As a seasoned crypto investor with over a decade of experience, I have witnessed numerous market fluctuations and learned to read between the lines. The recent 10% dip in Ethereum’s price might seem daunting to newcomers, but it is not uncommon in this volatile market. However, the continuous selling spree by the Ethereum ICO wallet “0xBF4” has raised concerns and intensified bearish sentiments.

Based on figures from CoinMarketCap, Ethereum‘s price decreased by approximately 10.23% over the past week, mirroring a broader market decline. This downturn in the cryptocurrency market is believed to be influenced by several factors, such as escalating geopolitical issues in the Middle East and an increase in liquidations of long positions.

Over the past day, Ethereum has shown some signs of improvement, increasing by 3.21%. However, investors are still hesitant about a complete price rebound as pessimistic sentiments dominate the market. It’s worth mentioning that an individual who participated in an Ethereum ICO has recently sold a significant amount of ETH, fueling worries about a potential extended downturn.

Ethereum ICO Wallet Continues Selling Spree, Offloads 40,000 ETH In Two Weeks

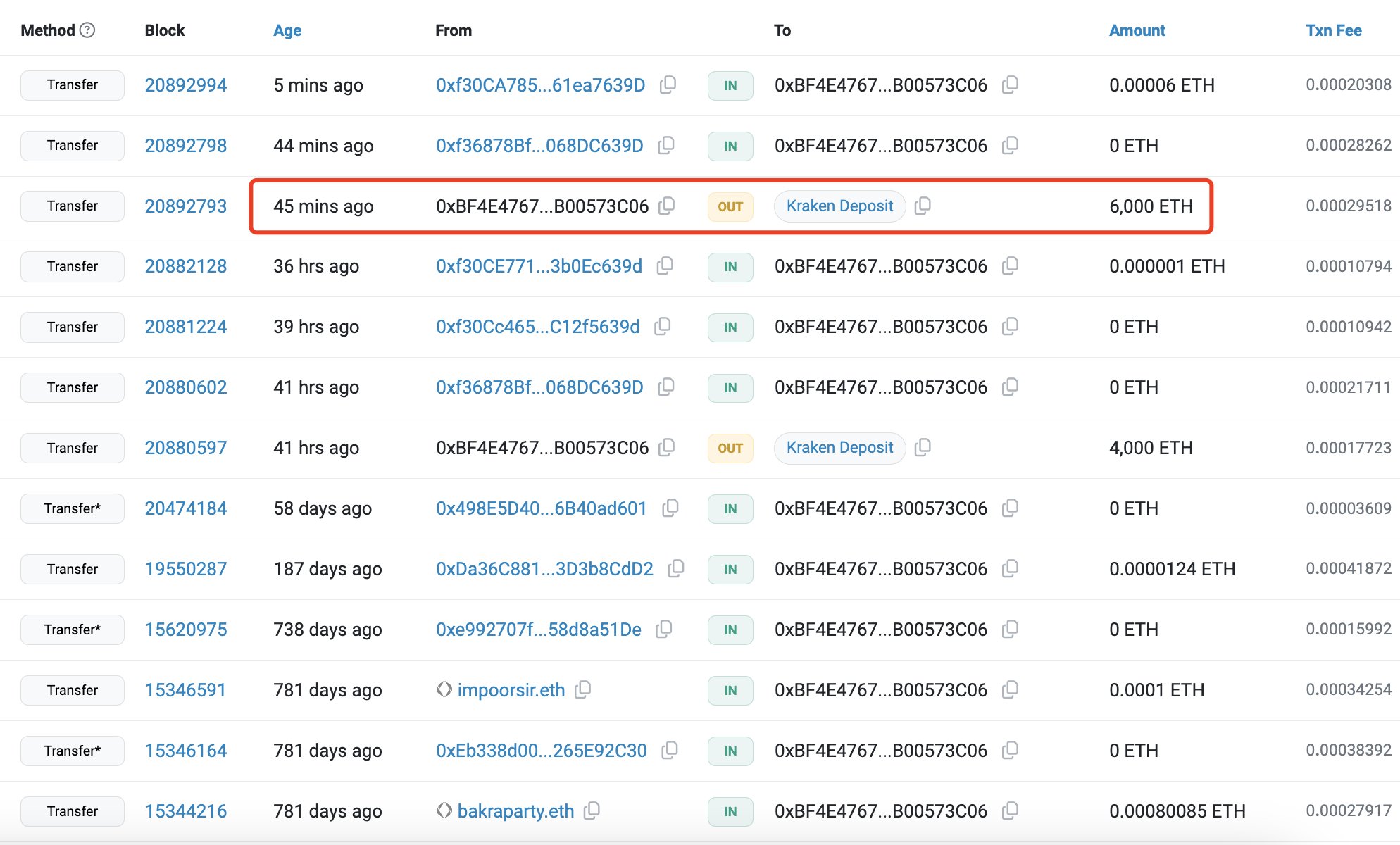

Based on information from blockchain analysis company Lookonchain, it’s been found that a wallet with the Ethereum address “0xBF4” transferred approximately 6,000 ETH, equivalent to around $14.11 million, to the Kraken exchange last Friday. This particular wallet has been traced back to an early Ethereum investor who bought about 150,000 ETH, worth a staggering $368 million, during the asset’s initial coin offering (ICO) in 2014.

According to Lookonchain, the entity “0xBF4” has sold another 19,000 ETH, worth around $47.54 million, within the last week following their initial sale. This is the second such transaction since the ICO phase ended. Interestingly, since September 22nd, this significant ETH holder has moved out approximately 40,000 ETH, equivalent to $101 million, leaving them with a remaining balance of around 99,500 ETH, valued at about $238 million.

As a researcher, I’ve observed that substantial token transfers by major holders, often referred to as “whales,” are typically viewed as bearish signs. This is because such actions suggest doubts about the asset’s potential for long-term growth and profitability. Transactions like those made by “0xBF4” could potentially initiate a wave of panic selling among smaller investors, intensifying the downward pressure on Ethereum’s price.

108,000 ETH Moved To Exchanges In 24 Hours

Beyond the wallet address “0xBF4”, other investors have recently liquidated significant amounts of ETH. According to analyst Ali Martinez, approximately 108,000 ETH worth around $259.2 million have been moved to exchanges in just the past day. This extensive selling activity suggests increased pessimism in the Ethereum market.

At present, Ethereum is being exchanged for approximately $2,399 after a surge in its price. Yet, its daily trading volume has dropped by 17.48% to reach $14.61 billion. If pessimistic trends continue, ETH might retreat towards roughly $2,200, which is a significant potential price point. Under heavy selling pressure, Ethereum could dip down to around $1,600.

Currently holding the second position among cryptocurrencies, Ethereum boasts a market capitalization of approximately $291.40 billion, accounting for around 13.47% of the overall market share.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-05 23:46