As a researcher with a background in blockchain and digital assets, I have been closely monitoring the developments within the crypto space for quite some time now. The latest Binance Research report indicating Ethereum’s increasing issuance rate has certainly raised eyebrows, especially considering its previous “ultrasound money” claim.

As per Binance Research’s most recent report, it was observed that the emission rate of Ethereum (ETH) increased significantly in September 2024. This development has sparked discussions about whether Ethereum can still uphold its “deflationary digital currency” label.

Ethereum Issuance Rate Continues To Surge

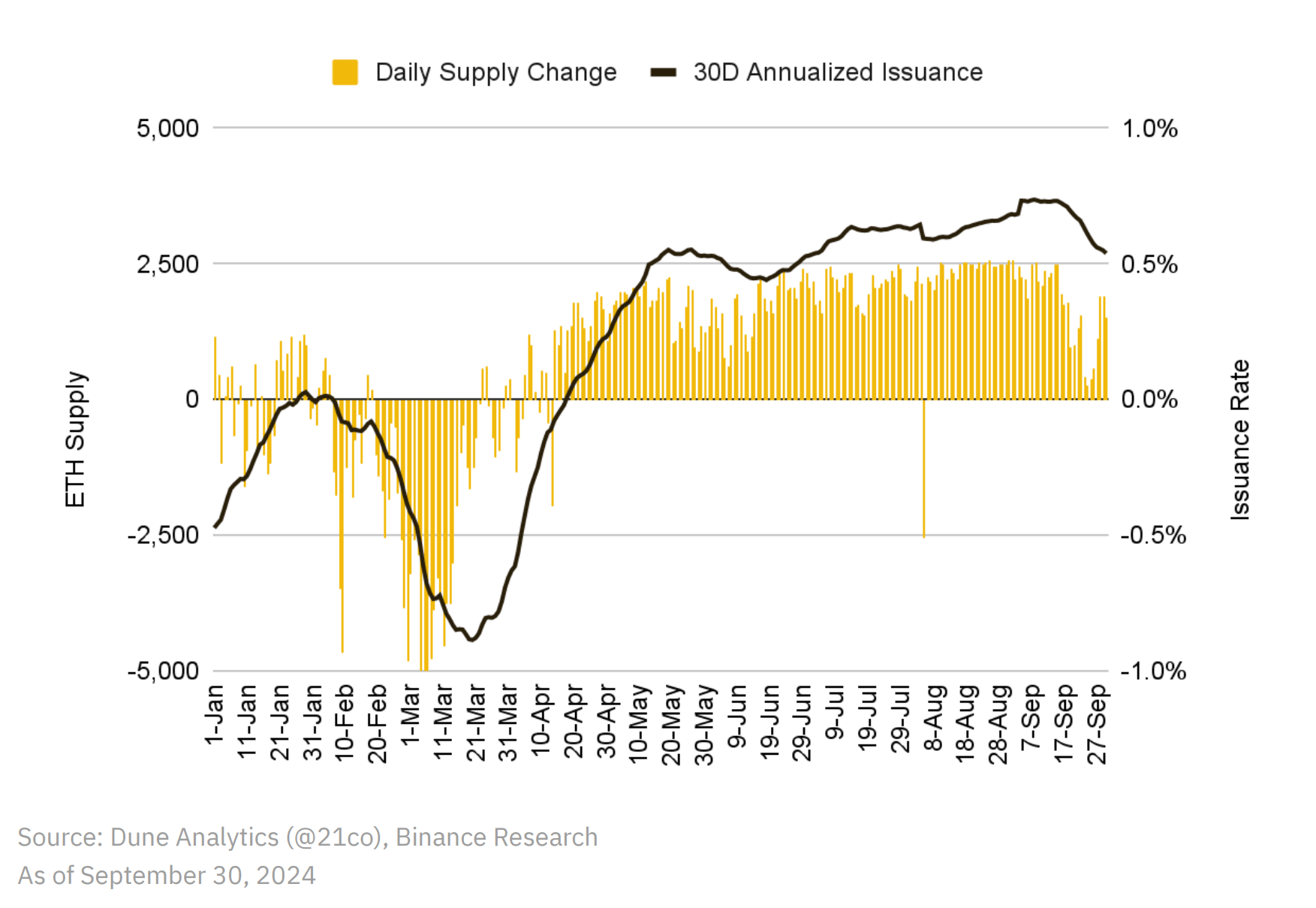

According to the October 2024 Monthly Market Insights report from Binance Research, it was noted that the rate at which Ether (ETH) is issued increased in September, transitioning from a state of being deflationary.

In simpler terms, it’s been around two years since Ethereum, the second largest digital asset in terms of reported market value, had an annualized inflation rate similar to its current 0.74% over a 30-day period. This sudden increase in ETH supply has caused some to question whether Ethereum still holds the title of being a form of “ultrasound money”.

It’s intriguing that the term “ultrasound money” derives its concept from Bitcoin‘s (BTC) idea of “sound money.” Unlike Bitcoin, which has a fixed supply of 21 million units, Ethereum’s (ETH) supply could theoretically become deflationary, potentially enhancing its scarcity and safeguarding it against inflation-induced degradation of purchasing power.

The rapid issuance of Ethereum might be due to multiple reasons, such as minimal on-chain transactions on the mainnet, which results in reduced transaction fees. As a result, the rate at which Ether is destroyed through burning decreases.

2021 saw Ethereum’s main developers implement EIP-1559, a feature that incorporated a gas-fee burning system. The goal of this mechanism was to decrease the number of Ethereum tokens in circulation, thereby exerting deflationary pressure on the token by making its supply scarcer.

As a crypto investor, I’ve noticed that the number of transactions on the Ethereum network (mainnet) has been decreasing, which means less Ether (ETH) is being destroyed through the burn mechanism. This situation is happening faster than new ETH is being created, resulting in an overall inflationary trend for Ethereum.

