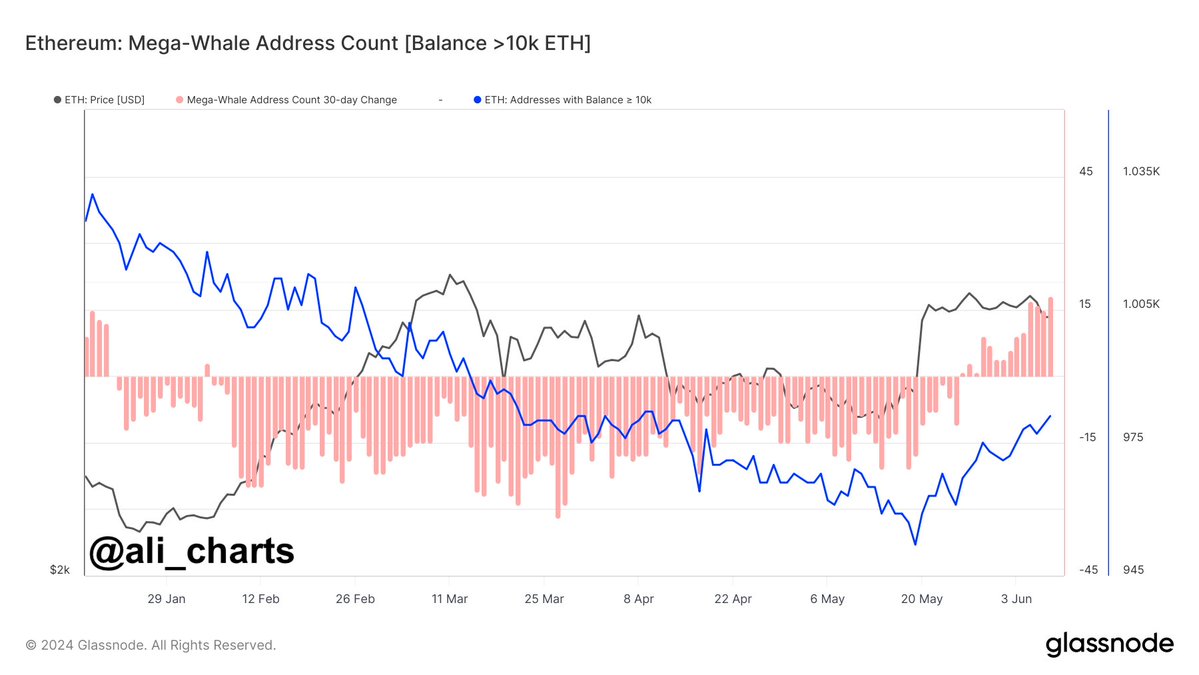

As a crypto investor, I’ve noticed an intriguing development in the Ethereum market. Specifically, I’ve observed that the number of Ethereum addresses holding more than 10,000 ETH has grown by approximately 3% over the past three weeks. This expansion suggests a substantial surge in demand for large quantities of Ethereum.

Market analysts have presented varying opinions regarding Ethereum’s future price trend. According to “Trader Tank,” Ethereum could potentially decline to $3,500. However, he also considers the possibility of a bullish turnaround if Ethereum manages to surpass the $3,700 threshold again.

As a researcher studying the cryptocurrency market, I’ve noticed that Ethereum’s supply held on exchanges has reached an eight-year low according to crypto analyst Lark Davis. This observation implies that the upcoming Ethereum Exchange Traded Funds (ETFs) could result in a significant surge of Ethereum being taken off exchanges and transferred to cold storage or other wallets, leading to a potential “massive supply shock.” Consequently, this unexpected decrease in Ethereum’s circulating supply could cause a notable upswing in the price.

From my perspective as an analyst, the future price direction of Ethereum is still up in the air, leaving market participants on the edge of their seats for the next significant move. As we keep a close eye on market trends, it remains to be seen whether we’ll witness a breakout above $4,000 or a revisit to the support levels around $3,500.

The second largest digital currency by market size is presently priced at $3,690, representing a decrease of 6.5% over the previous fortnight.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-06-11 10:18