As a seasoned crypto investor with over a decade of experience under my belt, I must say that the recent surge in Ethereum accumulation is nothing short of astonishing. Having witnessed numerous market cycles and trends, I can confidently assert that this increase in faith towards Ethereum’s future is more than just hype.

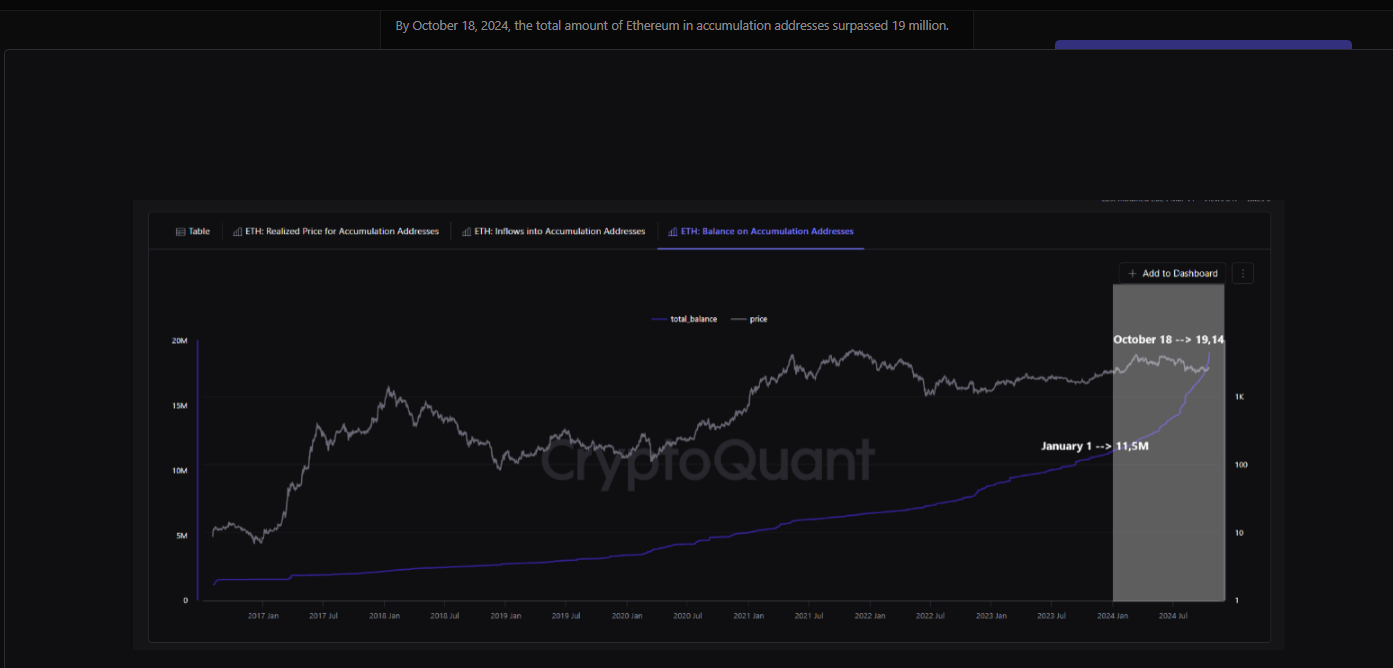

Enthusiasts of Ethereum are making a significant impact in the cryptocurrency world as the number of coins they hold has significantly grown. According to data from CryptoQuant, the amount of ETH being held long-term has increased from 11.5 million in January to nearly 19 million now, almost doubling the initial figure.

It seems that investors are becoming more confident about Ethereum’s future, as indicated by the significant rise in investments. The crypto community is abuzz with speculation, as some predict that Ethereum’s user base could potentially hit 20 million by the end of the year.

It’s evident that there’s a strong sense of optimism about Ethereum’s future prospects, even amidst market fluctuations, leading some to ponder the reasons for this growing trust and its potential implications on the broader crypto landscape in the future.

There’s growing interest among both institutional and personal investors to boost their investments, with several key factors at play. For instance, the recent green light from the U.S. Securities and Exchange Commission (SEC) for Ethereum-based spot exchange-traded funds (ETFs) has opened up opportunities for new market entrants.

Spot ETFs Push Demand

The approval of Ethereum spot ETF has significantly increased mainstream investor interest, suggesting a growing readiness among both individual investors and institutions for Ethereum’s long-term prospects. In fact, one cryptocurrency researcher predicts that by the end of 2024, the total amount of ETH stored in accumulating addresses could reach the market value of the largest global companies.

Continuing under the premise that Ethereum’s price stays approximately at $4,000, the analyst suggests that these trends could potentially lead the total worth of ETH stored in those specific addresses to surpass $80 billion. Currently trading at around $2,737, Ethereum has experienced a growth of more than 3% within the last day and over 10% over the past week.

Staking Secures More Ethereum

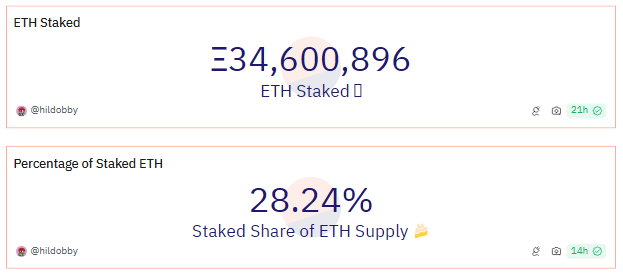

Another significant factor contributing to fewer ETH available for trading is the rise in Ethereum staking. As reported by Dune Analytics, more than 34.6 million ETH, which is approximately 30% of the total Ethereum supply, has been locked up through staking contracts. Consequently, this scarcity of tokens for sale has contributed to a moderation in prices.

If the quantity of Ether staked continues to rise, it could lead to further increases in ETH’s price. Additionally, a decrease in sell-side pressure could result in reduced volatility and increased prospects for sustained growth within the Ethereum market.

The Price Outlook Is Good

As an analyst, I’m observing a predominantly upward trend in the current fluctuations of Ethereum (ETH). Right now, ETH is trading above $2,700, a significant support level, largely due to the backing of its 50-day moving average. However, the 200-day moving average, currently at $3,022, continues to act as a hurdle. For Ethereum to sustain continuous price growth, it’s crucial to surmount this barrier.

As an analyst, I’m personally quite optimistic about Ethereum’s future, as the growing enthusiasm among its long-term backers indicates. The increasing tendency to stake in Ethereum and the development of spot ETFs hint that this optimism might not be misplaced. It will indeed be fascinating to observe if Ethereum can surmount major pricing hurdles; however, one fact remains undeniable: for now, the long-term outlook appears promising.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-10-21 10:52