Remarkably, during September 2024, Ethereum’s burn rate reached one of its lowest points since the much-awaited Merge, an event marking Ethereum’s shift from a Proof-of-Work to a Proof-of-Stake consensus mechanism. In simpler terms, this means that in September 2024, the destruction or ‘burning’ of Ether tokens happened at one of its slowest rates since the Merge, which occurred when Ethereum moved from a traditional mining process to a system that rewards users for validating transactions and securing the network.

Ethereum Layer-2 Solutions To Blame For Low ETH Burn Rate?

The report points to March 2024 as the starting point of Ethereum’s inflationary trend, following the implementation of EIP-4844 or the Dencun upgrade, which reduced transaction costs on layer-2 scaling platforms such as Optimism (OP), Arbitrum (ARB), Base, and Polygon (MATIC). The report adds:

Throughout the year, second-language users absorbed network activity, an effect amplified by overall market fluctuations. This led to a decrease in transaction fees and burned fees on Ethereum, with September recording one of the lowest levels since the Merge. This reduction in burn has prevented Ethereum from becoming more scarce, resulting in the positive daily changes in its supply that we observe now.

The data currently supports the statement given, as we see an increase in activity on alternative networking platforms (like Polygon) across various measures. For example, a July 2024 report highlighted substantial growth in daily active users and transaction volumes on this platform.

Likewise, the engagement with Decentralized Finance (DeFi) on Arbitrum escalated earlier this year as the decentralized trading platform Uniswap exceeded a total swap volume of $150 billion on its network.

A recently published report reveals that approximately half of the digital assets transferred from the Ethereum blockchain are winding up on Arbitrum, suggesting a strong confidence among users in the security and dependability of this layer-2 network. At present, ETH is trading at $2,385, experiencing a 1.7% increase over the past day.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

2024-10-05 12:04